n n n ‘. concat(e. i18n. t(“search. voice. recognition_retry”),’n

Indonesia Garment Industry Market

Dublin, January 29, 2024 (GLOBE NEWSWIRE) — The “Indonesian Garment Manufacturing Industry Research Report, 2023-2032” has been added to the ResearchAndMarkets. com offering. Indonesia is the largest economy in Southeast Asia and has an abundant struggling labor force with low hard labor costs. By the end of 2022, Indonesia’s population will reach approximately 275 million, the fourth largest population in the world, with approximately 70% of the population between the ages of 15 and 64, and the hard workforce will succeed. at around 140 million, a plentiful workforce and customer market. According to the analysis, the young demographic composition will bring 10 to 15 years of expansion to the Indonesian customer market.

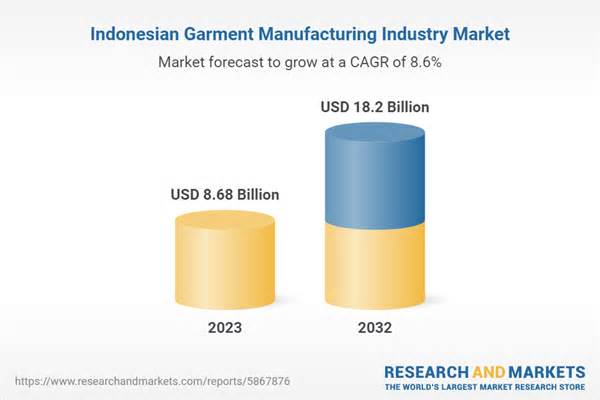

Indonesia is one of the world’s top ten textile producers, and the textile and textile products industry is one of the most important industries in the Indonesian economy, providing employment for more than 3.7 million Indonesians. The majority of Indonesia’s total textile and clothing production is used to supply international demand, of which 70% is exported, with the United States of America being the largest exporter of Indonesian clothing and textiles.As apparel companies continue to shift production out of China, Indonesia has become an attractive alternative. China’s position as a global cotton importer is declining, and most cotton exports are being shifted to competing countries, including Indonesia. The USDA forecasts that China’s cotton imports will increase by only 3.5 million bales over the 2021-2030 period, compared to an estimated 8.1 million bales for the major competing apparel countries Indonesia, Vietnam, Pakistan, Bangladesh, and Turkey combined. By 2030, China is expected to account for 24% of total global imports, while competing countries combined are expected to account for 47%.Indonesia’s garment industry is concentrated in West Java, Central Java, East Java and Banten, which together account for more than 85 percent of all garment, textile and footwear employment. The garment industry is labor-intensive and easy to relocate, and employers have been relocating factories to areas with lower minimum wages.From 2018 to 2022, according to the analysis, Indonesia’s textile and apparel export value shows a trend of change firstly decreasing and then increasing, with a CAGR of 4.16% from 2018 to 2022.In 2020, affected by the COVID-19 epidemic, Indonesia’s apparel manufacturing industry contracted, and Indonesia’s textile and apparel export value was 5.857 billion U.S. dollars, which was a year-on-year decline of 17.19%.In 2021 The Indonesian government relaxed the control measures, and the export of Indonesia’s textile and apparel industry recovered rapidly in 2021 and 2022, and the export value of Indonesia’s textile and apparel in 2021 and 2022 was US$6.909 billion and US$7.992 billion, respectively, an increase of 17.98% and 15.6% year-on-year, respectively.The textile industry is now a strategic target industry for Indonesia. The prospects of Indonesia’s textile industry offer golden opportunities for investors, especially in the supply of sophisticated machinery and production equipment and capacity building. Its business environment has become more lucrative due to the increased purchasing power of the population and the proliferation of e-commerce platforms. This aggressive consumer behavior following lifestyle trends will fuel high demand for functional textiles for apparel, automotive, fitness, sports and military applications. The recently established Industrial Services and Solutions Centre (ISSC) facility at the Centre for Standardization and Textile Industry Services (BBSPJIT) is in its prime. It provides information services, testing, calibration, product and quality system certification, technical training and consultancy, develops standards for the textile industry and provides inclusive professional assistance to the textile industry. This integrated infrastructure will not only help meet domestic demand, but also increase the competitiveness of the textile industry in the global market, especially in the EU – one of Indonesia’s major export destinations. Indonesia is in the process of negotiating with the EU for an Indonesia-EU Comprehensive Economic Partnership Agreement (IEU-CEPA), and Indonesia is looking towards Vietnam and Bangladesh.At the same time, the Indonesian Government was constantly striving to build a productive, connected and sustainable textile ecosystem. By 2030, the country is expected to become one of the top five global textile manufacturers and one of the world’s top 10 economies in the Industry 4.0 era.In the coming years, Indonesia’s textile and apparel exports will continue to grow due to its low-cost advantage. The analyst expects the export value of Indonesia’s textiles and garments to reach US$ 18.2 billion in 2032, representing a compound annual growth rate (CAGR) of about 8.6% from 2023-2032.Topics Covered

Overview of the garment in Indonesia.

