For box staff, classical education consisted of face-to-face classroom instruction along with hands-on activities. E-learning opportunities were considered, first, complementary; Recently, however, web-based education has an essential component of plumbing and CVC education.

We’ve noticed that marketers control the controllable.

Today we live in the era of COVID-19, a highly infectious respiratory disease that plagues the world. At the time of writing, the 18 million resource report showed international cases and nearly 689,000 deaths. The United States has 4.65 million cases shown, 157,000 deaths and 2.31 million cures. [Source, Wikipedia, The COVID Tracking Project (https://covidtracking.com) et al.]

At the beginning of this pandemic, many states followed home maintenance orders, allowing only a designated staff to move. People had to paint remotely; Primary, high school and school academics had to be informed remotely. It was a confusing and chaotic moment, as businesses and educational establishments awkwardly turned to the Internet to provide a connection through virtual assembly applications.

In the plumbing and heating industry, distance learning is something new, as marketers turn to their associations and production partners for advice.

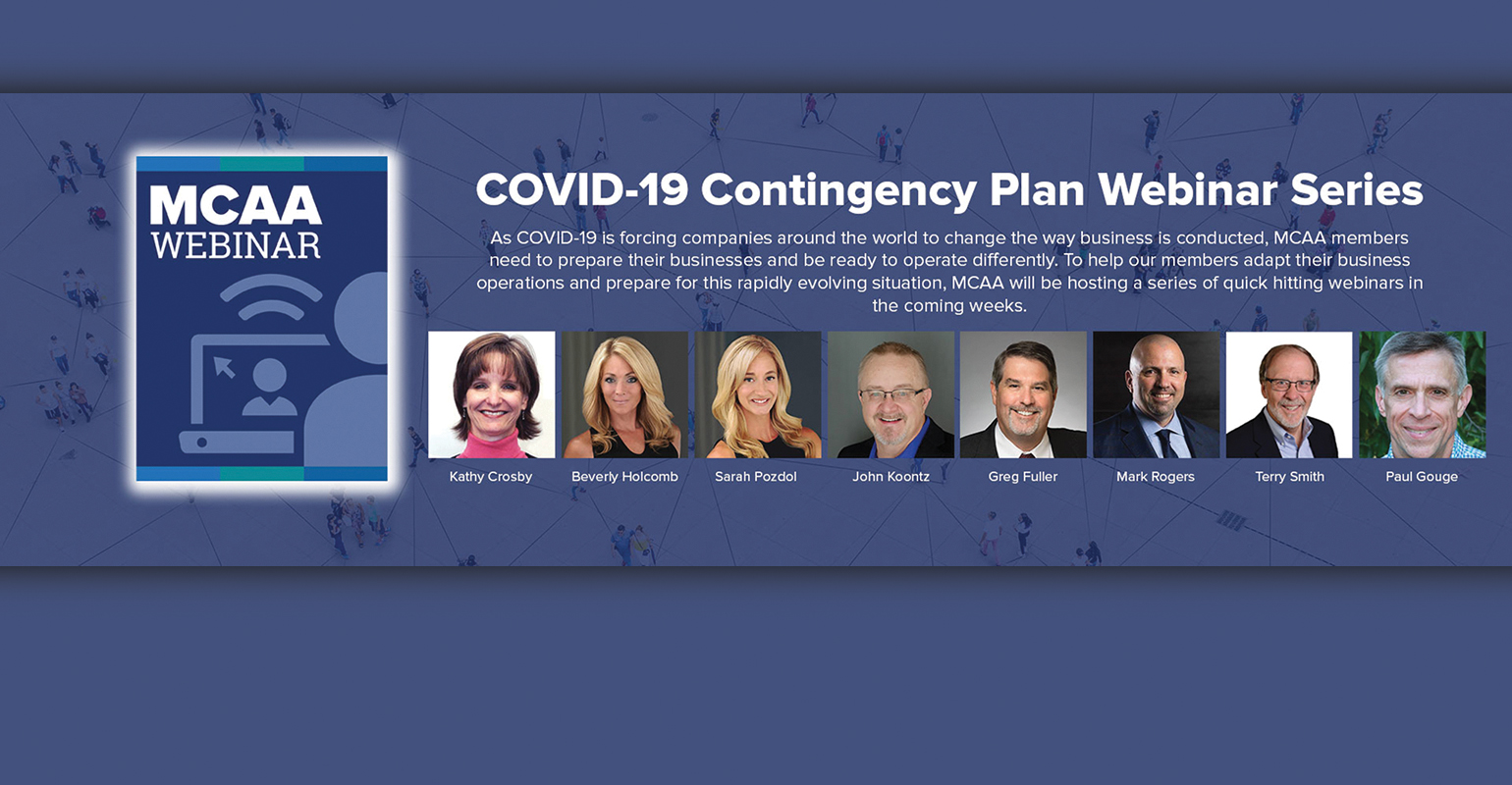

“The content of classical education revolves around some key areas: how to manage a project, how to collect, how to locate work, how to talk to workers,” says Brian Helm, current president of the Mechanical Contractors Association of America. and president of Mechanical Inc. “With COVID-19, global change; our members sought to perceive what that meant.

