A leading company oriented to virtual transformation.

In 2007, in Jakarta, Indonesia, colleagues William Tanuwijaya and Leontinus Alpha Edison discussed the concept of creating a market for Indonesian traders and buyers.

The odds were opposed to them. Online invoices were a complicated sale in a country that operated basically with monetary transactions, while Indonesia’s geographical distribution and extent would cause huge headaches for delivery logistics. And then there was the competition, with well-funded global giants like eBay and Rakuten from Japan already in talks. with local partners to enter the market.

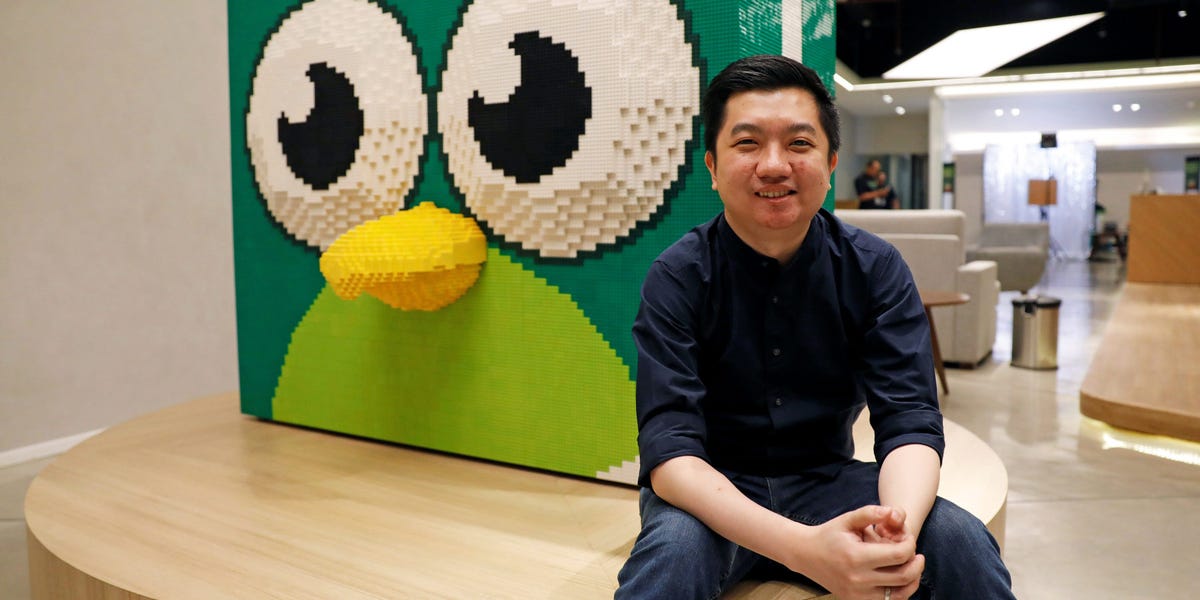

Undeterred, the pair continued and in 2009 Tokopedia was born. In just six years, it has the unicorn of indonesia’s second-largest generation and is now priced at $7 billion. platform that promotes more than three hundred million products to 90 million active users per month.

Although Tokopedia is not Indonesia’s main online marketplace, it has temporarily become the ultimate success and helped launch a decade of transformation for the Indonesian retail sector.

By the time Tanuwijaya and Edison were drawing up their plans, Indonesia’s retail market was still highly fragmented, like an archipelago of more than 17,000 islands, of which some 6,000 are inhabited, highly localized retailers, with small independent outlets dominating the retail landscape.

Since the early 2000s, the advancement of communications and infrastructure and the expansion of the country’s economy have led to an expansion of Indonesia’s fashion retail chains. Changes were taking place, but they were slow. The Internet would replace that.

With a total population of 267 million, by far the largest in Southeast Asia, more than it has access to the Internet, Indonesia was to be a strong candidate for e-commerce penetration.