Economic and political environment of the Indonesian garment industry

What is the effect of COVID-19 on the Indonesian textile industry?

Indonesia Garment Industry Market Size 2018-2022

Analysis of Indonesia’s Top Apparel Companies

Key Drivers and Market Opportunities in Indonesia’s Apparel Industry

What are the main drivers, challenges, and opportunities for Indonesia’s apparel industry in the planned 2023-2032 era?

Who are the key players in the Indonesian garment industry market and what are their competitive advantages?

What are the expected profits of the Indonesian garment industry market in the forecast era 2023-2032?

What strategies have been adopted by the key players in the market to increase their market share in the industry?

Which market segment of Indonesia’s apparel industry is expected to dominate the market till 2032?

What are the headwinds facing Indonesia’s textile industry?

Key attributes

Report Attribute

Details

Number of pages

60

Forecast Period

2023-2032

Estimated Market Value (USD) in 2023

$8.68 Billion

Expected market (USD) until 2032

$18.2 Billion

Compound Annual Growth Rate

8,6%

Regions Covered

Indonesia

List of chapters1. Indonesia Garment Industry Development Overview 1. 1 Definitions and Classifications 1. 2 Analysis of Main Products 1. 3 Impact of COVID-19 on Indonesia Garment Manufacturing Industry 2. Garment Manufacturing Industry Overview Indonesian clothing industry 2. 1 Development environment of clothing industry in Indonesia 2. 1. 1 Economic Environment 2. 1. 2 Political environment 2. 1. 3 Social environment 2. 2 Source analysis of clothing in Indonesia 2018-2022 2. 2. 1 Indonesian industry Garment Manufacturing Analysis of Major Foreign Investment Source Countries 2. 2. 2 Garment Production 2. 3 Indonesia Garment Market Demand Analysis 2. 3. 1 Main Garment Consumer Groups 2. 3. 2 Size of Indonesia’s domestic clothing market clothing 3. Research on imports and exports of Indonesian textile and clothing industry 3. 1 Imports 3. 1. 1 Import of raw fabrics 3. 1. 2 Main resources of imports 3. 2 Exports 3. 2. 1 Indonesia Garment Industry Export Analysis 3. 2. 2 Major Export Destinations 4. Competition in Indonesia Garment Manufacturing Industry 4. 1 Barriers to Entry in Indonesia Garment Manufacturing Industry 4. 1. 1 Government Policies 4. 1. 2 Sales channels 4. 1. 3 Brand barriers 4. 2 Competitive design of the Indonesian garment production industry 4. 2. 1 Bargaining strength of raw curtain suppliers 4. 2. 2 Bargaining strength of consumers 4. 2. 3 Competition within the clothing industry 4. 2. 4 Potential participants 4. 2. 5 Alternatives 5. Study of costs and production value Garment Manufacturing in Indonesia 5. 1 Cost Analysis of Garment Manufacturing in Indonesia 2018 -2022 5. 1. 1 Raw Material Cost 5. 1. 2 Labor Cost Analysis of Garment Manufacturing in Indonesia 5. 2 Analysis of Garment Prices in Indonesia 6. Profile of Top Garment Manufacturing Companies in Indonesia6. 1 PT Indonesia Toray Synthetics6. 2 PT Acrylic Textile Mills6. 3 PT Century Textile Industrie TBK6. 4 PT Petnesia Resindo6. 5 PT Jabato International6. 6 PT Indonesian Synthetic Textile Mills6Array7 PT EasternTex6. 8 PT OST Fiber Industries7. Indonesian Garment Manufacturing Outlook, 2023-20327. 1 Factors Influencing the Development of the Indonesian Garment Manufacturing Industry 7. 1. 1 Market Drivers and Opportunities in the Indonesian Garment Manufacturing Industry 7. 1. 2 Threats and Challenges Facing the Indonesian Garment Manufacturing Industry 7. 1. 3 Industry Outlook and Market Opportunities 7. 2 Competitive Landscape Forecast for the Indonesian Garment Manufacturing Industry 7. 3 Supply Forecast Manufacturing garments in Indonesia, 2023-2032 7. 3. 1 Forecast of import of raw materials for manufacturing of garments in Indonesia 2023-2032 7. 3. 2 Forecast of exports of garments in Indonesia 2023-2032 7. 4 Forecast of demand Garment Manufacturing Segment Market in Indonesia 2023 -2032 7. 4. 1 Overall Market Demand Forecast for Garment Manufacturing Segment in Indonesia, 2023-2032 7. 4. 2 Manufacturing Segment Demand Forecast of garments in Indonesia, 2023 -2032 For more data on this report, https://www. researchandmarkets. com/r/rww31t

About ResearchAndMarkets.comResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attached you

Indonesia Garment Industry Market