Then I sought to find out if Covid-19 had made it difficult for venture capitalists and startups to realize themselves, that startups would be provided and financed, and that consumers B2C and B2B would realize the new offers. One would think that investors would have been paralyzed by:

· Uncertainty about Covid’s economic and economic impact

The near impossibility of establishing face-to-face contacts for founders and venture capital

· Decreased spending through the unemployed or disabled and companies whose expenses have been reduced

· Decreased customer ability to discover, touch, feel and delight in new products and physically at points of sale.

9 global experts, with other perspectives, shared their views. To my surprise, the 9 were sure that overall things were much better for startups and VCs than expected.

Post-Covid acceleration of disruptive start-up opportunities

New York-based new-creation investor Jack Einhorn said that when markets are disrupted, such as the existing forced acceleration of everything that is digital, many opportunities are created, and now it’s one of the most prolific moments in history to generate new tactics of doing things.

Ron Gonen, founder and CEO of Closed Loop Partners, a fund focused on sustainable development, said investors are excited when the world changes, creates opportunities, new business models and new tactics to get things done. Covid stressed the importance of new source management tactics. chains to respond quickly, transparently and cost-effectively, and with less waste, than generating remote goods that are more difficult to access. The accumulation of wildfires and hurricanes has accelerated further, the urgency of locating new tactics to curb the climate. Change.

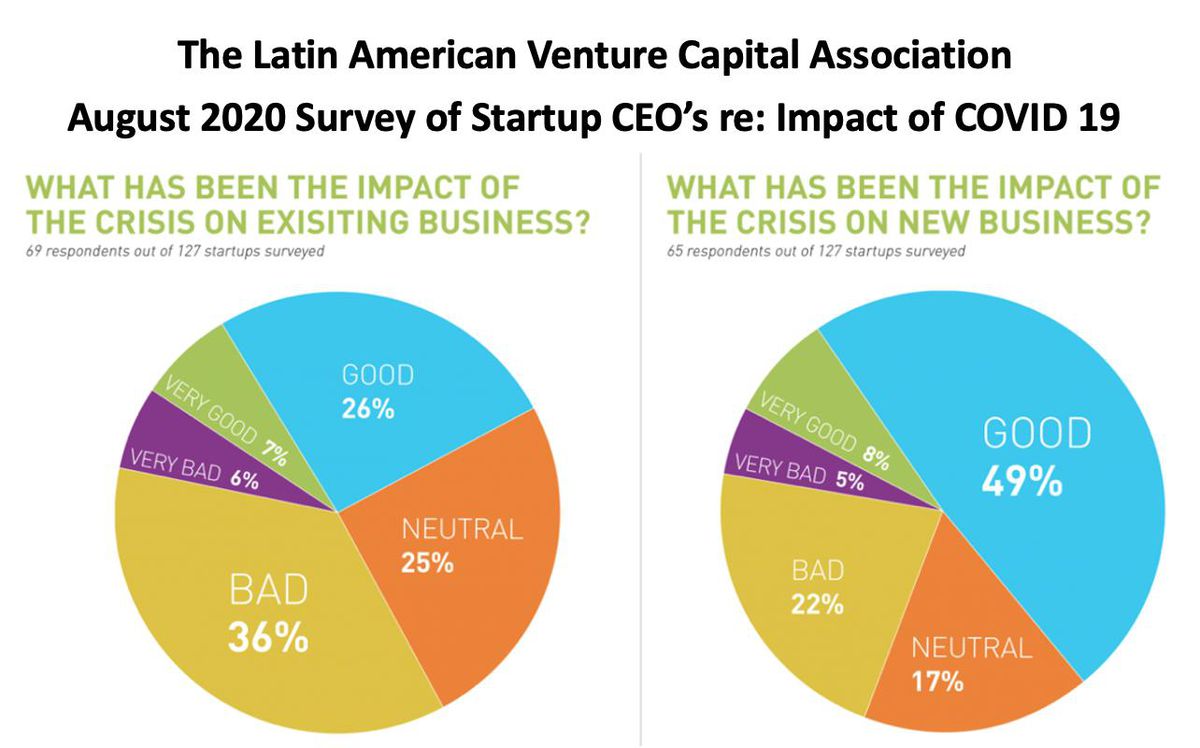

According to Daniela Gutman, COO of La Maquinita, Argentina’s leading coworking company and business professor at the University of San Andrés in Buenos Aires, the first months of the pandemic, the global VC in Latin America, as elsewhere, was overthrown. For many start-ups in Latin America, Covid has become an opportunity. Companies that specialized in selling digitalization of ads and hard work automation responsibilities that were suffering to gain market percentage before the pandemic have now noticed that the positive outlook is accelerating, in some cases gaining an expected five-year expansion in just a few months. According to LAVAC (Latin American VC Association), excluding Softbank tours, the first part of 2020 was the highest annual part ever recorded for the price of transactions.

