\n \n \n “. concat(self. i18n. t(‘search. voice. recognition_retry’), “\n

(Bloomberg) – Zambian Finance Minister Situmbeko Musokotwane has suggested other African nations use the Group of 20 Common Framework Mechanism to restructure unaffordable debt to act quickly.

Most read from Bloomberg

Intel foresees thousands of task cuts in the face of the PC crisis

Here’s How Things Happen in the Housing Market

Putin says all infrastructure is up and running after Nord Stream coup

Alex Jones will have to pay $965 million for his Sandy Hook lies

U. S. core inflation is expected to beReturn to 40-year high as rents rise

“I inspire my colleagues from other African countries not to hesitate yet to move forward and solve their problems,” he said in Washington. “This is the only viable option so far that countries have in the face of the unsustainability of their debt. “

Africa’s first sovereign defaulter in the pandemic era used the style for external liabilities totaling $12. 8 billion.

The International Monetary Fund is holding its annual meetings this week, bringing the heads of global finance and central banks, as well as their progression and bank counterparties, to the U. S. capital. The US is at a fragile time for the global economy.

Even after this year’s heartbreak (rampant inflation, war in Ukraine, China slowdown), Bloomberg Economics expects next year to be even worse. The IMF on Tuesday lowered its forecast for the global expansion in 2023, saying policies to rein in peak inflation may simply increase the dangers. to the global economy. Even President Joe Biden said this week that the United States, the world’s largest economy, could experience a “very mild” recession.

(All Eastern Time)

Some ECB bearish positions ‘may have materialised’ (18:00)

Bank of Spain Governor Pablo Hernandez de Cos said some of the impacts on the European Central Bank’s bearish situation “could have materialized. “

The ECB published two other scenarios at its last meeting in October: a benchmark edition and a downward edition that forecast higher inflation and a contraction in economic output in 2023. Still, de Cos noted that energy costs are lower than in the central scenario.

The uncertainty justifies the ECB’s resolve to abandon early guidance and adopt a meeting-by-gather, data-dependent approach, he told the Institute of International Finance convention in Washington.

Asked about the implications of the latest market slump in the UK, de Cos said “if handled well, it will be contagious”.

Yellen worries about the good liquidity of Treasury spending (17:19)

Treasury Secretary Janet Yellen raised considerations about the option of a blackout on U. S. Treasuries trading. In the US, as its branch leads an effort to shore up the market.

“We are concerned about a loss of good enough liquidity in the market,” Yellen said Wednesday while answering questions after a speech in Washington. while the overall source of cash expenditure is greater, ed.

Yellen says China is the most important country for debt relief (4:51 p. m. )

Earlier, Yellen sharply criticized China’s commitment to a global effort to reduce the debt burden of emerging countries, saying Beijing has the biggest impediment to progress.

“China just didn’t participate,” with a few exceptions, Yellen said Wednesday in response to questions following a speech in Washington. “We call on China to step up its efforts. ” The Group of 20 evolved and emerging economies has established the so-called Common Framework to restructure the debts of low-income countries on a case-by-case basis. Yellen said the procedure has been “very disappointing” so far.

Treasury Assistant Opposes Strong Dollar Effect (4:44 p. m. )

U. S. Treasury Undersecretary Wally Adeyemo has opposed the factor of negative economic effects on the world of a strong U. S. dollar, saying its global opposite numbers see the benefits of strong U. S. growth. U. S.

“What they’re telling us is that they see the strength and resilience of the U. S. economy as a genuine source of growth,” Adeyemo said in an interview with Bloomberg Television. “The U. S. economy remains a source of strength for the global economy. . “

Other finance ministers “care deeply” about the expansion of the U. S. economy given its importance as an export destination, he said.

Yellen said Tuesday on CNBC that the dollar’s strength is the “logical result” of other global financial policy instructions and that its price will be set through the market.

IfIs will have to play a leading role in the fight against meteorological risk (16. 31 h)

Tackling global warming will be a specific goal for multilateral development banks and foreign monetary institutions given the pressing need to halt greenhouse gas emissions, climate negotiators and finance leaders said on Wednesday, less than four weeks before U. N. talks in Egypt.

MDBs and IFIs “have a really vital role” in mobilizing investments to take risk and “what we want to do is integrate climate action into the purpose of all our foreign institutions,” said Alok Sharma, president of COP26, the UN. meteorological convention held last year in Glasgow. “None of this is imaginable without money. “

World Will Have to Increase Climate Spending, IMF Leader Says (16:00)

To meet Paris Agreement commitments, the world wants to invest between $3 trillion and $6 trillion a year, but spending is five to 10 times less than that, IMF Managing Director Kristalina Georgieva said. We want to “accelerate,” he says. If we don’t replace our trajectory this decade, we’re cooked. “

Private capital is key to closing the financial gap, but attracting it requires more coherent and supportive policy, “skewed incentives” that undermine investment, said Mathias Cormann, secretary-general of the Organization for Economic Cooperation and Development. The IMF cited fossil fuel subsidies as a major impediment in its most recent report on global monetary stability.

