\n \n \n “. concat(self. i18n. t(‘search. voice. recognition_retry’), “\n

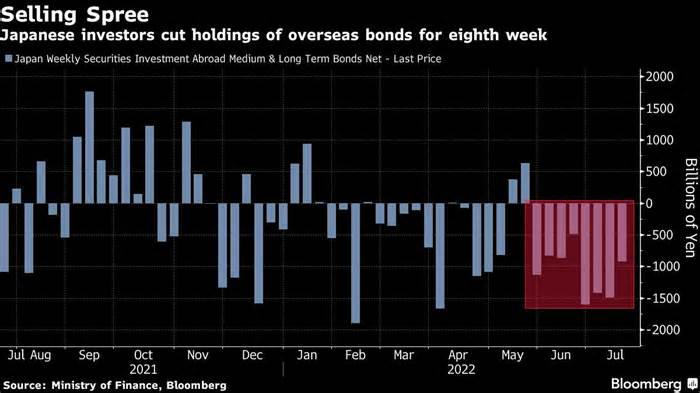

(Bloomberg) — Japanese investors reduced their holdings of foreign bonds for a record eighth week as federal reserve interest rate hikes and accelerating inflation undermine their demand for foreign debt.

Most read from Bloomberg

Americans who can’t afford a home move to Europe

Lieutenant Musk tested from an internal investigation into Tesla’s purchases

These are the toughest (and least) passports in the world in 2022

Biden hires Covid as resistance to the pandemic

Former Coinbase Director Arrested in U. S. Cryptocurrency Insider Trading CaseUSA

The Asian nation’s budget unloaded a net amount of 919. 6 billion yen ($6. 7 billion) in foreign securities from steady sources of revenue the week of July 15, according to flow data from the Finance Ministry. Bloomberg began gathering knowledge in 2005.

“Distrust of a further drop in Treasury costs remains deeply entrenched amid concerns about U. S. inflation. “Which discourages appetite for foreign bond purchases,” said Tsuyoshi Ueno, senior economist at Tokyo’s NLI Research Institute. “There could also be a move to reduce losses. “

The most recent era covers the era in which a U. S. government report is reported. The U. S. supreme court released on July 13 showed the customer value index hit a new four-decade high of 9. 1% in June, fueling expectations that the Fed would increase its pace of tightening.

Concerns about accelerating inflation and central bank rate hikes have weighed on bond costs around the world this year, led by Treasuries. U. S. 10-year bond yieldsjumped to 3. 13% from 0. 73%.

“The era where Japanese investors face headwinds to buy foreign debt has continued, and the liquidation trend may last a little longer,” NLI’s Ueno said. peak, the one-way promotion environment can change. “

Most read from Bloomberg Businessweek

Sam Bankman-Fried Turns $2 Trillion Crypto Path into a Buying Opportunity

USA. The U. S. has lost control of PC chips

Post-mortem sperm extraction turns men into fathers

Mortgage boycott how deep China’s housing crisis is

Brain-computer interface start-up implants the first in an American patient

©2022 Bloomberg L. P.