The Gulf countries, led by Saudi Arabia, showed courage and praised the strength of their economies, saying they could face any amount of impacts from the oil crisis. Unfortunately, more and more evidence suggests otherwise: Gulf economies are in a desperate scenario. because of its over-reliance on oil.

With oil costs stagnant at $40/bbl, S

Budget deficit

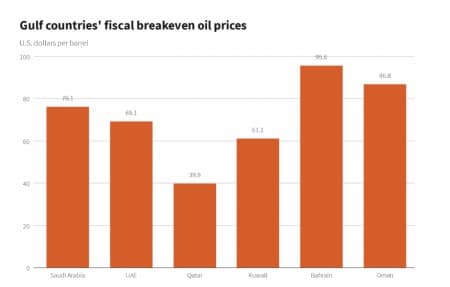

While Saudi Arabia, the region’s largest economy, has some of the lowest production costs in the world, the stark truth is that oil at $40 is far from what the kingdom wants to balance its books. Indeed, the IMF has estimated that Saudi Arabia wants oil. it is worth $76. 10 to the budget balance of the existing year, with existing oil leaving the country with a massive budget deficit of 11. 4% of GDP. Oil accounts for approximately 87% of Saudi budget revenues, 90% of export earnings and 42% of GDP.

Looking ahead, the United States ran a budget deficit of 4. 2% of GDP in 2019, but will see this figure succeed at 13. 1% in fiscal 2020 due to the negative effects of Covid-19. that the US budget deficit in fiscal year 2021 will return to broad levels of 4. 1% of GDP and will accumulate to 8. 7% of GDP through 2049.

Interestingly, Saudi Arabia has denied being in austerity mode and says it will stick to its budget announced in December, however, the country tripled its value-added tax, announced spending cuts in non-priority spaces, and suspended the cost-of-living allowance. .

The other GCC countries are much better placed.

Only Qatar, with a balanced oil value with a budget of $39. 90, will record a budget surplus.

The scenario is not expected to happen any time soon.

While Goldman Sachs ranks among positive top oil forecasts with oil value forecasts of $65 consistent with the barrel through the third quarter of 2021, other analysts are less positive. For example, a recent Reuters survey predicted a slight increase, with a Brent average of $50. 45 consistent with barrel in 2011.

That would still take a long time to fill the deficits of top Gulf countries, as Saudi Arabia would need oil costs of $66 a barrel next year to balance its books.

Source: Reuters

The GCC’s strictest fiscal measures have begun to weigh greatly on economic activity, and the business situation is deteriorating in Saudi Arabia and the United Arab Emirates.

Depressed economic activity is weighing heavily on banks in the region, forcing a wave of mergers as they struggle to survive.

Saudi Monetary Authority, the kingdom’s central bank, has revealed about $27 billion in stimulus packages to its declining banking formula that suffers years of low expansion in loans to the personal sector.

In January, Dubai Islamic Bank, the largest Islamic lender in the United Arab Emirates, reached an agreement to buy the smaller rival Noor Bank through a share agreement. The merged entity now has more than $75 billion in assets. the book of plays of competitors through the recruitment of more foreign investors and the increase of their foreign-owned ceiling to 40%.

Related: The Secret to Canada’s Oil Sands Survival

Although the UAE has one of the most diversified economies in the region, they remain incredibly dependent on oil, with the exception of Dubai. The UAE is the eighth largest oil producer in the world, pumping 3. 1 million b/d, with oil exports representing approximately 30% of GDP.

Qatar is the 17th largest oil producer in the world, pumping 1. 5 million barrels of this product constantly. The country’s economy relies heavily on oil, oil and herbal fuel that account for more than 60% of GDP, 85% of export earnings and about 70%. % of total revenue.

Meanwhile, Arab Bank of Oman has completed plans to win over local competitor Alizz Islamic after Omnivest, one of Oman’s largest investment funds, sold its 12% stake. The merged entity will be a whooly owned unit through Oman Arab Bank with $8. 4 billion in assets. .

Oman pumps one million barrels of crude oil a day, making it the world’s nineteenth largest manufacturer just before Libya. Like Middle Eastern countries, Oman relies heavily on oil and fuel resources for 68% of GDP and 85% The country is expected to record one of the largest budget deficits in the existing fiscal year, with a maximum of 20% of GDP.

Debt market

Related: Iraq sends more crude oil despite OPEC production cut promise

Fortunately, most of them still have a lot of goodwill and have little trouble getting massive loans.

GCC countries have controlled to block long-term debt at a low rate in recent times, as they have raised nearly $50 billion in foreign debt markets in the current year.

Dubai visited the public debt market this month for the first time in six years, raising $2 billion as a component of a tight price agreement, a smart sign that markets remain open to the region despite the recession.

More maximum Oilprice. com readings:

Read this article in OilPrice. com

This story gave the impression in Oilprice. com