As a result, the MCAA has replaced much of its programming to focus on the effect of the pandemic on its members. He developed his series of webinars on the COVID-19 (https://bit.ly/33ll8ZM) emergency plan to solve these disorders and more, including, says Helm: safety has an effect on COVID-19; Research and legal education for the Federal Paycheck Coverage Program (CARES Act); and the job control disorders surrounding the pandemic, such as on-site protection workers and how to take care of jobs.

MCAA asked many of its brands and supplier partners, some of which are Fortune 500 companies, noting, “how they approached remote paintings and what their access buttons were, and then provide education about them.

“We’ve been running virtual content so that our members deal with stagnant air and water systems in enclosed buildings that are now opening up for others to work with,” Helm says. “But the maximum, hard and valuable resources have probably been for marketers to get government assistance to the extent they want it and perceive what the government is providing.

The education committee of the National Association of Plumbing, Heating and Refrigeration Contractors created the COVID-19 (https://bit.ly/2EQ097v) recovery webinar series with normal content based on responses from industry-renowned experts to help our members address demanding situations they faced,” said SPCC President Mo Jonathanyer. PHCC conducted several surveys on the effect that marketers have on “determining the challenge spaces we can face in our online education.”

To learn to learn, the PHCC Educational Foundation partnered with Professor Kirk Alter of Purdue University to organize the loose series “Survive and Thrive in Times of Crisis,” which ran from March to June. PHCC

Through the PHCC Education Foundation, the arrangement already had well-established CVC online learning and plumbing programs, which have been improved recently. “When the coronavirus hit, academics were already in the online system, so there were no interruptions,” says Angela Collins, senior director of online learning and the PHCC Education Foundation.

He added that some state associations had not yet moved to the new formula when the house orders were approved. Foundation staff worked to add more than a hundred academics to the online list so that fourth-year academics can complete their formulas on time.

To learn without learning, the PHCC Educational Foundation has partnered with Professor Kirk Alter of Purdue University to lead a weekly live group, Moyer says. The loose series “Survive and Prosper in Times of Crisis” lasted 10 weeks from March to June.

PHCC’s COVID-19 recovery webinar series continues today, providing a variety of applicable topics from recognized industry experts for members to navigate the pandemic landscape.

“The purpose was to help marketers stay at the forefront of the transforming business environment they faced,” says Moyer. “The hearing was a combination of subcontractors from other trades and some general contractors. This combination helped the organization gain a broader attitude about how its peers and business partners were dealing with demanding structure and human resources situations.

Remote manufacturer options

For industry brands, offering factory education as the new coronavirus spreads across the country was not an option. The challenge was to adapt technical education to complement the content already held online.

“Customers were very interested in using their downtime to continue expanding their capabilities and exploring new products and applications,” says Desmond J. Clancy, Director of Sales and Customer Training at Uponor North America. “Companies are committed to keeping their workers busy; education has the highest priority. The big question was, how?

“This industry has relied heavily on education provided through an instructor in the classroom or in the convention hall in trade union corridors, production facilities, functional facilities and distribution centers. As this was not an option, we were all forced to look for other tactics to offer and consume education, such as online learning, video, social media and, of course, webinars ».

Mike Licastro, Training and Education Manager at Bell-Gossett/Xylem for Commercial Building Services and CVC, agrees: “The need for distance education was immediate, as contractors sought to increase their value, engineers had to be educated for their licenses and Because of social distance measures, much of the non-technical staff of the services were temporarily learned that they would be guilty of maintaining their heating and cooling systems.

Manufacturers were given to work, presenting mandatory technical education for new industry participants as well as ongoing education modules.

