The Egyptian economy has struggled for the past 10 years, as misfortune and poor decision-making have damaged the economy and, consequently, the well-being of Egyptian citizens. For example, Egypt and the International Monetary Fund (IMF) recently agreed to an agreement to correct the many disorders facing the Egyptian economy. These are the main points of this agreement and Egypt’s long-term prospects.

Egypt’s economy has been affected over the past decade. The Arab Spring that began in 2010 sparked unrest in the North African country and was followed by political turmoil in the form of President Morsi’s military ouster in 2013, the repression of the Muslim Brotherhood. political party, the advent of a new charter in 2014 and small crises that affected the country’s ability to serve in a stable manner. The clash in Ukraine has added another layer of headaches to Egypt’s economic prowess.

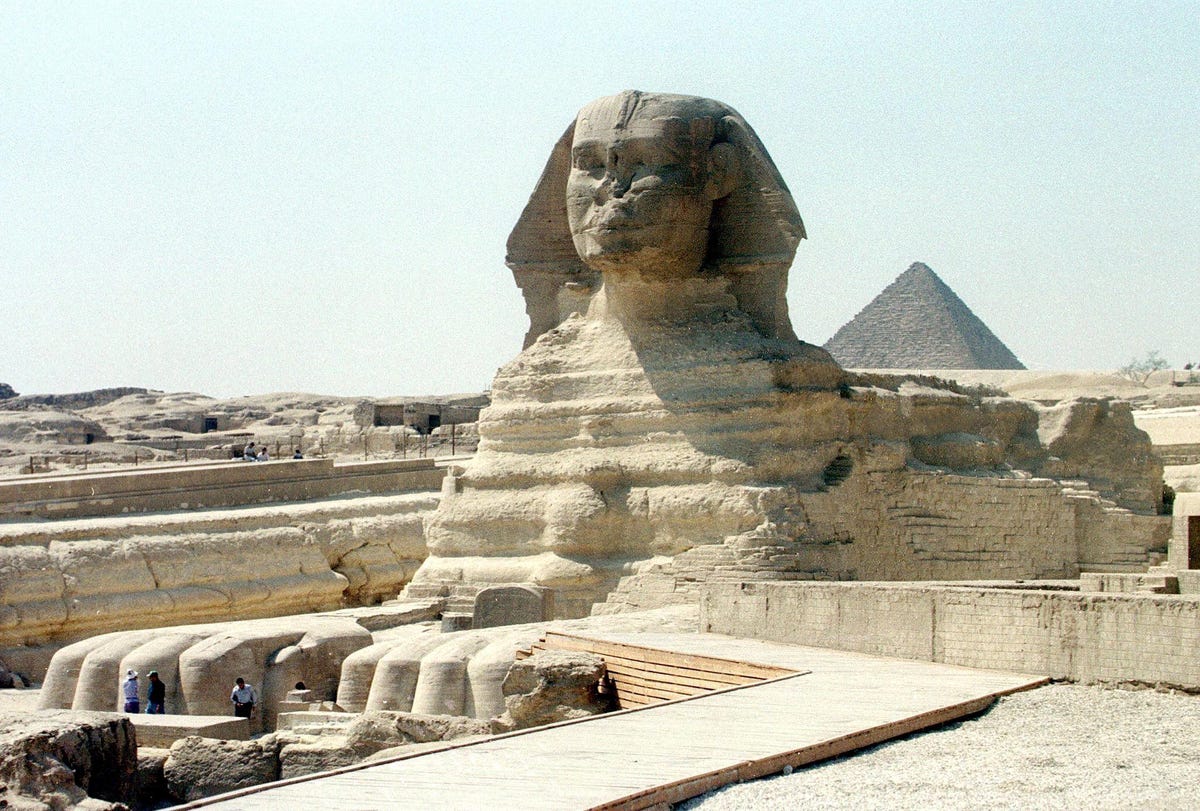

Tourism was once the main driving force of Egypt’s economy and accounts for 15% of the country’s GDP. However, political turmoil has reduced this facet of the economy, with tourists attacked by kidnappers and terrorists. The coronavirus pandemic has also played a role in Egypt’s failure. economic status. The tourism industry has yet to fully recover, leaving Egypt dependent on oil and fuel production and the Suez Canal as its main sources of income.

