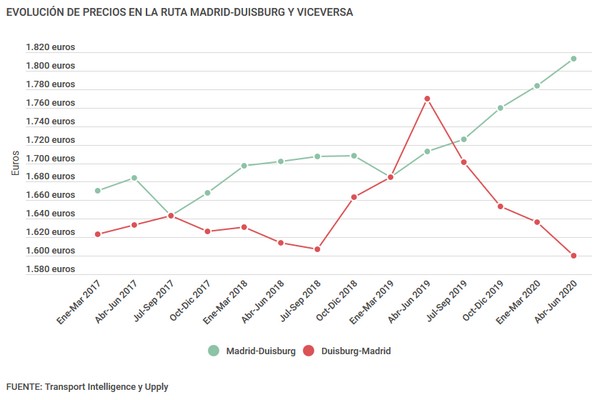

Exports of fruit and vegetables and other perishable products from Spain to Europe, namely Germany, kept road transport costs high in the last quarter of 2020. amounted to 1,813 euros, the highest quarterly figure since 2017, according to Transport Intelligence and Upply research. road transport fares in Europe (Figure 1). “Spain is one of the main players in the fruit and vegetable sector and, as a result, its fleet has more than 40% refrigerated trailers,” said William Béguerie, a road transport expert on the Upply virtual platform. “It’s the first refrigerated shipping country in Europe.”

Fig. 1. Price adjustments at Madrid-Duisburg and vice versa

Compared to the latter, the new scenario created through the coronavirus has led, in some cases, to the value exceeding 40% of the overall levels, according to the expert. Moreover, a third thing is that uncertainty about the return or return of goods due to the existing macroeconomic environment has led carriers to increase values to Germany to offset losses.

In fact, goods transported by road between the German town of Duisburg and Madrid experienced the largest year-on-year drop in value in Europe, with a replenishment of 9.6% from April to June, reaching 1,600 euros. The British consultan consulting justified these effects through the slowdown of the car industry, key on the road, as it accounts for 20% of the bilateral industry in terms.

As a result, increased imbalances in demand for means of transport have affected changes in value, as the pandemic has had and continues to have a greater impact in Spain than in Germany. In this sense, Transport Intelligence has seen a widespread trend across Europe: the peak countries affected by Covid-19 have imported fewer goods. As a result, the fastest recovery in Germany has maintained export values on the Madrid-Duisburg route, while the weaker recovery in Spain has reduced imports.

The Madrid-Paris link remains relatively solid. However, one of the main routes that remained relatively solid from April to June was the Madrid-Paris link, which has noticed continuous falls in recent quarters. Freight to France fell 0.3% to 1,350 euros compared to the first quarter, while in Madrid they rose 0.3% to 1,234 euros. However, Transport Intelligence warned that this progression does not deserve to be attributed to a sound macroeconomic situation, as while there have been some symptoms of recovery, the industry remains weak between the two destinations (Chart 2).

Fig. 2. Price adjustments in the Madrid-Paris direction and vice versa

Average value of European freight Shipconsistent withs paid an average tariff of 1.58 euros consistent with the kilometre in the quarter of the moment, 0.3% less than at the beginning of the year. The variation in costs between directions depends largely on their length: longer directions have created efficiencies, reducing the constant and variable costs related to road shipping or route-consistent and therefore the value consistent with the kilometer. Meanwhile, the opposite effect occurred in shorter directions. Transport Intelligence called this feature “stable in the market”. In this sense, the Birmingham-Madrid direction remains the cheapest in relative terms by distance, with 0.8 euros consistent with the kilometer, at the same point as in the first quarter.

The study also found that the average freight is worth 1,083 euros, or 0.3% less from quarter to quarter and 1.8% less than one year after year (Fig. 3). According to the study, declining demand has led to maximum levels of available capacity, while carriers have been forced to face higher operating prices due to points such as higher border controls.

Fig. 3. Average European shipping price

Only a few sectors, such as prescription drugs or e-commerce, have maintained or increased their demand for road transport in recent months. Containment, factory closures and store closures caused volumes to collapse, and drivers recorded part of operating hours from mid-February to early April, according to the study. This minimization in activity resulted in a minimisation in energy demand, resulting in a 8.2% minimisation of diesel loads at the time of the 2020 quarter to the first quarter. However, the Transport Intelligence and Upply report argues that this charge savings have not been reflected in shipping charges paid through shippers.

We ask that you complete all fields marked with aArrayA.

Subscribe to our newsletter and stay up-to-date with the latest news!