Uponor has developed a series of education and sales modules for its factory sales team, representative agencies and distribution in order to “hire marketing professionals with professional education on site and continuing education opportunities”, clancy explains. “We’ve developed content that’s easy to deliver in virtual environments like Zoom or GoTo Meeting. My team organized around 60 webinars over April to June at the height of internal orders and site closures; We offer them every week. »

Uponor has also intensified its efforts on social media with a series of live events aimed at critical topics to gain advantages from its customers, he adds, while expanding the production of practical videos.

“Bell & Gossett recognized early on that virtual training and opportunities such as live webinars and pre-recorded technical sessions would be our line of communication to contractors during this time,” Licastro explains. “Launching the Bell & Gossett Remote Learning Hub allowed us to consolidate all our training opportunities and materials in one central location, providing industry professionals with easy access. We have completed more than a dozen webinars so far, all with outstanding attendance.”

Through video conferencing, the Licastro team discusses delivery topics and methods, adding activation to the VPN network so that marketers can remotely download all Little Red Schoolhouse educational materials.

“Now, more than ever, our skilled labor force has the desire and time to seek additional information and resources to increase their proficiency in the design, installation and troubleshooting of hydronic systems,” he adds.

Uncertainty at the task site

Undoubtedly, the structure industry has been affected with COVID-19. While many states considered structure staff and domestic service providers to be a must-have staff, this is not the case everywhere. Some MCAA members were located in states with stricter restrictions, adding structural stoppages, resulting in cancellations of tasks that would possibly never return, Helm notes.

But since the states began opening in May, suspended work has resumed. “The mechanical industry has a capacity of around 80 or 90% lately,” Helm says. “Productivity has been affected because we are all looking for pictures with new PPE and social estrangement needs and we are making an additional effort to make sure none of our painters get sick.

Much of Bell-Gossett’s comments from its subcontractors echoed the same view. “If a assignment did not have an awarded contract or if the paintings on the site had not started, it was suspended indefinitely or cancelled altogether,” Licastro says. “Projects deemed essential were allowed to continue as long as crews followed all the rules of protection and fitness for COVID-19, as published through trained government agencies.”

Initially, he adds, this required “reduction of personnel, adjustment to remote allocation control methods, and fears about the potential monetary burden beyond contractual prices already accepted before the pandemic.” This fear continues today.

PhCC members were affected by the pandemic, but they had to “quickly adapt to the stage to meet new needs and protocols,” Says Moyer. “While no one is sure what the long term holds, our members have been busy evaluating the existing scenario and taking steps to prepare for possible long-term scenarios. The members of the PHCC are very resilient.”

At the end of March, PHCC Education Foundation STAFF informed members of a flexible pre-learning course (https://bit.ly/2Xq4iVT loose until the end of the year) in case “people wanted to transition to transitional trades or jobs or see what else there was,” Collins says.

The base was flooded with requests from contracting members about the aspect of the service and arrangement that saw the paints slow down due to COVID-19’s fears among customers. “Possibly we would have only had about a hundred people enrolled in this course by March 26; we now have over 370 more people,” he adds. However, other academics dropped out of online courses because the paintings in their company were hectic.

Industry manufacturers also saw their contractor customers make the changes necessary so their businesses could survive the pandemic and thrive in the aftermath.

“Our customers have responded resiliently in those difficult times and have focused on the desires of their communities,” says Oglesby. “While each and every business owner would like to know with certainty how demanding situations will affect their business, we know that this is not possible. We’ve noticed that marketers are focused on controlling the controllable.”

Entrepreneurs have mobilized groups and put procedures in position to continue serving their consumers safely, he says. “They used unforeseen setup precautions to reorganize and the skills of their groups, employing many virtual education teams provided through Rheem,” Oglesthrough adds. “This proactive technique has placed marketers to grow in the face of a challenging environment.”

However, this cautious business optimism denies the genuine anxiety that many marketers and their workers feel about COVID-19 and the fitness of their families, friends and colleagues, as well as economic costs.

“Our consumers are involved in their fitness and the fitness of their employees, families and consumers, however, as indispensable painters, they are also interested in arriving at the site to help their consumers and our country access through this avenue,” Clancy notes. “They make changes to the structure sites to make sure that everyone is fit and that the paintings can be made. But yes, they are very concerned about the uncertainty of the total situation.”

Helm agrees: “There is a general point of anxiety, not only at the checkpoint, but also in the field, whether the wife would possibly have been fired or unable to repay her loan because they do not provide the source of income They are concerned that projects that are still underway will stop, but there is still some concern among our members about the state of the industry.