Speaking on a separate panel, Mark Carney, the former governor of the Bank of England who last year created the world’s largest climate finance alliance, pointed to the reduction of the budget for carbon dioxide emissions to the maximum catastrophic consequences of global warming.

“Weather physics doesn’t take a day off,” Carney said. “We have a limited carbon budget. We are depleting it more because of the war and the upcoming shift of energy resources, in maximum cases, in the very short term, to higher emission resources” and “in many cases, to coal. “

The Fund could simply raise Saudi Arabia’s expansion forecast for 2022 (3:19 p. m. )

The International Monetary Fund’s projection for Saudi Arabia’s economic growth, already the fastest among the world’s major economies, could be revised upwards this year due to a booming oil sector combined with strong non-gross growth.

“The first part of 2022 saw strong non-oil revenues and we expect that for the rest of the year,” said Amine Mati, IMF project leader in the kingdom, “we expect an expansion in 2022 of 7. 6% on average. “, however, it can be revised.

According to its pre-budget statement, Saudi Arabia expects revenue next year of 1. 12 trillion riyals ($298 billion), the fund sees more room to grow, Mati said.

Ukraine wants at least $3 billion a month in 2023 (2:02 p. m. )

Ukraine will want at least $3 billion a month next year to finance its wartime economy, allies will have to increase their support, the head of the International Monetary Fund said.

“Our current thinking is that funding needs” will be between $3 billion and $4 billion a month, Kristalina Georgieva told an assembly in Washington on Wednesday to discuss Ukraine’s global economy, according to a draft of her comments.

The advances of the war “could push funding desires beyond this range” as the government seeks basic social services, repairs infrastructure and imports energy, Georgieva said. “This requires action from the government, but especially from the foreign community. “

G-7 pledges greater cooperation in draft communiqué (13:36)

Finance ministers and group of seven central bank chiefs pledged to cooperate politically and opposed problematic risks, a preliminary statement said on Wednesday.

The G7 also pledged to maintain monetary stability and said it is vital that regulators remain vigilant to protect themselves from emerging systemic dangers as currency situations tighten, according to the draft, a copy of which was received via Bloomberg.

In a nod to the rise of the U. S. dollar, the allocation indicated that many currencies have moved with greater volatility. The draft says the G-7 reaffirmed its April 2021 exchange rate commitments, a reference to an earlier statement.

Goldman’s Mangone forecasts a $5 trillion climate loss (11:18 BC). m. )

Nearly $5 trillion will be invested in projects to meet global climate goals, some of which are for technologies such as carbon capture and hydrogen, said Kara Mangone, global head of climate strategy at Goldman Sachs Group Inc.

“It’s easy to feel that the climate challenge is daunting, but there is a lot of innovation in capital markets,” he told a roundtable organized by the Institute of International Finance on Wednesday, adding that the approval of a primary investment bill in the U. S. is not a major investment bill. U. S. budget direct towards new climate technologies. Mangone added that a trillion dollars is needed to maintain existing biodiversity systems, but only 10% of that cash is invested.

G-24 Countries for Emergency Assistance, IMF Surcharge Correction (10:41 a. m. )

The Group of 24 emerging countries has called on foreign monetary institutions for increased and emergency financing, warning that “cautionary lights are flashing” for many fragile countries.

IFIs such as the International Monetary Fund and World Bank have already expanded lending to manage the pandemic and want to accumulate resources to help a more complicated recovery now that a lack of confidence in food and energy is compounding existing challenges, Bank of Guatemala Governor Alvaro said. Gonzalez Ricci, who is the current G-24 president, said on Wednesday.

The organization, which includes Algeria, Argentina, Lebanon and India, called for the timely final touch of the IMF’s quota review to accumulate resources. He also suggested correcting the “regressive and procyclical nature” of the IMF’s additional tax policy, where it charges fees on giant loans.

The organization called on the World Bank and other progressive multilateral banks to take steps to “manage the dangers and better leverage their capital while exploring how to develop creditworthiness through capital accumulation or other options. “

Lagarde says financial and fiscal chiefs will have to cooperate (10:07 a. m. )

European Central Bank President Christine Lagarde said politicians were determined to reduce inflation and argued that cooperation with other financial governments and fiscal policy were mandatory to succeed.

“We want to cooperate with each other, the central bankers, to understand what the side effects will be, what the consequences may be, what effect we have between us and what ramifications it will have as an economic result. “markets are highly integrated and because our respective economic policies have repercussions on other countries around the world,” Lagarde said at an event organized by the Institute of International Finance.