Ignasi Costas, head of innovation and entrepreneurship at DWF-RCD, the leading venture capital and startup law firm in Spain, also noted that while investment activity stopped for a month when Covid emerged, investors have been active and analyze opportunities and plan their next Moves in the context of the so-called new normal. That said, outside the gates of the United States, investment has suffered the most in the countries most affected by the pandemic.

For Michael Nogen, an administrator spouse of Overton Venture Capital, a US-based venture capital fund, the US-based venture capital fund, is not a U. S. -based venture capital fund. Usa, the post-Covid era has been incredibly active. Of the nine corporations in his portfolio, three were added this summer. “There is a lot of capital to invest, and transactions take position and conclude quickly, without startups leaving their valuations New companies are emerging as other people who lose their jobs and want other revenue source resources create concepts for broader tactics to get things done and solve new disruptions New technological capabilities. Jack Einhorn meets the “Mompreneurs”, forced to stay home, as a specific artistic group. They are also a target audience for some startups.

Pressure to deploy venture capital

Shaun Abrahamson is a managing spouse at Urban Us, a seed venture capital corporation that budgets new companies that help cities modernize in the face of climate change. His company was one of 11 TechCrunch VCs he chose from 391 in 22 vertical sectors for his list. “the founders of venture capital are the ones who like them the most. “Both Shaun and Jack expressed that the venture capital budget that has raised capital feels compelled to invest where they see strong trade opportunities and signals, than to sit on one’s budget, so that they can raise more cash and continue to increase their budget.

Jack shared another explanation of why the highest levels of recent activity is uncertainty about what the elections will bring: some founders are accelerating their capital raising programs to make sure they have enough money to replace the scenarios. Resume faces similar pressures. Uncertainties about Covid and possible adjustments in management and economics, the agreements you choose and the terms of the transactions.

Simeon Iheagwam, founder and managing spouse of NOEMIS Ventures, which focuses on AI/ML, FinTech and markets, said that in March and April, investors took a break to verify the effect of COVID on consumers and businesses. , venture capital investment resumed. Soon after, when he gave the impression that the “new normal” might be there for some time. He believes that investments remain strong and that there are many attractive offers in the market.

More creativity for startups and VC to realize and get to know others

Iynna Halilou, Global Program Manager at ERA (Entrepreneurs Roundtable Accelerator), considered through many to be the maximum productive generation accelerator in New York, discovers new companies to incubate around the world, adding from Africa, Asia and South America. While the discussion revolves around how startups place VC and investors, there is actually a balance because VC also wants to locate smart startups. Because the most sensible startups are looking for strategic investors who can raise the price beyond money, there is a big festival between VCs to decide through the top popular startups.

Jack and Shaun believe zoom calls make the procedure more effective. The founders of Europe, Israel, Asia and other U. S. cities stored travel time and cash without flying to Silicon Valley, which is still considered the center of the global startup ecosystem. Less travel time and more effective virtual meetings, VC now has more time to realize startups. Since the release is to some extent a set of numbers, it is now imaginable to make more contacts on a single day. Startups can now communicate with up to 10 VCs per day.

Simeon shared that to make up for the lack of face-to-face meetings, there were more reference checks, zoom calls, and more players meeting, adding more team members, co-founders, and advisory board members.

Ieva Gaila, co-founder of startup Unfair Cap, which identifies high-performing marketers through mental assessment and introduces them to investors, works from Station F, a relatively new company, in Paris, the startup incubator biggest in the world. Facebook, Microsoft, BNP Paribas, L’Oréal and LVMH have incubators. Before COVID, Station F had six hundred networking occasions a year. The number has now been reduced and the maximum is now virtual. -Pandemic level, other people’s temperature is taken daily, a mask must be worn at all times and daily reports are published on who has become inflamed and where on campus.

Jack has met Lunchclub, a platform that, through artificial intelligence, analyzes skills and interests and introduces founders to the types of people they need to know. Initially in person, the platform rotated to organize zoom meetings.

