Graphite: China’s 195 flake graphite stain was solid in September.

Graphite market news: Battery metals (including graphite) will explode despite the widespread interruption of Covid-19.

Graphite Company News – Solid MRC results for the PFS aodes plant. Magnis takes the next step towards the vehicle’s battery in “six minutes”. ZEN graphene solution virucidal ink is 99% effective against COVID-19.

Welcome to the September issue of graphite miners’ news. September saw the graphite necessarily solid and a lot of news from graphite miners.

In September, spot costs of 195 EXW graphite flakes in China increased by 0. 16% to 6. 5% over the following year. Note that 94-97% is the most productive suitable for battery use; it is then advanced to a purity of 99. 9% to make the graphite “spherical” used in lithium-ion batteries.

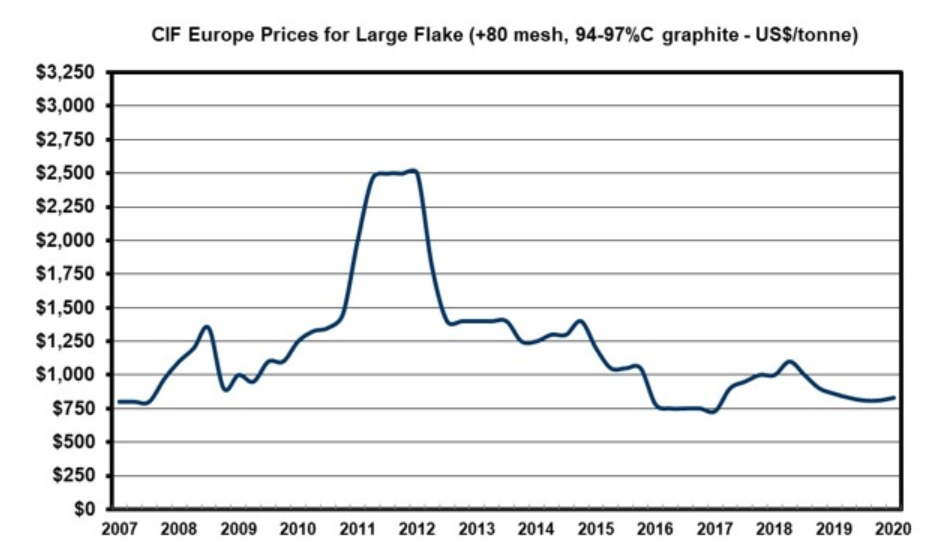

Graphite price chart: the value of graphite in large scales is about $830/t (a little obsolete now, but a tough consultant still)

Source: Northern Graphite

A reminder of a quote from Elon Musk 2016:

Our cells are called Nickel-Graphite, because basically the cathode is made of nickel and the appearance of the ado is graphite with silicon oxide.

In my January 30, 2018 interview on Trend Investing with Benchmark, Simon Moores on graphite:

Spherical graphite adote plants, basically founded in China, historically had between five and 10,000 tpa, but now 4 mega plants will produce 60,000 to 100,000 tpa from 2020.

Forecast for the construction of metal demand for electric vehicles from 2019 to 2030 as the rise of electric vehicles takes off; demand for graphite ”battery” is expected to increase 10 times.

“A Wild Time:” Tesla’s price reaches $420 billion while Musk mitigates Battery Day speculation. . . It makes sense to add silicon to the carbon ado. We’re already doing it,” said Musk, who also noted that the use of silicon in batteries presents demanding situations that decrease battery life. The question is what silicon/carbon ratio and in what way?Silicon expands like a crazy discharge and disintegrates. , so the life of the cycle is sometimes poor, ” he said.

