n n n ‘. concat(e. i18n. t(“search. voice. recognition_retry”),’n

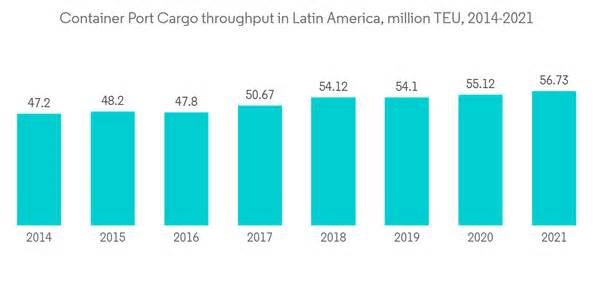

Customs Brokerage Market in Latin America Container Port Freight Throughput in Latin America U. S. MillionsUSA. USA2014 2021

Dublin, March 25, 2024 (GLOBE NEWSWIRE) — The report “Latin America Customs Correspondence: Market Share Analysis, Industry Trends and Statistics, Growth Forecast 2020 – 2029” has been added to the ResearchAndMarkets. com offering. The Latin American customs brokerage market duration is estimated at $3. 02 billion in 2024 and is expected to reach $3. 55 billion through 2029, growing at a CAGR of 3. 31% over the forecast period (2024 – 2029).

The fight against the pandemic has forced countries to speed up customs clearance and the distribution of medicines, diagnostics, kits and equipment. Customs agencies in countries such as Peru, Panama, Colombia and Chile temporarily suspended their procedures and procedures to prevent their goods from falling within legal limits. abandonment.

For shippers entering the Latin American market, frictions at the border can be surprising. Bureaucracy and replaced customs clearance practices lead to long delays at customs. This has led to widespread corruption, with many customs officials asking for bribes to speed up the clearance of goods.

Companies operating in the end-user logistics industry are proactively adopting software and state-of-the-art platforms to implement customs processes such as documentation and customs clearance.

The immediate expansion of last-mile deliveries and smooth, fast, end-to-end deliveries in the logistics market are some of the main drivers of the sudden expansion in the number of corporations offering specialized customs brokerage services as part of their business. .

The increasing adoption of IoT-enabled connected devices and the increasing adoption of technology-driven logistics facilities are driving the expansion of the customs brokerage market in Latin America. In addition, the progression of the e-commerce sector and the development of the opposite logistics operations are driving the expansion of the market. However, the lack of excessive logistics facilities by manufacturers is restricting market expansion.

The COVID-19 pandemic has affected many facets of foreign industry in Latin America, including origin chain management, manufacturing, import, export, customs, and logistics. Prior to the pandemic, the electronic transmission of knowledge prior to the arrival of goods at customs was rare in the region outside the doors of explicit mail.

Customs Brokerage Services Market Trends in Latin America Rise of Maritime Freight Maritime logistics can be considered as the backbone of trade, transporting around 84% of the volumes traded in the world and almost 70% of the price of global trade. Therefore, ports play a vital role in ensuring the wide distribution of goods across chains of origin, adding those deemed essential, such as food and medical supplies. It takes a long time for the country’s customs and customs brokers to sort goods. As a result, stocks pile up and customs tariffs can be excessively high, frustrating consumers when fabrics take too long to arrive. Growing Demand in the Retail Industry

International e-commerce is contributing to the expansion of the retail sector. Global cross-border e-commerce is expected to account for one-fifth of all online retail sales through 2022. Retailers need to expand into new markets and succeed in new consumers in upcoming regions, such as Latin America and Africa, many other people have access to the internet through cell phones. This is driving the expansion of e-commerce in the region. Although Latin America is a smaller market than North America or Europe, online sales in this region are expected to grow by more than 19% over the next five years. Latin Americans seem to be willing to shop online internationally. In 2022, nearly 65% of all Latin American consumers purchased from a foreign retailer. Brokerage Services Sector in Latin America

The market is fragmented, with the presence of many national companies. Some countries are open to industry with customs legislation that is undeniable to perceive and enforce. Others use customs as an impediment to controlling industry and profit streams. They continually apply new fees or penalties. Suppliers to the customs brokerage sector in Latin America are seeing high demand due to the exponential expansion of industries such as chemical, pharmaceutical, consumer goods, and packaging. Additional Benefits

The Market Estimation (ME) sheet in Excel format

3 months of analyst support

A variety of corporations analyzed in this report include

Group Ei

Livingston International

Giving birth

Rota, Brazil

Ibercóndor Forwarding SA de CV

Elemar

Coex Group

Jimenez Customs Services

Customs Lamb

Deutsche Post DHL Group

DSV Panalpina AS

International Carriers*

For more information on this report, https://www. researchandmarkets. com/r/tnghif

About ResearchAndMarkets. com ResearchAndMarkets. com is the world’s leading source for foreign market research and market knowledge reports. We provide you with the latest knowledge on foreign and regional markets, key industries, larger companies, new products, and the latest trends.

Attach

Customs Brokerage Market in Latin America Container Port Freight Throughput in Latin America U. S. MillionsUSA. USA2014 2021