The company’s policy, trials and design have combined to weigh the shares of publicly traded for-profit criminal companies. The downstream creates uncertainty, the scourge of investors, and is that presidential elections will replace demanding situations in the sector.

“Stocks have fallen since May 2017, but have fallen dramatically since June 2020,” said Manish Shah, chief executive of Miami-based Tollbooth Strategy. “Investors avoid stock for at least a few years. “

This will make it difficult for investors to evaluate long-term clients of corporations and it turns out that many are leaving the sector.

Geo Group’s inventory came Monday at $11. 25 per share, 38. 93% less than its 52-week maximum. CoreCivic recently reported $7. 89 according to the stock, 56. 15% less than its 52-week maximum.

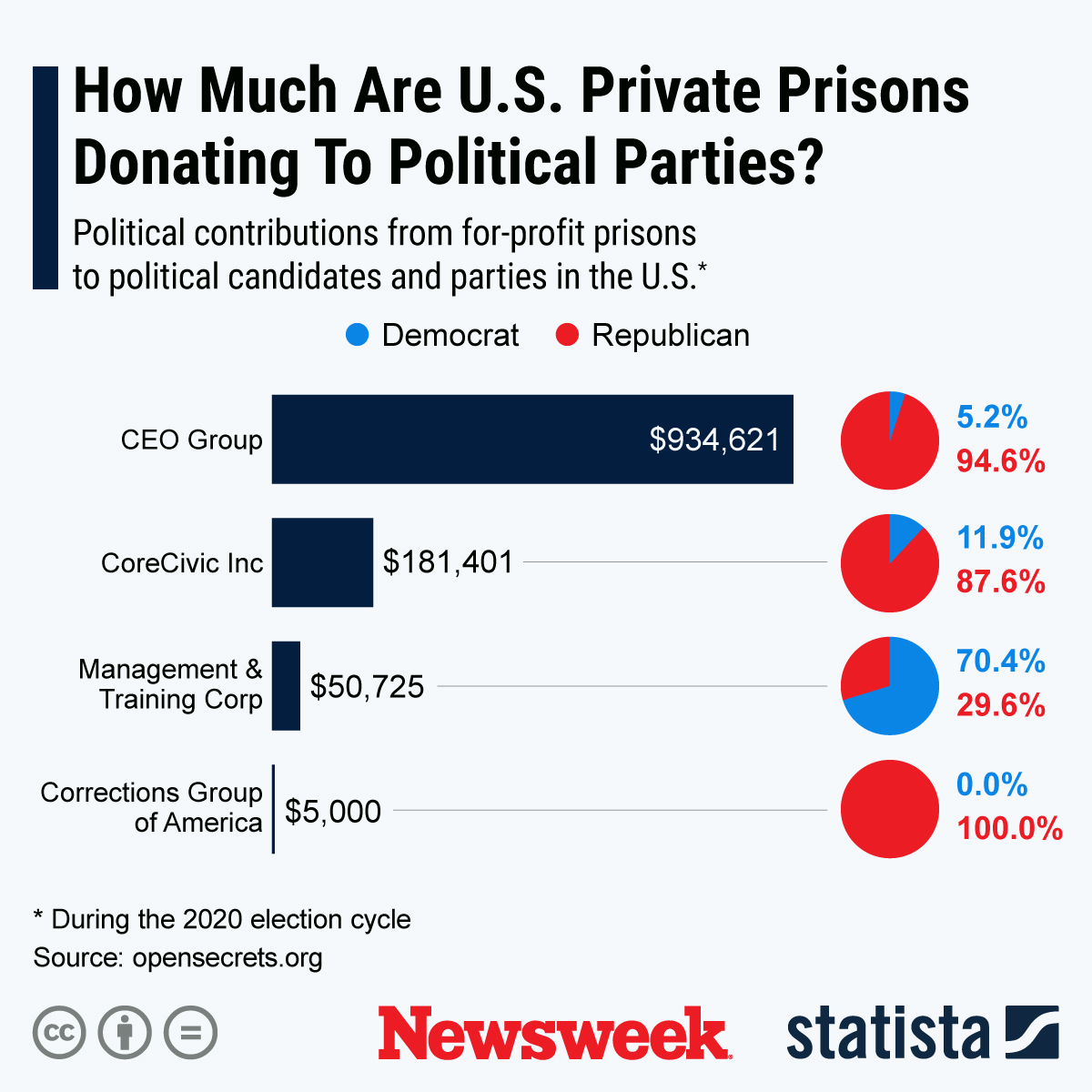

In June, CoreCivic announced the suspension of its quarterly dividend, bringing out the coronavirus pandemic and the desire to rethink its corporate structure. While Republicans sometimes help the use of prisons for profit and Democrats sometimes oppose them, the elections will not be the lingering controversy. .

Critics argue that personal prisons create an inherent conflict of interest and that incarceration is not a for-profit company. Supporters argue that personal prisons release the government from the charge of pension benefits and fitness and are controlled in accordance with government standards. , adding immigration and U. S. customs, remain in the hands of the government, and supporters of personal prisons say corporations only detain those arrested through others.

Corporations have been structured as a genuine real estate investment that is accepted as true with (REIT), forcing them to move 90% of the net source of income to shareholders to avoid any tax obligations. The tax-free movement attracts a large number of investors who focus on dividends rather than inventory appreciation, making personal criminal corporations dependent on the inventory market because they have no reserves, Shah said.

“They want to build new amenities to bring cash to life and benefit growth,” he said. “It’s not a challenge when the market spot is high, but when the market spot is volatile or declining, capital is cut off. “

A REIT can offer diversification and reduce risk, making it a key component of a consistent source of revenue portfolio. REIT typically owns or manages a source of advertising that generates genuine real estate revenue, such as buildings, grocery stores, shopping malls, or components.

Some REIT would possibly keep underlying mortgages on properties. A REIT would possibly be maintained through a mutual fund or a publicly traded fund.

