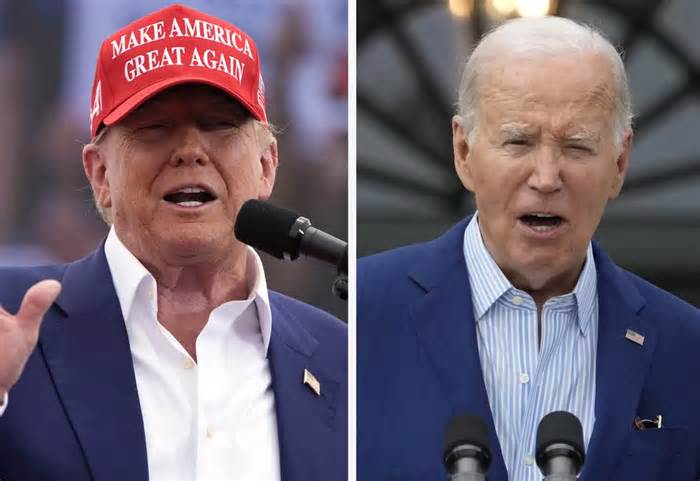

In an estimate of spending and profit projections over a decade, the Committee for a Responsible Federal Budget said former President Donald Trump approved $8. 4 trillion in new debt during his presidency, compared with $4. 3 trillion approved under President Joe Biden. But the CRFB has admitted that the projections are subject to being superseded and that an estimate of overall debt over 10 years is likely to be misleading with reality. According to my own analysis, Trump spent at least a trillion dollars less when he was president, adding to the wave of pandemic spending, than Biden spent in the first 4 years of his own presidency.

CRFB’s strategy is to compare all spending and executive orders signed by each president and charge their net increases and decreases to the national debt. While this technique is laudable in its attempt to determine the long-term effect of presidential policies, it ignores the duty of successors to replace policies they do not like and the wide variation in scores. For example, CRFB estimates the 10-year charge from the Trump Tax Cuts and Jobs Act of 2017 at $1. 9 trillion, even though the sharp expansion of overall federal profit streams has led the Joint Committee on Taxation to dynamically estimate the charge at $1. 5 trillion and the Tax Foundation. estimate it at only a part of a trillion dollars. On the other hand, the CRFB claimed that Biden’s Inflation Reduction Act reduced the deficit by $252 billion, but the nonpartisan Congressional Budget Office recently stated that the Inflation Reduction Act would raise $300 billion between 2024 and 2033. Again, this doesn’t mean The CRFB is fake, but the decade-long strategy requires choosing from a wide variety of professional estimates.

In my humble opinion, another attractive technique is to determine how much presidents have spent and accumulated taxpayer cash during their own presidency.

Instead of focusing on overall debt levels, the Treasury should break down federal spending and monthly earnings. According to this data, Trump spent $5. 9 trillion more than he earned between January 2017 and December 2020.

To compare this to Biden, we use two parts: adding the existing Treasury knowledge from January 2021 to September 2023, $5. 3 trillion in compound deficit, and then the CBO deficit projection for fiscal year 2024, which runs from October 2023 to September 2023. year, 1. 9 trillion dollars. The total then amounts to about 7. 2 billion dollars. It’s not the best comparison in four years, but it’s close. It is also a more meaningful measure than simply comparing overall public debt levels due to the Treasury’s idiosyncratic excess of monetary reserves. the pandemic.

Another way to measure this is by comparing CBO annual budgets, which fit fiscal year schedules. This means that this estimate will come with the September-December era of the last presidency, but we will get a greater comparison between precisely 4 years of Trump and 4 years of Biden.

Trump racked up $5. 6 trillion in debt to the CBO between fiscal year 2017 and fiscal year 2020. From FY21 to the planned FY2024, Biden will have accumulated $7. 8 trillion in debt.

Why does this snapshot comparison between Trump and Biden particularly differ from the CRFB estimate? This is largely because, while Trump’s tax cut law has not and will not fully pay for itself, it has spurred enough genuine economic expansion not to depress tax revenues. as much as experts expected. For example, the corporate source of income tax has amounted to approximately 1. 7% of our annual economic output throughout Biden’s presidency, even though he has kept the corporate tax rate at the 21% set through the Tax Cuts and Jobs Act. . Furthermore, although the CRFB does not purport to establish statutory spending through a single president, but only primary spending orders and bills, it absolves successive presidents of the obligation to proactively pursue fiscal policy. For example, Trump surely deserves to be held responsible for Obamacare spending during his time in office because he failed to fulfill his key crusading promise to abolish Obamacare. Biden benefited from the Tax Cuts and Jobs Act through a physically powerful economic expansion, although by the CRFB’s estimate he is not held responsible for its prices.

The CRFB’s approach also relieves Trump and Biden of the duty to expand mandatory interest spending, when in reality, their rights and refusal to limit their rights are possible foreseen options that deserve to be reflected in their money records. Moreover, in Biden’s case, 42% of the construction increase in net interest bills is a direct result of his refusal to control spending, even discretionary spending, despite the Federal Reserve’s attempt to bring inflation to its maximum target of 2%.

CLICK HERE TO READ MORE ABOUT THE WASHINGTON EXAMINER

There are many other tactics for aggregating the data, and the BFRC’s report is precisely wrong. But this is misleading if we are going to evaluate the actual four-year returns of amounts spent and tax revenues paid to the Consolidated Revenue Fund.

Trump did not govern as a staunch fiscal conservative even before the pandemic, and his cynical refusal to reform the entitlements that are at the root of our looming deficit crisis amounts to a 21% cut in Social Security spending. But in his four years in power in the workplace and even with the pandemic, Trump’s net deficit is at least $1 trillion less than what Biden will generate in his first 4 years.