n n n ‘. concat(e. i18n. t(“search. voice. recognition_retry”),’n

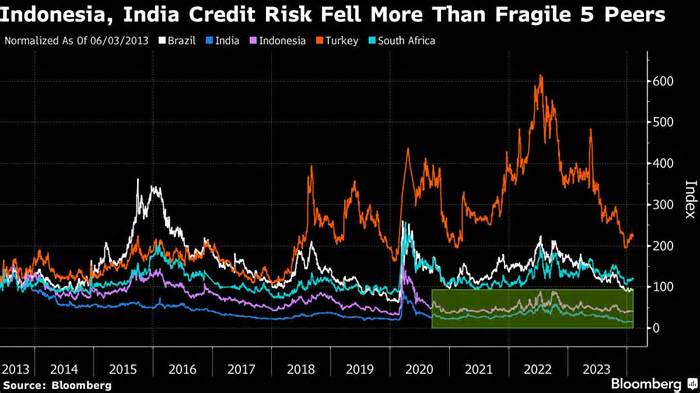

(Bloomberg) — India and Indonesia were once grouped together as components of Morgan Stanley’s “Fragile Five. “A decade later, they are a favorite among investors.

Most on Bloomberg

Germany’s Days as an Industrial Superpower Are Coming to an End

Top Nigerian Banker Killed in California Helicopter Crash

White House Calls Trump’s NATO Remarks ‘Horrifying’

Trump Says War in Ukraine Will Have to End Even as U. S. Aid Moves Forward

The outlook for the bonds and currencies of the two Asian behemoths has brightened following successful programs of reforms and fiscal restraint, according to fund managers including Fidelity International, Robeco Group and abrdn. Even elections in the two countries this year are unlikely to spook investors.

The initial Fragile Five – which also included Turkey, South Africa and Brazil – referred to countries perceived as most at risk due to their heavy reliance on foreign investment to boost growth. The improvement in financials – as evidenced through credit default swaps – shows that market sentiment towards India and Indonesia has changed nearly 180 degrees since the term was coined in 2013.

“Both India and Indonesia have strong short- and long-term fundamentals,” said Kitty Yang, tactical asset allocation analyst for multiple assets at Fidelity International in London. “Growth is underpinned by positive (and ongoing) reforms over the past 10 years under the leadership of Prime Minister Modi and President Jokowi. “

India’s five-year credit default swaps (derivatives used for bonds opposed to default) have fallen about 85% from their peak in 2013, reflecting an improvement in the country’s credit quality. CDSs with similar maturities on Indonesian debt fell 70% over the same period. On the other hand, the default exchange costs of Turkish loans have increased.

Foreign investors poured a total of $14 billion into Indian and Indonesian bonds last year, even as global debt markets liquidated due to the prospect of higher and more sustainable global interest rates. This is the largest joint inflow to the two countries since 2019, for capital outflows of $3. 9 billion in 2013.

‘For a long time’

Indian bonds have rallied over the past four months on the prospect of inclusion in a global index, and extended their gains in February after government markets announced lower-than-estimated debt sales.

The government also said it planned to cut its budget deficit to 5.1% of gross domestic product, below the 5.3% predicted by economists in a Bloomberg survey.

“India is long overdue for a credit rating upgrade” as reforms have improved its fundamentals and resilience, thus creating some of the best opportunities in equity and fixed-income markets, said Kenneth Akintewe, head of Asian sovereign debt at abrdn Asia in Singapore.

Prime Minister Narendra Modi, who is running for re-election in May, referred to the Fragile Five in a speech to parliament this month. Under the previous government, “the global total used words like ‘Fragile Five’ and political paralysis for India. And in our 10 years, among the five most sensible economies. That’s how the world talks about us today,” he said.

The word “Fragile Five” was coined by Morgan Stanley’s James Lord about a decade ago, identifying those countries as vulnerable economies. Lord is now global head of the Bank’s foreign exchange and emerging markets strategy. A Morgan Stanley representative declined to comment.

Disciplined Indonesia

Indonesia has also made wonderful strides in its finances.

After temporarily exceeding the regulatory budget deficit limit of 3% of gross domestic product in 2020 and 2021 due to Covid-related spending, the government reduced the deficit to 2. 38% in 2022, a year earlier than expected. The budget hole narrowed to 1. 65% in 2023, according to the revised 2. 28% projection made in July.

Indonesia has been very disciplined with keeping its fiscal deficit below the 3% threshold, with the exception for a couple of years during Covid, said Stephen Chang, a fund manager at Pacific Investment Management Co. in Hong Kong. “Even with a new administration, we think some of these economic policies will continue.”

Risk Factors

An election to appoint a new Indonesian president on Feb. 14 would have been a major threat to investors in the past, but is now perceived as less of a fear given that reforms are well entrenched.

This despite front-runner Prabowo Subianto campaigning on promises such as free lunches for 83 million beneficiaries and saying he was comfortable with the country widening its debt point to 50% of gross domestic product.

Markets are also concerned about the resignation of Finance Minister Sri Mulyani Indrawati, who is credited with stabilizing the government’s finances.

Sri Mulyani has made the Ministry of Finance “a better place than she found it in both of her terms, and that assists the fundamental investment thesis for Indonesia,” said Philip McNicholas, an Asia sovereign strategist at Robeco Group in Singapore. Still, “it seems unlikely that there would be an evident deterioration in the overall process of the ministry,” he said.

McNicholas said the outlook for both Indonesia and India remains positive.

“Both economies have favorable long-term economic prospects. There is still plenty of fruit to be had, providing the opportunity for additional expansion prospects.

What to see

India, Poland, and the Czech Republic will release their inflation figures, and any further disinflation symptoms will likely stoke dovish bets.

The central bank of the Philippines will announce a resolution on Thursday.

GDP data for Hungary, Poland and Colombia

Chinese markets will be closed for the whole week for Lunar New Year, while South Korea, Taiwan, Singapore and Malaysia are all shut at least on Monday

Brazilian markets are also closed for a holiday Monday and Tuesday, returning for a half-day on Wednesday

–With Ruth Carson, Malavika Kaur Makol and Carolina Wilson.

Most Read from Bloomberg Businessweek

OpenAI’s Secret Weapon Is Sam Altman’s 33-Year-Old Lieutenant

How Jack Dorsey’s Plan to Get Elon Musk to Save Twitter Failed

It’s time to talk about those bets on Taylor Swift in the Super Bowl

In a jet club where everything went wrong

Social media platforms no longer have news, Gen Z still treats them as a source of inquiry

©2024 Bloomberg L. P.