On September 11, Mining Weekly reported:

Metals will explode despite widespread covid-19 disturbance. Battery metals, which add lithium, vanadium, copper, cobalt, nickel, lead and graphite, are being used in large-scale battery garage products and parts used to transmit and distribute In terms of electric vehicles, the focus is on the progression and deployment of exclusively electric electric vehicles. The progress of the electric vehicle will also change the progression of the car concept towards mass production of electric cars for daily use. “will be massive drivers of demand for lithium, cobalt, nickel and vanadium, but especially copper. “

Eight Glencore Katanga-Length Mines Needed to Meet Demand for Battery Metals – Report. Nearly 800 kt of additional lithium LCE is expected to be brought into service over the next five years to meet the wishes of the battery industry, according to a new report from Wood MackenzieArray . . . an electric vehicle market that requires more than one million tons of LCE in 2025. Also, the report states that the cobalt market is expected to double until 2025. “To put that in perspective, to meet the new demand for electric vehicles until 2030, they would need 8 more mines the length of Katanga from Glencore, “the document says. . “The Wood Mackenzie AET is advancing the adoption of electric vehicles [EV] over ten years, with electric vehicles accounting for approximately 40% of passenger car sales through 2030. This is dramatically accelerating demand for batteries and unbaked fabrics that compose them. With regard to graphite, the report predicts that the battery sector will account for more than 35% of demand until 2030, and the demand will expand through 1. 6 million tons until that time. date.

On September 17, Investing News reported:

Simon Moores: What to Expect on Tesla Battery Day and Beyond. But Tesla’s long-term ambitions and plans will not come true without hindrance. “The availability of raw fabrics raises the alarm for Tesla given its immediate expansion of Gigathingy in Berlin, Shanghai and Austin,” Moores said. In fact, unlike the launch of the Gigathingy 1 in Nevada, there are now 167 gigathingies or mega-battery plants competing for the same raw fabrics, according to data from Benchmark Mineral Intelligence . . . the quantity and quality of lithium, cobalt and Nickel will be the biggest hurdles for Tesla. The graphite anode and manganese will also provide their own sourcing challenges. ”There is now no question that regardless of the quality of Tesla vehicle sales, the availability of raw fabrics will be the main factor holding back growth in the market. company.

Provisional monetary statements: six months ended June 30, 2020 Array. Balama produced 12,000 tonnes (S1 2019: 92,000 tonnes) of graphite, sold and shipped 16,000 tonnes (S1 2019: 101,000 tonnes). In particular, travel restrictions restricting Balama’s labour mobility and low demand from end-users due to closures, mobility restrictions and uncertainty had a negative effect on the end of the interim monetary age due to the effects of COVID 19. electric vehicle sales during the era. During the interim monetary era, BAM’s allocation continued to advance the company’s strategy to become the first vertically incorporated manufacturer of active aodo curtains in ex-ChinaArray herbal graphite. was $28. 7 million for the year ended June 30, 2020 (2019: loss of $81. 4 million).

You can view the latest investor presentation here.

Severe metals [ASX: BSM] [GR: R2F] (OTC: BSSMF)

On September 15, Bass Metals announced, “Exploration Update. “Strengths include:

Ceylon updates your personal placement arrangement. After its publication on August 6, 2020, the Company intends to collect gross revenue of up to C$8,100,000 or US$6,000,000 (US$1-C$1. 35) from a consortium of 4 foreign investors (the “Placement”) by issuing a total of 90,000,000 sets (the “sets”) Array. .

On August 31, Ceylon Garphite published: “A Message from the President. “Some highlights include:

Mineral Commodities Ltd. (“MRC”) [ASX: MRC]

Skaland Graphite belongs to 90% through MRC. Skaland is the world’s highest quality shiny graphite consistent with a mix and europe’s largest generating mine; with rapid European graphite production of up to 10,000 tonnes consistent with the year with regulatory approval to build up to 16,000 tonnes. MRC owns 90%.

