(Bloomberg) — Inflation in Japan slowed for a second month, giving central bankers an explanation for why to wait before ending their negative interest rate policy.

While the data support the view the Bank of Japan officials won’t rush into the first rate hike since 2007 when they meet next week, services prices remained elevated and suggest that an eventual normalizing of policy remains on the table.

Inflation expectations declined in Europe, while retail sales and consumer sentiment in the US increased.

Here are some of the charts published in Bloomberg this week on the most recent developments in the economy:

World

The Bank of Indonesia kept its benchmark interest rate unchanged and was cautious about easing financial policy as it waited for more convincing signs of rupiah stability and manageable inflation. Angola also held firm, while Kazakhstan and Paraguay continued their rate relief campaigns.

Asia

Japan’s latest inflation report gives the BOJ another reason to wait beyond next week’s meeting before ending the negative rate policy, while also adding to the case for a hike in coming months. For a second month, services prices rose at the fastest pace in three decades when excluding periods distorted by sales tax hikes.

China’s deflation was driven by falling prices in its manufacturing sector last year, adding to the risk of trade tensions with the US and Europe amid a major ramp-up in Chinese industrial capacity.

Japan welcomed 25 million tourists in 2023, the figure since 2019, as the weak yen helped attract post-pandemic visitors, boosting the country’s fragile economy. The return of a gigantic number of visitors to Japan is a positive progression for an economy that has experienced its steepest contraction since the peak of the pandemic this summer.

China’s population shrank at a faster pace in 2023 as births fell to a record low, accelerating a demographic shift that poses demanding long-term situations for a government already battling deflationary pressures and a property crisis. The decline in births may simply pose more demanding situations for the economy, which met its official expansion target for last year but remains stagnant on issues such as weak domestic demand and confidence.

Europe

Eurozone consumer inflation expectations fell in November to their lowest point in more than a year and a half, reinforcing markets’ view that an interest rate cut via the European Central Bank could be soon. imminent. Despite a slight rise in December, inflation is falling across Europe as its immediate slowdown triggers investors to speculate on rate cuts as early as spring.

Retail sales in the UK fell at the fastest rate since Covid-19 lockdowns three years ago, raising the threat that the economy could slip into a mild recession until the end of 2023.

WE

U. S. Retail Sales U. S. stockpiles posted their biggest increase in three months in December, capping off a strong holiday season that suggests customer resilience. However, economists warn that this momentum could lose steam in 2024, as customers face persistent inflation, peak borrowing prices and falls. savings.

Wage expansion is on track to slow to its pre-pandemic speed in the coming months, according to data from Task Search In fact, easing a source of inflationary stress that worried the Federal Reserve.

Consumer confidence rose in early January to its point since 2021, far exceeding expectations as short-term inflation expectations fell to a three-year low. More than a fraction of families expect their incomes to grow at least as fast as inflation. the proportion since mid-2021.

Emerging Markets

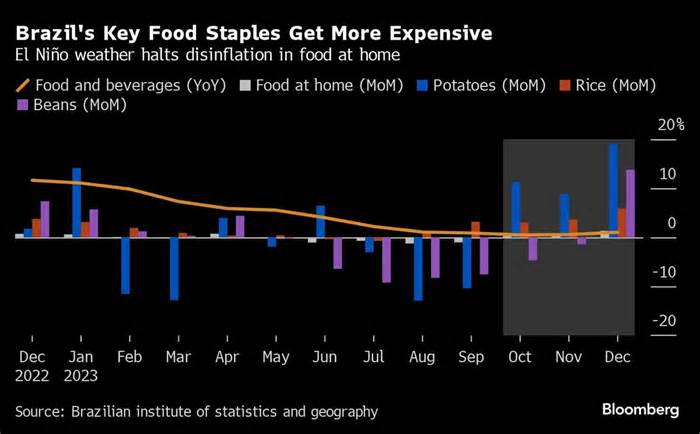

El Niño, the weather phenomenon that has long plagued agricultural powerhouses such as Brazil, has returned with a vengeance to the South American summer, bringing torrential rains to some parts of the country and leaving others unusually dry. As a result, the costs of raw materials such as rice and potatoes are soaring, casting doubt on the central bank’s plans to implement interest rate cuts demanded through the president and his electoral crusade promising to offer less expensive price lists to ordinary Brazilians.

–With Kelly Li, Barbara Nascimento, Yoshiaki Nohara, Zoe Schneeweiss, Dayanne Sousa, Alex Tanzi, Alexander Weber, Josh Xiao, Irina Anghel, Maria Eloisa Capurro, Toru Fujioka, Mia Glass, Tom Hancock, John Liu and Jing Li.

More stories like this can be found on Bloomberg. com.

©2024 Bloomberg L. P.