imagina

By Thijs Geijer, Senior Industry Economist

High energy costs are creating uncertainty for EU food manufacturers, although national energy aid measures are cutting the impact and protecting production. this winter and longer-term fuel source considerations persist.

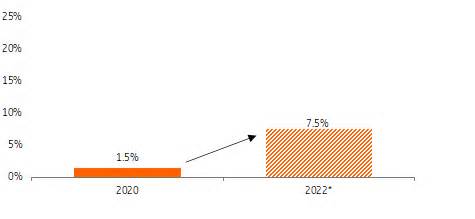

In 2019, when energy markets were still calm, energy accounted for 2% of overall food brand prices in the EU. Given the strong accumulation of energy value, we estimate that the percentage is lately between 7. 5% and 10% (worthless). caps or compensations).

There are also plenty of signs that some food brands have seen their energy costs add up to as much as 30% of their total costs. In food processing, activities such as grinding, baking, and processing fruits, vegetables, and potatoes consume a lot of energy.

At this point, there are big differences between what corporations pay for energy, as some still have consistent longer-term contracts, while others have had to renew their contracts at much higher rates.

Companies that have frozen energy costs before 2021 and corporations that use non-fuel energy resources to produce heat are in a more favorable position.

However, the differences will become less pronounced in the coming months as older, less expensive contracts expire and lucrative coverage and government measures point to some gaps.

The Netherlands is an example of how energy prices have a burden on food producers

Energy prices as a percentage of total food and beverage production prices

Source: CBS, *ING Research estimate

In addition to the direct effect on costs, there is also a shift of higher energy costs to food and beverage brands because they buy a lot of agricultural inputs and because they want transportation.

Sometimes agriculture is energy-intensive (see this previous article), and this is the case with greenhouse horticulture and mushroom cultivation. percentage has risen to more than 60%.

When agricultural commodity costs rise due to higher energy costs, the food industry also has to deal with this situation. Hard workload at load pressure.

Do we see symptoms of reduced food production in the EU due to high energy prices?So far, agri-food production has proven resilient, aided through the ability to pass on (some of it) the highest prices to consumers and consumers. .

This transmission is illustrated by the double-digit food inflation levels existing in the EU (see more in this article). However, knowledge on food production up to August shows that production volumes in the food and drink industry in the EU are higher this year. to 2021.

The long-term trend shows that production volumes are not very sensitive to external shocks, in addition to a sharp drop at the beginning of the Covid-19 pandemic.

Currently, we see two mechanisms that safeguard EU food production. Firstly, foreign industry and substitution allow food processors to keep facilities running in case European agricultural materials are insufficient.

High energy costs have not yet led to such a situation, however, earlier this year, the industry helped the production of spreadable and frozen potatoes amid shortages of Ukrainian sunflower oil.

Second, food manufacturers also benefit from government aid measures to cushion the effect of high energy costs on businesses and consumers.

Recent measures that gain advantages for businesses come with the reduced VAT rate for electricity and fuel in Belgium and Energy Cost Compensation (TEK) in the Netherlands. At the same time, the measures for customers are because they avoid drastic cuts in spending on fundamental desires such as food.

EU countries opt for a series of measures for the burden of companies

Selection of government measures in several countries

Source: Bruegel, VRT, FAZ, NOS, ING Research

The advent of all sorts of national power measures for corporations will temporarily distort the festival in many ways. This is very applicable as food and drink products are a major export category accounting for almost €270 billion or 8% of all intra-EU trade.

As a result, calls from food industry associations to maintain a points game box have become more potent in recent months. However, differences between countries are likely to accumulate, as some countries have more fiscal area than others.

The longer the energy crisis and the measures that are maintained, the more likely they are to discover to some extent which companies will best withstand this typhoon.

How measures distort the festival in various ways

Data Source Provider: ING Research

In our base case, energy costs in Europe will remain relatively high for several years. Assuming that energy measures are temporary, the competitiveness of European food products on global markets will worsen to some extent.