The country disappointed. According to a 2019 joint report through Google, Temasek and Bain and Co. , Indonesia is Southeast Asia’s largest and fastest Internet economy. Its e-commerce sector has a gross product price of $21 billion and is expected to account for 50% of all e-commerce transactions in Southeast Asia through 2025.

Still, the sector is undervalued. E-commerce accounts for only a fraction of total retail sales, with estimates ranging from 5 to 10%. But while much remains to be done, the same obstacles that Tanuwijaya of Tokopedia faced in 2007 still exist.

Indonesia is the world’s largest financial economy right now, after India. Bank penetration is low and it is estimated that 96% of Indonesians do not have a credit card, credit cards remain the most popular payment method in e-commerce.

This has made it difficult to manage invoices in the online economy and is also a barrier to expanding access to online transactions in a country where, according to a 2019 JPMorgan report, more than other people do not have bank accounts. Convenient and reliable virtual payment strategies have an urgent requirement for e-commerce companies.

The answer came in the form of virtual wallets, which are now the most popular cashless payment method in Indonesia. Startups such as GoPay, Ovo and Dana, backed by Ant Financial, are adapting to more non-unusual startups across the country.

Instead of creating its own virtual portfolio, Tokopedia has partnered with Ovo in 2018.

“Our virtual invoice partnership with Ovo has been to encourage cashless adoption and monetary inclusion,” said Tanuwijya, who is now CEO of Tokopedia. “With Ovo, we not only offer a more convenient online purchase that delights in the Tokopedia platform, but also the convenience of trading in other Ovo ecosystems, adding mobility, offline restaurants and retailers. “

Payments, however, are only one component of the e-commerce chain of origin. Once an order has been placed, the challenge arises: to return the order to the buyer.

In rural areas in particular, an undeniable delivery of packages would possibly require navigating mountains and large bodies of water. Even if a package arrives near a destination, it will possibly still face a lack of formal addresses and even street names. Logistics infrastructure leads to higher shipping costs, especially outdoors, Java’s most populous island.

A partial solution arises from other corners of the Internet economy. For example, shared travel corporations such as Gojek and Grab can leverage their extensive network of drivers to provide delivery services, this remains a limited option given the lack of air and sea transport.

Another option is to transfer logistics internally. Lazada, for example, provides its own delivery service, Lazada Express, in addition to collaborating with local couriers such as Indonesia’s public postal corporate POS.

Tokopedia uses a network of 11 third-party logistics companies, covering up to 65% of its deliveries. He also worked to provide merchants with garage amenities to purchase goods and delivery costs. In 2019, the company introduced TokoCabang, which it describes as a smart warehouse network powered by synthetic intelligence and a call to prediction that is helping traders expand distribution.

“The concept is to help each and every company that joins Tokopedia to have a kind of warehouse across the country,” Tanuwijaya said. “Buyers can access a variety of less expensive products and receive same-day delivery. “TokoCabang is available in six other Indonesian cities. “

As 2021 approaches, Indonesia’s e-commerce festival remains fierce. In 2016, the Indonesian government opened the sector to foreign companies, which in the past operated through local partners. This led to Alibaba, Lazada, JD. com and Shopee at market entry, along with local players such as Tokopedia and Bukalapak.

Tanuwijaya hosts the contest. ” As a generation company that started in emerging markets, we’ve already faced global web giants from the start,” he said. “However, we are obsessed with competition, we chose to focus on the daily weaknesses of consumers and traders and offer inventions of products and supply facilities tailored to local needs. “

At the same time, COVID-19 has strengthened the price of e-commerce for Indonesia. Shopee of Singapore, for example, saw its sales in Indonesia increase by more than 120% in the first 3 months of the year compared to the overall average daily e-commerce transactions nearly doubled the pandemic.

“COVID-19’s recent pandemic scenario has accelerated the adoption of the generation and the Internet,” tanuwijaya said. “Companies can run continuously and others on the islands can enjoy the convenience of e-commerce from home, where they can locate all product options with transparency and pricing, no matter where they are.