Due to its economic and political problems, the inflation rate in Egypt continues to rise. In April 2022, it surpassed 13% for the first time since 2019 and has been climbing ever since. The latest reading in September 2022 saw inflation exceed 15%. .

In 2016, Egypt borrowed $12 billion from the IMF and devalued its currency, the Egyptian pound, to offload the loan. The loan financed, but the government invested the cash in the military and intelligence agencies instead of investing it in the economy. This has sent millions of its citizens into even deeper poverty. Meanwhile, Egyptian officials have asked the IMF for more cash, 3 times more between 2016 and 2022.

The full main points of the agreement between the International Monetary Fund and Egypt have still been published, but the two sides have reached agreement on the terms of the loan. Instead of giving cash to Egypt with few functional needs as in the past, the IMF is forcing the Egyptian government to accept a comprehensive monetary reform plan for the next 46 months.

The IMF created a $3 billion Extended Financing Facility agreement (based on U. S. dollars) in exchange for Egypt’s commitment to movements that help the country cope with external shocks, improve its social safety net, and put in place reforms that will boost the sector’s movements. Growth and creation of tasks. Egypt has already taken steps to provide social protection, allowing its currency to reach industry and phasing out mandatory letters of credit for import financing.

The Extended Financing Facility agreement also requires the Egyptian government to anchor its fiscal policy to reduce overall public debt and gross financing needs. The government will need to review its tax system, continue its social protection policies, and take steps to protect purchasing power. of its low-income citizens and pensioners.

Saudi Arabia and the United Arab Emirates are taking steps to invest money in Egypt to maintain stability in the region. While the motives for such moves are not purely altruistic, there is an enlightened self-interest at play to avoid further unrest in Egypt and the other Middle East. The IMF recognizes this commitment and expects monetary assistance from regional and foreign partners for Egypt.

To understand the nature of the IMF is to understand the importance of this arrangement. The International Monetary Fund is a global organization composed of 190 member countries. Its monetary resources come from the capital subscription quotas of IMF member countries. Member countries can borrow from the budget to cover emergencies and deficits when they revel in monetary difficulties.

The purpose of an IMF loan is to stabilize a member’s finances and currency while allowing it to pay for the imports its citizens want. The loan also helps the member country return to a state of economic expansion and resolve the messes that led to wanting to borrow in the first place. When a member requests a budget from the IMF, it does so with the wisdom that the IMF will impose lending situations in the form of governmental, economic, and social reforms.

The IMF also monitors the foreign formula and developments in the global economy. The objective is to identify the dangers to global economic stability and monitor the economic and economic policies of member countries.

The IMF believes Egypt has enormous potential for expansion, provided the government stays on track. The expanded financing facility arrangement will allow the personal sector to grow through reduced state control over personal industries. It also seeks access to education for a larger component of the population. Egypt has also requested investments from the Resilience and Sustainability Fund, which provides long-term financing to build resilience to climate change.

If the Egyptian government rises to the demanding situations proposed by the IMF, the outlook for the Egyptian economy looks promising. The country will want to ensure the protection of tourists if it needs to recover this industry, but Egypt’s goals of its other people’s living situations and allowing its currency and personal industries to thrive suggest that the country has a solid plan to move towards a richer world in the future. It will take years to see the effects of those efforts, but Egypt is now acting to build a better future.

As an investor, you are unlikely to contribute directly to the long-term single nation, but you can contribute to the economic progress of a varied set of political and economic improvement projects around the world. One way to do this, with greater diversity built in, is the Global Trends Inversion Kit for Q. ai.

Q. ai gets rid of investment assumptions. Our synthetic intelligence scours markets for the most productive investments for all kinds of tolerance to threats and economic situations. Then he groups them into practical investment kits that make making an investment undeniable and, dare we say it, fun.

Download Q. ai today for AI-powered investment strategies. When you deposit $100, we charge another $100 into your account.