However, the global demand for calories is higher due to population expansion and well-being, affordability is a developing issue. We expect the overall competitiveness of more premium products, such as infant formula, beer or frozen potato chips, to be less affected.

But for commodities such as milk powder, olive oil and pork, the European Commission’s agricultural outlook has already signaled a decline in export volumes in 2022. This is attributed to one of the reasons, adding the high costs of energy, food and fertilizer, as well as drought. and animal diseases.

Therefore, emerging energy costs are something that affects EU exports, it is not the only thing. On the other hand, the strengthening of the dollar is a driving force in the opposite direction and lately is supporting EU exports.

Of the seven main food-producing countries in the EU, the importance of fuel as an energy source is found in the Benelux (Belgium, the Netherlands and Luxembourg) and the lowest in Spain and Poland.

In addition, a giant component of the Benelux electric power source comes from fuel-fueled power plants. Although fuel source considerations this winter have eased somewhat, the fuel rationing option poses a serious problem threat to corporations that use fuel to generate heat in their production processes, especially if they have limited fuel switching characteristics.

Food processing plants that use other energy sources, such as coal, oil or wood chips, are lately better located and operating at full capacity, although their energy inputs are sometimes less sustainable.

Another threat is that EU member states are expected to reduce electricity demand for peak hours between December 1, 2022 and March 31, 2023. This can force corporations to move more production to night or weekend shifts or reduce production if this is not possible.

Food and beverage brands in the Netherlands and Belgium are the most dependent on gas

Energy resources used in terajoules in the food, beverage and tobacco industry, 2019

Data Source Provider: Eurostat, ING Research

High energy costs are adding to food inflation and the current point of food inflation is driving adjustments in food consumption. These adjustments range from increased discounter purchases and a higher market share for personal brand products to a rebalancing between expensive protein serving sizes and less expensive carbohydrates. In restaurants.

The impact of higher energy costs can be felt most in the fruit and vegetable aisle of supermarkets. Here, there will be all sorts of substitution effects in the demonstration this winter.

Due to more energy-intensive processing, canned and frozen vegetables are less competitive than new vegetables. In addition, the cultivation of tomatoes, cucumbers and peppers is much less hot this winter for many horticulturists in northwestern Europe.

If they leave their greenhouses empty, stores will most likely get more vegetables from growers in Spain, Italy, Morocco and Turkey. These products need less energy to grow, but still require more expensive diesel to carry. In turn, this may mean that some consumers will turn to other types of vegetables that offer greater value for money.

Prices of processed vegetables rose more than those of new vegetables

Dutch Consumer Price Index 2015 = 100, data per month

Source: CBS, ING Research

Contingency planning is likely to be a major topic of discussion in discussions about the strategy for 2023 and beyond.

For food manufacturers, cutting production in the short term is not easy. This is true for companies that have contracted a secure volume of agricultural inputs or for cooperatives that are obliged to purchase milk, animals or crops from their members.

In addition, if they reduce production, they threaten to waste contracts and customers, posing an even greater threat to business continuity. While it is noted that EU farmers have more flexibility to make the decision to reduce production, they regularly have consistently higher costs, meaning that even in adverse market conditions, they will make the decision to “keep ploughing”.

Tracking movements made across food brands to cope with higher energy prices:

This year, the EU was able to fill the fuel tank in the existing grades partly because Russian fuel is still available. Futures markets now appear to be worried about the coming winter and Europe’s ability to build up stocks without Russian fuel supplies.

In the event of continued shortages of sources, this can be a burden for food manufacturers, as many food production plants have been supplied or upgraded to run on fuel over the past decade.

These considerations are obviously prompting food corporations to rethink their long-term energy strategies, adding facets such as outsourcing energy supply, optimal energy mix, and similar investments.

This publication has been prepared through ING for informational purposes only, regardless of a specific user’s means, monetary scenario or investment objectives. The data constitutes an investment recommendation, investment, legal or tax advice, or an offer or solicitation to purchase. or sell any monetary instrument. Read more.

Original message

Editor’s note: The summary bullets for this article were selected through the editors of Seeking Alpha.

This article written by