When you come across the acronym “NTUC,” the FairPrice supermarket comes to mind, as any self-respecting aunt would attest.

However, ordinary people can also combine it with the famous insurance plans presented through NTUC Income. Now rebranded as Income Insurance, how do your insurance plans fare in today’s market?

There is a prevailing notion that Income’s Travel Insurance plans come with a hefty price tag. Additionally, certain internet users have voiced grievances about the perceived challenge in filing claims.

Are these rumors true? Let’s delve into the fact once and for all.

Income has two travel insurance plans:

Each travel insurance plan is then further sub-divided into three plan tiers which provide different amounts of coverage:

The premiums your travel insurance pays largely depend on the country you are traveling to. Usually, the farther away your destination country is, the more expensive your travel insurance will be. Here are the countries covered through income source travel insurance:

Here’s a review of the premiums and policy of Income’s standard travel insurance plans:

From $250,000 to $1,000,000, Income Travel Insurance’s out-of-country medical policy is beneficial to some of its competitors, such as Sompo Travel Insurance’s $200,000 to $400,000 out-of-country medical limit.

However, keep in mind that Emergency Medical Evacuation has the same out-of-country medical claims limit for adults over the age of 70, which may not be enough if you are in this age range.

If medical policy is vital to you, FWD insurance offers unlimited policy for medical evacuation and repatriation.

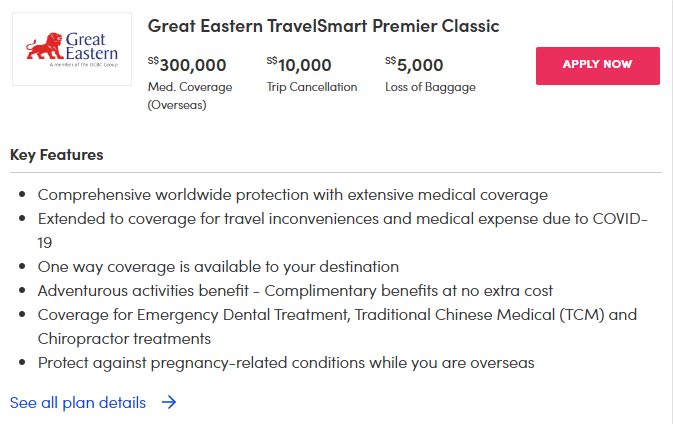

One of the great benefits of Income’s insurance is the maximum policy in case of vacation cancellation, which ranges from $5,000 to $15,000. Other insurance providers might not be so generous. For example, Great Eastern offers between $2,000 and $15,000, while AIG offers between $2,500 and $15,000.

Income is one of the few insurers in Singapore that offers comprehensive insurance plans that cover pre-existing fitness situations such as asthma, eczema, diabetes, high blood pressure and even core illnesses. The other two that cover pre-existing situations are MSIG insurance. and Etiqa insurance.

The most obvious difference between Income’s Enhanced PreX Travel Insurance plan and its regular Travel Insurance plan is, of course, price. The cheapest Income Enhanced PreX plan costs over twice the price of a regular Income Travel Insurance plan.

For those with primary fitness issues, they don’t really have a choice. There’s no point in getting reasonable umbrella insurance without any policy for you because, in fact, you can’t possibly claim for medical expenses, evacuation costs, or similar delays. an outbreak of your condition.

This is especially beneficial if your illness is life-threatening or if it is too expensive to treat abroad.

However, if you have a condition that’s pure suffering but not immediately life-threatening, such as eczema, then it is your choice whether you want to spend more on Pre-Ex travel insurance for better coverage.

It’s vital to review policy limits if you really want to buy pre-existing insurance. For what? If you are in a place where healthcare is very expensive, such as Europe or the United States, you may need to upgrade to the Enhanced PreX Prestige plan.

Is Income insurance useful for pre-existing fitness situations?For one, Income PreX insurance covers Covid-19, while MSIG TravelEasy Pre-Ex and Tiq Pre-Ex insurance does not cover it for Covid-19. So if you need either existing fitness situations and Covid-19 coverage in your insurance, Income Enhanced PreX is your only option.

While Income Pre-Ex insurance gives you Covid-19 coverage, the problem is that it has reduced the medical benefits you get if you’re 70 or older.

For example, for those aged 70 and above Income Enhanced PreX’s overseas medical and emergency medical evacuation coverage share a total claim limit of $500,000 for its basic plan tier (as opposed to up to $250,000 in overseas medical expenses and $500,000 in medical evacuation coverage for under 70s).

In comparison, the basic MSIG TravelEasy Pre-Ex plan offers $250,000/$50,000 for medical care (under 70/over 70) and $1,000,000 for evacuation regardless of age, while Tiq Travel Insurance’s core plan offers $200,000 for medical care and $1,000,000 for evacuation and repatriation of fatalities. remains.

Otherwise, Income Enhanced PreX’s various baggage cancellation and retention benefits are pretty good.

Whether you purchase Popular Income Source Travel Insurance or an Enhanced Income Source Travel Insurance Plan from PreX, have the relief of knowing that all Income Source Travel Insurance plans automatically come with Covid-19 coverage.

You may not find the Covid-19 policy chart in the same income insurance policy wording as above. Instead, there is a separate document related to the drafting of the Covid-19 insurance policy that is worth referring to.

