The retail landscape has shifted from traditional outlets to single-scale retailers for at least the past three decades. Today, online grocery shopping is an integral and vital component of the retail industry, with an increasing percentage of consumers preferring to shop whenever and wherever they want. After Black Friday and Cyber Monday sales volumes reached all-time highs despite economic headwinds and a dubious outlook, it can be established that e-commerce is the long term, but also the present.

The advent of the Internet and digital technologies has transformed our methods of working, learning, and communicating, along with altering our shopping habits. Two decades ago, the concept of online shopping was nearly unknown, even in nations with advanced internet infrastructure. However, by now, it has become the favored shopping method for a significant number of consumers.

Rapid urbanization on a global scale, coupled with the expansion of the internet and the use of mobile devices for e-commerce platforms, is driving the expansion of the market. This expansion is further driven by the growing preference for quick, easy, and cost-effective purchases. , as well as the influential role of social media in customer behavior.

For businesses, e-commerce is the most efficient, cost-effective, and undeniable way to expand. It allows businesses to operate without a physical store, which in particular reduces infrastructure, communication, and overhead expenses, while reducing environmental impact. The emergence of personal branding and direct-to-customer business models is definitely shaping the market in the long run. These models allow corporations to collect customer data, deliver tailored products and experiences, and satisfy and engage visitors.

Since those “founding fathers” of e-commerce started the engines of online shopping, the retail landscape has changed tremendously. E-commerce, along with several generational shifts, has altered the culture of shopping malls and is expected to replace brick-and-mortar stores, albeit very gradually. However, the Covid-19 pandemic, with its confinement and social distancing measures, has given a great boost to e-commerce activities, multiplying the speed of expansion of everything digital, adding purchases.

In 2021, global e-commerce sales increased by 17% year-on-year, after rising more than 40% in 2020, at the height of Covid-19 restrictions. Although the speed of expansion has stabilized after the pandemic slowed, global online sales continue to increase at a healthy pace. In addition, pandemic-like lockdowns have accelerated all online shopping-like trends, such as the addition or expansion of online selling features in brick-and-mortar retail stores, or the expansion of online shopping ways to groceries, furniture, and non-public items like fitness or psychology. . Sessions. We have continued the existing trend, much faster than expected and, in fact, things will not change.

Today, there are over 26 million e-commerce websites globally; about a third of the world’s population shops online. The accelerating mobile penetration continues to propel e-commerce sales further along, thanks to the proximity and convenience of mobile shopping apps and payments. About 70% of all online purchases globally are made through a mobile device.

In addition, younger generations are turning to social commerce, that is, direct purchases through the meta platforms (META) of Facebook and Instagram, through TikTok and other social platforms. In recent years, social grocery shopping has grown 3 times faster than the now traditional online grocery shopping. In 2022, approximately 30% of consumers said they make purchases based on recommendations from influencers discovered on social media sites.

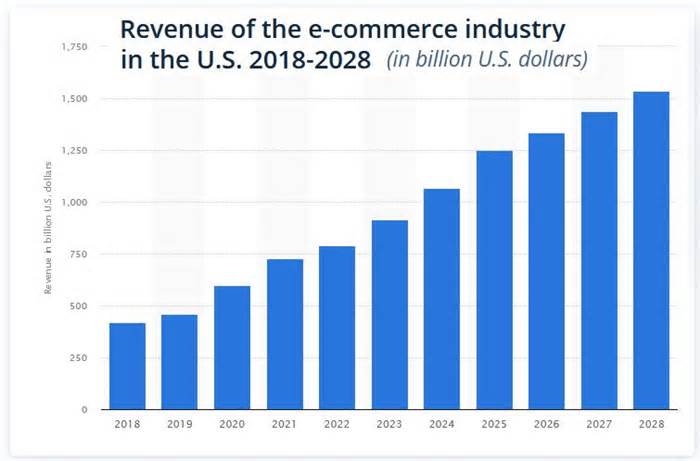

Last year, online retail profits in the US amounted to $800 billion; It is estimated that until 2023, this figure will reach around one billion dollars. By 2028, online retailers’ profits are expected to grow between 70% and $1. 5 trillion. This year, about 16% of all purchases in the U. S. are made online. ; This figure is expected to rise to 30% within a few years. In the long term, as “digital natives” upgrade more classic generations in boxes, the majority of those boxes will be digital.