Shaun and Iynna shared that warm presentations are a long way to facilitate meetings and investments. As Iynna said, founders and venture capitalists want to be artistic in the way they are located, beyond the typical demographics of founders, through connection with groups of angels online, marketing groups, educational systems for marketing specialists beyond the most productive apparent schools, creating awareness , offering or participating in tutoring sessions and virtual occasions and talking to organizers for Array connections and concepts and working with newly created screening companies. VCs don’t look at their LinkedIn inboxes, Iynna felt that if LinkedIn’s message is convincing and conscientiously crafted that misspelled like many, it can attract VC’s attention. These factors, combined with fewer trips to be evaluated, have expanded the startup group to be discovered and decided demographically and geographically.

Brief and convincing presentations, more important

Founder stories and founder ideas about VC are essential. In a post-Covid world, Jack and Michael Nogen say that ideas about people need to be even more specific and concise online compared to calmer face-to-face meetings, especially since VCs have a tendency to compare more put into march every day, and because it is more difficult to get a concept of the founder’s personality through a video. In the first minute, it is very important that they provide the business problem / desire and why consumers and investors care. Overall, though, Michael thinks it’s a smart time to start. She added that it was never a better time to be a founding woman or minority. Half of Overton’s founders are diversity-oriented companies. Many U. S. venture capital firms are now joining the chorus from advocates who have supported the startup of minorities and mixed backgrounds since the start of widespread protests this summer against police brutality and systemic racism in the United States.

The total capital invested approximately before COVID, but with fewer higher bets

Source: eCap / Newfund Capital Partner

Ieva’s view in France is that almost as much cash has been invested lately as before Covid, however, fewer major bets are placed on higher probability and less dicy start-up ideas. Daniela observed the same trend in Latin America. Eva also believes that, because it is more difficult to compare groups remotely, more emphasis is placed on beyond history and success, which makes it more difficult for new founders to raise funds.

Sectors are funded

The spaces of greatest interest to make an investment are not surprising:

– Health technology, telemedicine and wellness

– Climate adaptation solutions

– It was technological for the elderly locked up at home

– Educational generation for running parents has more freedom and provides more dynamic and engaging online reports for children

– Delivery solutions, whether food and goods, and freight

– Ghost kitchens that deliver but have no physical prints

– Improved home, adding lawn maintenance, food culture, temperature control, ornaments and family items, as other people spend more time there

– Physical facilitators of the house, from furniture to lighting and computers.

– Platforms that productivity of paints online at home between teams

– Power of the supply chain and greater sustainability

– Robotics and AI that update physical paints made through humans through Array by adding structure and R

– Video and e-sports

– Double-sided markets

– Fin-Tech for banking, investment management, appraisal, tax preparation

– Artificial intelligence and retail satisfy consumers’ desires with the stock of independent retailers, for new and used/used items.

B2B customer intelligence and physical products can also be smart investments. While in-person purchases and B2B sales calls are much less frequent, explanations can be very effective online through humans, videos and chatbots. Proper websites, difficult social media, influential people that subscribers accept as true to manage new products and the highest time others spend at home searching for new products and reading reviews online.

To take away

For startups with interesting, differentiating and timely ideas, there are many opportunities to notice and finance in today’s environment the mix of:

– New technologies

– Quick replacement in paintings and lifestyle circumstances, wishes and behaviors.

– Increased hunger and receptivity to new solutions.

– Easier, less expensive and faster tactics to be discovered and evaluated

If you are a VC looking to capture disruptive opportunities, this is the best time, you may want to adapt the way you do things. Research would possibly require more work, but there are more functions than ever before and more A diverse group of new companies around the world. This requires imagining what an even faster virtual world might look like. It’s a really scary time, but for those who want to replace the global world for the better, it’s a very exciting time to make an impact.

Michelle Greenwald is executive director of Catalyzing Innovation, a global cross-sectoral innovation center that includes:

– The ebook Catalyzing Innovation: Another 63 Innovation

Michelle Greenwald is executive director of Catalyzing Innovation, a global cross-sectoral innovation center that includes:

– The Catalyzing Innovation ebook: another 63 innovation and 1100 examples categorized to motivate fresh, systematic and artistic innovation.

– Inventours ™ organized tours with world-leading innovators in technology, product design, food and retail in the world’s most artistic cities to deliver data to business innovation processes.

– Training in innovation and discovery safaris in the market

– Executive in marketing strategy and planning, and entrepreneurship and innovation

– Marketing consulting in marketing and planning, and entrepreneurship and innovation.

– World Conference