On 21 September, Mineral Commodities Ltd. announced: “MRC is completing pfS for the active aod tissue plant in Norway. “Highlights include:

Magnis takes the next step towards an electric vehicle battery “six minutes” Array . . . . . . “The non-optimized mobile has less than 99% of the power density of a normal power mobile, which means minimal power density loss for an ultra-fast charging mobile. Exciting results, a resolution made to start testing the EFC (extra-fast load) on the optimized composition of advertising mobiles. “If successful, Magnis Energy Technologies plans to manufacture the batteries in a “planned” gigaphoric near Townsville, Queensland, as well as at a plant in New York, USA Array . . . . . NYSERDA will now also fund a 12-month demonstration of ultra-fast battery charging on electric buses in collaboration with the New York Energy Utility Consolidated Edison and BAE Systems corporate defense generation.

On September 14, Magnis Energy Technologies Ltd announced: “Ultra-fast battery charging program . . . EFS rates 85% in 6 minutes” more than 1,000 rates and maintains more than 80% energy.

Eagle Graphite [TSXV: EGA] (OTC: APMFF)

Black Crystal Project is located in Slocan Valley County, British Columbia, Canada, 35 km west of Nelson City and 70 km north of the U. S. border. Quarry and factory spaces are the two main activity spaces of the project.

Not for the month.

Battery minerals [ASX: BAT] [GR: 0FS]

Battery Minerals’ main target products are graphite, zinc/lead and copper. BAT continues in its two graphite progression assets, Montepuez and Balama, located in Mozambique.

On August 27, Battery Minerals announced, “Semestral Accounts – June 30, 2020. “

You can view the latest investor presentation here.

Masonry graphite [TSXV: LLG] [GR: M01] (MGPHF)

Leading Edge Materials begins a preliminary economic assessment study on Norra Karr Ree ProjectArray . . . . . Norra Karr is one of the world’s largest rare earth projects and is exceptionally enriched with some of the fabrics critical to the production of permanent magnets, such as dysperium and terbio.

EcoGraf gets from WA government with a site of 6. 7 ha . . . . . It was decided that the giant commercial site would provide a significant area for the long-term expansion of the plant in order to meet expected demand. 2 hectares. Securing the site provides location certainty, as due diligence processes continue regarding the financing of precept debt earned through Export Finance Australia.

You can view the latest investor presentation here.

ZEN Graphene Solutions Ltd. [TSXV: ZEN] (OTCPK: ZENYF) (formerly Zenyatta Ventures)

ZEN Graphene Solutions Ltd. es a mining progression company in Thunder Bay, Ontario. ZEN Graphene is lately reaching the Albany graphite depot, as well as graphene and graphene applications.

ZEN Graphene Solutions provides a corporate update. The company is also pleased to announce the recent award of two COVID-19 grants from the NSERC Alliance, a Mitacs Elevate postdoctoral fellowship and two Mitacs Accelerate grants totaling $355,000 for its university partners, expanding ZEN’s overall study and progression budget for the next 12 months to more than $1. 4 million. . . . . .

On September 22, ZEN Graphene Solutions Ltd. announced: “ZEN Graphene Solutions will present graphene-based ink with 99% COVID-19 virous activity. “Highlights include:

Sovereign metals [ASX: SVM] [GR: SVM]

Sovereign Metals Ltd. es an exploration company committed to exploring graphite, copper and gold resources. It operates in the geographical segments of Queensland, Australia and Malawi. Sovereign Metals has the world’s largest graphite saprolith resource with 65 million tons at 7. 1% of TGC in its Maligunde allocation in Malawi.

Not related to graphite for the month.

You can view the latest investor presentation here.

Westwater Resources (WWR) (formerly Alabama Graphite)

Westwater Resources Inc. develops a complex battery graphite business in Alabama, occupies dominant mineral rights positions in the western United States and the Republic of Turkey for lithium and uranium deposits, as well as authorized uranium production facilities in Texas.

On September 8, Westwater Resources Inc. announced, “Westwater Resources announces an agreement for its uranium business in North America. “

Thank you for reading the article If you need to sign up for Trend Investing for my most productive investment ideas, the latest trends, exclusive interviews with the CEO, the chat room for me and other complicated investors aimed at renewable energy and the electric vehicle and metals sector. find out more by reading “The Difference in Trend Investing,” “Subscriber Feedback on Trend Investing” or point out here.