“o. itemList. length” “this. config. text. ariaShown”

“This. config. text. ariaFermé”

(Bloomberg) –

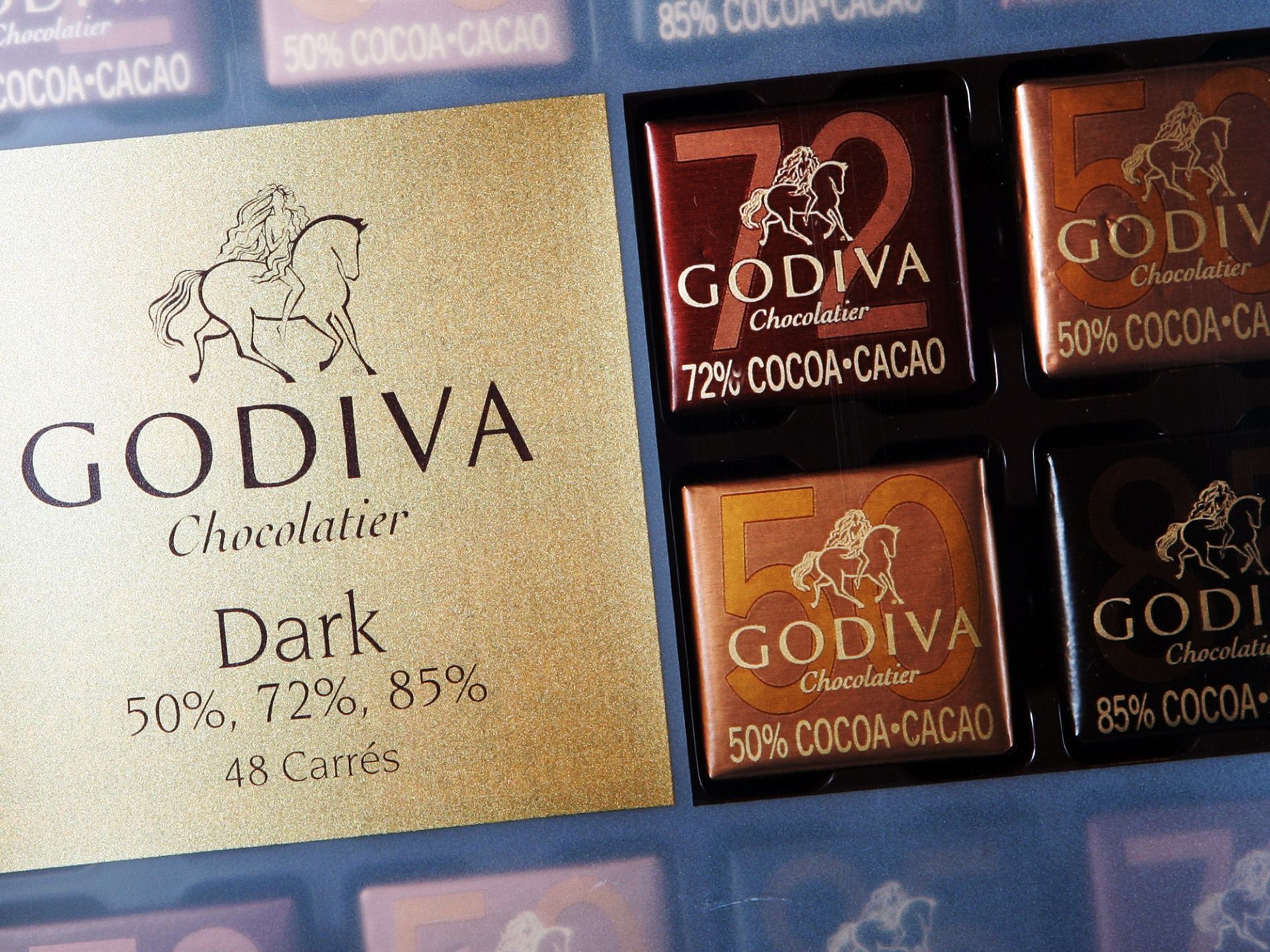

Turkish chocolate owner Godiva and McVitie cookies is putting on hold a plan to sell some of their assets and will increase food production to fulfill the developing call due to the coronavirus pandemic.

Yildiz Holding AS has suspended efforts to get rid of its Kerevitas Gida Sanayi ve Ticaret AS frozen food department and its UK salt biscuit unit Jacob’s, according to others with direct knowledge of the company’s Istanbul-based plans. It will leave companies outdoors their main food production concentrate, depending on investor interest in assets, they said.

The world’s third-largest cookie maker continues to increase sales by more than 10% this year by increasing production, other people said. Yildiz, owned by Turkish billionaire Murat Ulker’s family circle, has credit for the growing demand for food to repay bank loans after restructuring $6. 5 billion in loans in 2018, the largest debt reorganization through a Turkish company.

Yildiz made an early repayment of $ 600 million, sales generated abroad, bringing the total it paid to $ 2. 6 billion under the deal with Turkish lenders, Yildiz said last week.

Although he refused to comment on the replacement in the asset strategy, or his perspective, Yildiz said in an email that he performed “well” in the first part of the year “despite the ordinary cases caused by the global pandemic. “The organization expects a double-digit sales expansion in 2020 of 65 billion lire ($8. 8 billion) a year ago, with exports and overseas operations representing 40% of that.

Kerevitas announced in December that he had hired Morgan Stanley to advise the company. Early last year, Yildiz commissioned Oppenheimer Holdings Inc. getting rid of his involvement in Jacob’s cracker business and production facilities in the UK, said resources close to the UK at the time. Question.

Kerevitas rose 5. 5% to 5. 21 lire in Istanbul, their fourth direct day of earnings. Gozde Girisim, the equity arm of franklin Resources Inc. group, fell by 6. 2% and ulker’s main manufacturer Biskuvi Sanayi AS Group fell by 1. 7%.

Acquisition of revelry

The promotion procedure for the holding’s brick-making and mining unit Kumas Manyezit Sanayi AS is subject to approval by antitrust authorities, the other people said.

Yildiz has grown worldwide through acquisitions of more than $4. 3 billion, adding Belgian Godiva Chocolatier Inc. , United Biscuits and DeMet’s Candy Corp. between 2008 and 2016 before having to reorganize its debt. He sold his Godiva chocolate business in Asia-Pacific for $1. 3 billion to a North Asian personal equity fund in early 2019, while retaining ownership of the brands.

Ulker Biskuvi, which has factories in Egypt, Saudi Arabia and Kazakhstan, expects sales to accumulate by 17% this year, after a 20% increase in the first six months, the unit said last month.

Turkish Godiva Yildiz appoints Fahrettin Ertik as CFO

(Add foreign sales in the fifth paragraph).

For more items like this, visit bloomberg. com.

Subscribe now to forward with the ultimate reliable source of commercial news.

© 2020 Bloomberg L. P.