Most of us probably wouldn’t look at the individual coverage limits of our travel insurance. We place a great deal of buy-in on insurance companies to cover basic needs.

The good news is that Income’s Travel Insurance Covid-19 extension is simple and adequate. Take Covid-19 overseas medical coverage, for example. Income offers $150,000 while MSIG TravelEasy’s basic plan offers $75,000.

Then, the Covid-19 quarantine subsidy abroad, for which Renta provides $100 per day, up to $1,400. In contrast, Etiqa’s basic package provides $100 per day, up to $500 only.

Income’s insurance covers regular vacation activities, such as scuba diving and skiing. It’s also smart enough if you’re just looking to snorkel or sign up for a simple hike with an advisor or tour organization with a licensed outdoor adventure operator.

However, thrill seekers could opt for a more lenient insurance provider, such as Direct Asia insurance, which covers extreme sports and martial arts well.

If you’re considering Income’s Travel Insurance, you should be comparing it against established household insurance providers such as MSIG and Etiqa.

All three insurers, Income, MSIG, and Etiqa offer Covid-19 coverage in their travel insurance plans automatically. Other plans that include automatic Covid-19 coverage include Starr TraveLead Comprehensive, Bubblegum Travel Insurance, Singlife Travel Insurance and DBS Chubb Travel Insurance.

In terms of medical expenses abroad, MSIG offers a policy comparable to Income’s insurance. When it comes to other related and logistical policies, such as vacation cancellation and lost luggage, the policies of the Income and MSIG insurance plans are also more or less tied up.

All things considered, Income and MSIG travel insurance plans are shockingly similar and competitive. The one key difference is emergency medical evacuation coverage for people aged 70 and over-Income’s Travel Insurance parks that under the overseas medical expense limit.

When you compare income source insurance to one of the most popular “budget” insurance providers, FWD, you’ll realize that the insurance offerings are very similar and competitive.

Between income source insurance and FWD insurance, the policy is largely on par if you’re considering a basic insurance plan with the Covid-19 policy. However, FWD costs are lower even if you purchase the Covid-19 add-on.

At a glance, here’s how Income’s insurance compares to other leading insurers in Singapore.

Although many Singaporeans probably won’t bother paying extra for income source insurance just because it’s a well-known brand, their insurance plans are actually quite expensive.

However, with promotions like the current forty-five percent off promotion, it can be good value for money. All popular packages consistent with vacations are eligible for the promotion. For example, if you need to stop at temples for a week in Myanmar, the cheapest Classic package will only charge you $33. 55 after the discount. Here are the premiums that are paid with the existing forty-five percent promotion:

In addition, Income is offering an additional 15per cent off Enhanced PreX per-trip plans with complimentary personal accident coverage for six months.

If you’ve followed insurance discussions on forums or even talked to your friends about kopi-related insurance claims, you’ve probably heard about Income’s bad reputation when it comes to claims.

Unfortunately, online forums like Hardwarezone and Reddit are full of similar stories from users claiming that their profit source insurance claims were slow, long, and fraught with difficulties. According to reports from users with profit claims, they concentrate on the desire to send original invoices.

To be fair, between these nasty stories, you’ll also find users who managed to claim from Income smoothly and received their cheques in the mail.

So, how do you make a claim? Your first port of call should be to get in touch with Income ASAP.

Income Travel Insurance Emergency Line: Call the Income Emergency Assistance Line at 6788 6616.

Here’s where it gets confusing. You have to identify the type of claim that you’re making and the “correct” way to submit it. Super important: all claims must be made within 30 days of the event or incident.

Online Travel Insurance Income Claims: Submit online insurance claims for the source of income with supporting documents such as invoices, flight routes, police reports, etc. You can do this to get the following benefits:

Paper Income Claims: For medical expenses, you need to fill out the Source of Earnings Insurance Application Form and register the paper form along with supporting documents such as hospital bill, medical report, boarding pass, etc. , at an earnings agency.

Income Email Claims: For claims that don’t involve inconvenience (see above) or medical expenses (see above), you’ll want to fill out the Income insurance application form digitally and email it with your supporting documents to pcc@revenu. Sg. Include your policy number in the subject line.

Income Claims Settlement Time: If there is no dispute, Income will resolve your claims within 10 business days or more in high-volume travel periods, such as school holidays.

Income insurance is rarely the cheapest on the market, but your regular insurance plans are very affordable and smartly priced when there’s a 45% promotion.

However, just because it’s a logo doesn’t mean it has the highest policy in the city, especially compared to newcomers like FWD. However, this is rarely a challenge for most travelers, unless you’re traveling to a well-loved place. country or find a scenario.

For most Singaporeans who just need to eat, relax and unwind during the holidays, Income’s insurance is more than adequate, especially as it also provides protection against Covid-19. However, daredevils deserve to note that it doesn’t cover more exciting activities like mountaineering. and other excessive sports.

If you have a pre-existing physical condition, Income Enhanced PreX is one of the few insurance features that’s right for you. It’s expensive, of course, but it’s probably worth it if you’re suffering from a life-threatening illness like asthma or central disease. Make sure the plan is sufficient to cover your overseas and/or evacuation expenses.

READ ALSO: NTUC Income Travel Insurance Review: Covid-19 Coverage, Pre-Existing Conditions, Premiums

This article was first published on MoneySmart.