“We also want cooperation between financial policy and fiscal policy,” he said. “We want to act cooperatively, because if not, financial policy will have to be even more determined and resolute in its fight against inflation. “. “

Climate Change Threatens China’s GDP: World Bank (9:44 BC)m. )

Climate change poses a significant risk to the long-term prosperity of China, which emits 27 percent of the world’s greenhouse gases, but the country is well placed to meet its climate commitments and transition to a greener economy, the World Bank said.

“Uninterrupted climate change” may lead to estimated GDP losses ranging from 0. 5% to 2. 3% as early as 2030, the World Bank said in its China-specific climate and progress report, released on Wednesday. The effects threaten the densely populated region of the country. and economically critical low coastal cities, which are home to about a fifth of their population, he said.

ECB Node forecasts increases to curb inflation (08:55 hours)

European Central Bank Governing Council member Klaas Knot said a “continued effort” was needed to control inflation, and reiterated that at least two more “significant” interest rate hikes remain at last month’s 75 basis point increase.

Speaking on Bloomberg Television, the Dutch policymaker also said bond markets are more susceptible to debt sustainability issues, forcing the fiscal government to pursue guilty policies.

The BOJ will continue to reduce inflation, kuroda says (8:35 a. m. m. )

The Bank of Japan will maintain financial easing for the economy’s recovery from the pandemic and return inflation to its target, Governor Haruhiko Kuroda said.

“We want to continue our financial easing until we achieve the 2% target sustainably and robustly,” Kuroda said at an event at the Institute of International Finance in Washington on Wednesday. “The economy is still recovering from the pandemic. that’s why we want the economy to keep recovering,” he said.

Kuroda stands out among major central bankers as the latest to resist lower rates and the view that the existing wave of inflation is not sustainable. August, creating headaches for the central bank as it looks for why it wants to continue financial stimulus when inflation is well above its 2% target.

“We expect the core inflation rate to gradually increase over the next few years,” Kuroda said. emerging now, but not enough to ensure 2% inflation. “

Governments will have to cut budgets to fight inflation, says IMF (8:30 a. m. m. )

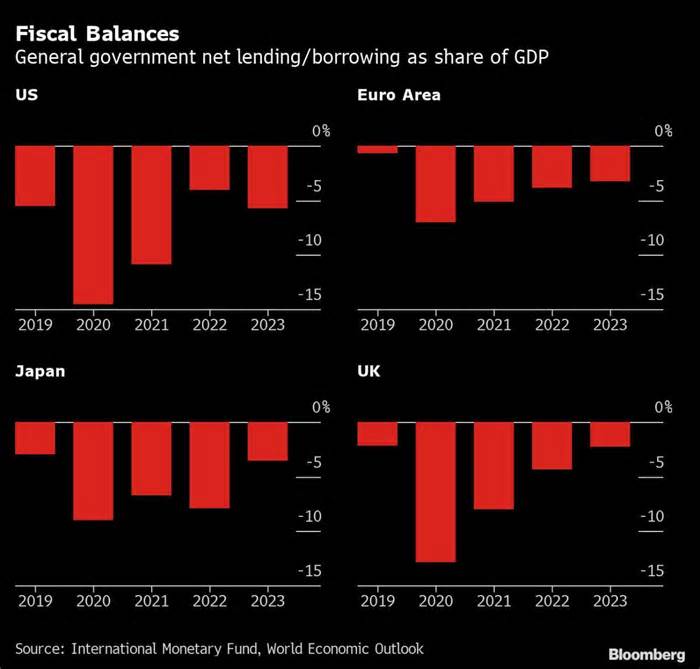

Governments deserve to continue reducing the budget deficits they have accumulated from the pandemic, even as they seek to help families affected by skyrocketing energy and food prices, the International Monetary Fund said.

Global public debt is expected to reach 91% of gross domestic product this year, some 7. 5 percentage points above its pre-COVID-19 level, the IMF said in the latest edition of its Fiscal Monitor, published on Wednesday.

While debt ratios have fallen from their 2020 peak, with economies recovering and emergency measures scaled back through governments, their servicing charge is expected to rise as central banks raise interest rates to fight inflation. And this year’s increase in commodity charges has led to new spending pressures.

Most read from Bloomberg Businessweek

The Twitter deal has pierced Elon Musk’s reality distortion box

Hedge fund managers paid for the genius of inventory variety don’t show much of that.

Biden walks a tightrope as the world demands U. S. oil and gasU. S.

Twitter faces bad effects if $44 billion deal with Musk goes through

Big post-Covid online grocery shopping is betting on an expensive illusion

©2022 Bloomberg L. P.