As companies integrate increasingly complex technologies into their platforms, they will add to the strong expansion drivers of e-commerce. Artificial intelligence (AI)-powered grocery shopping assistants, virtual truth (VR) fitting rooms, and instant robotic delivery are among the many advancements that will allow consumers to shop with greater convenience, power, and pleasure.

So, now that we have established that online commerce is a large, fast-growing market, let us look closely at the companies working in this sphere vis-à-vis their investment potential.

Of course, the first name that comes to mind is Amazon, looming large in the U.S. e-commerce landscape, with almost 40% market share in online purchases. eBay, while immensely popular in Europe and many other regions, holds a considerably smaller U.S. market share, with only about 3.5% share among the e-commerce retailers. Another well-known name is Etsy (ETSY), a marketplace for handmade products, which is slowly losing to Amazon and eBay but is still very popular.

Some of the most well-known e-commerce stores and their generation enablers, indexed on U. S. exchanges, are listed on U. S. exchanges. U. S. applications, in addition to those mentioned above, include:

» Shopify (SHOP), a global leader in e-commerce software, provides an e-commerce platform that helps small businesses build an online store and sell online.

Mercadolibre (MELI), an e-commerce platform in Argentina and payment ecosystem provider.

» Wayfair (W), an e-commerce company selling furniture and home decor goods in the U.S. and globally.

Chewy (CHWY), an online-only puppy supply company, sells puppy food, medications, fitness products, and toys through its online page and mobile app.

Affirm Holdings (AFRM), which offers a virtual and mobile commerce platform, point-of-sale payment solutions, merchant solutions, and a consumer-centric app.

» Maplebear Inc. (CART), operating as “Instacart,” provides online grocery shopping services to households in North America.

Global-e Online (GLBE) provides a platform that enables and accelerates direct-to-consumer global cross-border e-commerce through localization of the food shopping experience so that overseas transactions are as seamless as domestic transactions.

Solo Brands (DTC), a direct-to-consumer platform that promotes premium outdoor lifestyle brands.

Alibaba (BABA), a global e-commerce giant founded in China and indexed in the United States, which operates AliExpress, as well as several other online and B2B retail platforms.

PDD Holdings (PDD), a China-founded retail giant whose US stock industry operates several platforms, adding the new and developing Temu. com that hopes to compete with AliExpress and Amazon.

» Coupang (CPNG), a South Korean e-commerce company, sells everything from apparel to furniture.

Of course, this is just a partial list, which includes only pure-play online shopping providers and enablers. Many of the legacy store chains and retail giants now have a significant chunk of their sales online, with the e-commerce proportion rising from quarter to quarter.

While the e-commerce scene is teeming with companies of all shapes and sizes, choosing those that can persist, grow, and reward their investors with significant gains is not an easy task. The vast number of differences in these companies’ financial and business metrics, as well as their prospects, calls for a thorough analysis, which requires digging into the data, analyzing companies’ finances, industry competitiveness, growth prospects and risks, and more.

Thankfully, at TipRanks, investors can leverage the existing analysis, utilizing research done by Wall Street’s leading analysts, collected and made accessible by TipRanks. TipRanks also has several tools, such as a stock screener, stock comparison tool, technical analysis screener, and others, which can help investors employ the vast amounts of data and research stored in its database, to their benefit.

As another option, investors can purchase one of the retail ETFs, one of TipRanks’ many ETF teams to decide which is the winning fund:

To conclude, e-commerce companies provide their investors with an opportunity to profit from an accelerating shift to online and mobile shopping. However, it is important to take into account the companies’ finances and prospects to pick the winners that can create long-term value for their shareholders.