\n \n \n “. concat(self. i18n. t(‘search. voice. recognition_retry’), “\n

(Bloomberg) – U. S. crude sales are expected to be expected to be in the case of u. S. crude oil. U. S. crudes reach new records next year as U. S. oil hits the U. S. The U. S. is gaining more and more market share in Europe.

Most read from Bloomberg

Biden Unveils Plan to Free Students from ‘Unsustainable Debt’

Biden to Unveil Long-Awaited Student Debt Relief Measures on Wednesday

Six months of Putin’s war reveal the symbol of the Russian superpower

Covid incubation shortens with new variant, study finds

Apple’s new iPhone 14 will show that India is ending the tech hole with China

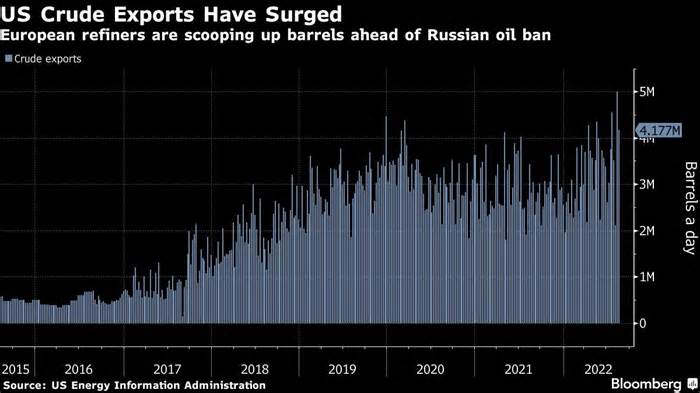

Earlier this month, weekly government figures showed an unprecedented five million barrels a day of U. S. crude exported. Shipments are expected to average more than four million barrels a day over the next few months and next year, according to the oil industry’s high. optimistic.

In a global standoff with one of the worst energy crises in history, the United States is gradually becoming the go-to supplier of additional barrels. It is very likely to remain in this position as OPEC’s reserve capacity is limited and the EU plans to cut maximum purchases of Russian crude in December. Fuel costs soared after the Russian invasion of Ukraine disrupted flows, while the “extreme” volatility of the oil futures market due to low liquidity led the Saudi oil minister to further cuts in sources despite shortages in client countries. .

U. S. suppliers U. S. producers that have gained a market share in Europe will likely retain it for the next two years, as other producers besides those in the North Sea and West Africa do not have consistently higher production, said Conor McFadden, head of oil for Europe at Trafigura, among the largest exporters of U. S. crude.

While the end of U. S. reserve oil releases will be the end of the U. S. reserve oil. While the U. S. economy this fall could briefly reduce exports, with those huge outflows unlikely to diminish in the long run, according to a survey of industry analysts. Usa. U. S. drillers have higher production, albeit at moderate rates, and the country’s refining capacity is not expected to increase, leaving more oil for export. In fact, weekly exports exceeded four million barrels consistent with the day for consecutive weeks for the first time since the export ban. cancelled late in 2015, according to overdue data from the Energy Information Administration released On Wednesday.

Read more: U. S. Oil Exportsat all-time highs as the crisis worsens

Annual shipments of U. S. crude are expected to be shipped to the U. S. U. S. oil imports will grow from an average of 3. 3 million barrels in a day to 3. 6 million barrels in a day this year, up from 3 million in 2021, according to oil analysts from ESAI Energy, Rapidan Energy Group and Kpler’s outflows are expected to average 4. 3 million next year, according to ESAI oil analyst. Elisabeth Murphy.

Much of this will allow Europeans to map out new sources ahead of the December boycott of Russian power through the region’s trade bloc. Currently, the U. S. The US accounts for only about 16% of European crude oil imports through waterways, up from 15. 3% before the war. Said Rohit Rathod, senior oil market analyst at Vortexa.

And there is room for greater participation in the Russian market. “EU-27 countries still take in about 1. 1 million barrels per day of Russian marine crude,” said Matt Smith, an oil analyst at Kpler.

It’s not just about filling the power vacuum that Europe leaves through Russia. U. S. flows The U. S. is already replacing barrels from other classic suppliers to Europe, adding Kazakhstan, where its flagship CPC crude has noticed disruptions in exports due to technical issues.

U. S. volumes U. S. crude is cutting West Africa’s market share in Europe and helping to offset disrupted crude flows from Libya due to politically motivated production shutdowns, said Hunter Kornfeind, oil market analyst at Rapidan.

European refineries are more comfortable with reliable and stable shipping of U. S. oil, Trafigura’s McFadden said. they went to Midland because they knew it would happen,” he said.

The entry of U. S. barrels The U. S. has also put pressure on regional European crudes. At the start of the week, Ekofisk crude, a soft North Sea quality that competes with U. S. supplies. month before. Meanwhile, 40s crude, some other North Sea quality, was trading down 70 cents from brent dated, at a premium of more than $5 last month.

Read more: U. S. oil spillsin Asia as an option for long-term flows

Going forward, purchases from Asia are also key to keeping U. S. crude exports high. USA Over the past two months, Asian countries have recovered giant volumes of U. S. oil. As the festival intensifies with the Middle East. still aimed at China and India since the invasion of Ukraine.

“The long-term trend in a world that wants more oil is that the United States will export more,” McFadden said.

Most read from Bloomberg Businessweek

A ‘tsunami of cuts’: 20 million American homes are on their electricity bills

It’s good to locate a seat in this stylish airport lounge

SoftBank’s Epic Losses Reveal Masayoshi Son’s Broken Business Model

Get in position for the magic mushroom pill

Truth Social has a moderation problem

©2022 Bloomberg L. P.