In a study report, Standard and Poor’s revised its outlook for CoreCivic from “stable” to “negative” based on its expected debt payment. Expects revenue to drop from 5% to 8% this year and a small single-digit decline in 2021 CoreCivic’s Board of Directors recently voted in favor of a taxable company to avoid the REIT’s dividend obligation. The replacement did not increase its percentage price.

Reviewing the perspective of Geo, S

Last year, Trump’s leadership issued a new rule that states that migrants who have entered another country in a northerly direction will have to seek asylum there other than at the US border. But it’s not the first time America is practically over.

In July, a federal ruling in San Diego provisionally approved the ban on personal criminal contracts in California. In a lawsuit, GEO Group argued that Assembly Bill 32 was a “transparent attempt across the state to end the federal government’s detention efforts within California’s borders. “It would phase out existing detention centres until 2028. Trump’s leadership responded, arguing that California law unconstitutionally interfered with the federal government’s enforcement of immigration law.

Earlier this month, Geo Group, based in Boca Raton, Florida, declared a quarterly 34-cent monetary dividend consistent with the stock. The company stated that it owned or controlled 125 “safe facilities, repair centers and network re-entry centers” with approximately 93,000 beds. In the United States, Australia, South Africa and the United Kingdom. Geo Group said it has about 23,000 workers worldwide. In 2019, revenue totaled $1. 37 billion.

In a statement, George Zoley, CEO of Geo, said: “During the fourth quarter of 2019, we completed the increase and 3,600 in past idle beds and entered into several new federal contracts that are expected to generate long-term profit and growth in the money “.

CoreCivic, in Brentwood, Tennessee, consists of approximately 50 correctional centers and 29 residential re-entry sites with approximately 78,000 beds. In 2019, the company reported profits of 35 cents consistent with a consistent percentage of profits of $1. 9 billion.

Fewer incarcerated immigrants mean a lower source of income for the company, CoreCivic’s CEO said.

“While we experience positive expansion trends throughout 2019, our fourth quarter included a decrease in usage through immigration facilities and customs than expected,” said Damon Hininger, Executive Director of CoreCivic. mergers and acquisitions) and new government contracts will mitigate the standardization of ICE’s use. “

You’ve got four loose pieces left this month.

To read, sign in or create an account.

Find out why nearly a quarter of a million subscribers start their day with the 5.