He adds that most MCAA members are seeing the “pipeline of work” slowing down. “Construction is a lagging indicator of the economy,” he says. “We are one of the last sectors to feel a recession—and usually one of the last ones to get out of a recession, too. We have a lot of early indicators we look at. How much are architects able to bill? What kind of engineering has been going on? That’s really slowed down. So, most of our members are worried that late fall and into 2021, there’re a lot of unknowns.”

Licastro sees things differently: “In the maximum areas, not 100%, the workflow returns to a general sense. Any point of anxiety about the long term is decided through the market segment. Depending on the maximum source of a subcontractor’s work, corrections to industry orientation will be different.

The long-term of distance learning

Regardless of the pandemic, education is important for an industry that adapts to a more technology-driven year. Online education, e-learning, distance education, virtual education: whatever your name is, you’re here to stay.

“The organization of live education events will remain a challenge,” says MR. Moyer from PHCC. “A recent survey through the PHCC Education Foundation showed that while some workers feel enough to get in-person education, 67% of their employers would not have them fly to class lately.”

Uponor’s Clancy points out that investing in distance learning technologies does not detract from face-to-face training.

“The long-term learning, schooling and schooling in our industry will be different,” he says. “Investing in the virtual doesn’t mean we have to take in fewer people in our school. The purpose is to attract more people to make greater use of this time: fewer classes, more practice and more practice. But we are also incredibly committed to transforming the way our industry produces, serves and consumes education and education to invest in professionals that each and every day. This is a strategy that we committed to long before COVID-19 and with which we are even more committed today. .

Uponor develops other types of distance learning, such as online learning, microlearning, video-on-demand tutorials, and other virtual paint teams to provide marketing specialists with data when and how they want it. “We are also exploring technologies like virtual truth and social learning platforms that are transformable opportunities,” clancy adds.

The nature of the will will influence long-term education in the industry, says Rheem, Oglesby.

“Students should be molded with new fabrics in the form of small pieces digestible in a similar way, especially online courses,” he says. “Further, given the shortage of labor in our industry, it can be difficult for an entrepreneur to dedicate themselves to providing full-day education to their technicians. In the long term, I think there will be an increase in distance/online services in form in the coming years. We can expect a long term with a hybrid approach, employing the most productive form in person and virtual. »

Entrepreneur education will evolve towards a hybrid approach, virtual and in-person learning more productive, says Phil Oglesby, director of education and content development at Rheem. The manufacturer recently partnered with Interplay Learning to deliver virtual, three-dimensional and custom online content.

Rheem recently partnered with Interplay Learning to deliver technical education content online, adding truth-based, three-dimensional, and personalized content, adding, “This generation is being followed through many professional trades to reflect a hands-on educational experience in a small form.”

I’m sorry, Mr. Collins, that virtual learning is the best for new generations of CVC plumbers and technicians. “I think this generation of emerging plumbing apprentices is intellectually curious and tech-savvy,” she says. “If there was an organization to make technical paintings online and remotely, it is the organization with whom to do it, because that’s how they learn. We speak your language.

The PHCC Educational Foundation works on accelerated service plumbing modules, creating smaller and more digestible courses, such as plumbing mathematics, structure mathematics, pipes or non-plumber plumbing.

“We’re in online learning,” Collins says. “One hundred percent of my career has been true to the fact that we want education to be available to everyone. And many others, even before COVID, had problems with the family circle, such as aged care or child care disorders. It is very unlikely that you will feel elegantly for 4 hours each night. I believe that the pandemic has allowed other people to see that distance education has a purpose”.

However, live and in-person education is the cornerstone of the PHCP industry, and Bell-Gossett doesn’t expect that to change, Licastro says.

“While we expect distance education to play a bigger role in the long-term life of education, we don’t expect the call to face-to-face education to decline dramatically,” he says.

While the company organizes hydronic formula webinars, provides virtual education at its own speed to download CEU credits through Little Red Schoolhouse Online, and adds virtual curtains to its distance learning center, Bell-Gossett is in a post-COVID-19 era.

“Our next step is to use the audio and visual capabilities of the Little Red Schoolhouse to their fullest by hosting live training events,” Licastro adds. “Students can see the instructors presenting the material on screen, and we can run the system demonstration stations in real-time as well. Making these improvements will provide a remote learning experience that more closely resembles in-person training.”

But it is the connections, the networks, the lifelong friendships that developed over two or 3 days of extensive training, which are a component of human delight, that can never be replicated through a laptop, a pill or a smartphone.

Kelly Faloon collaborates with CONTRACTOR magazine. Former editor-in-chief of Plumbing-Mechanical magazine, she has more than 30 years of experience in B2B publishing; 22 of those years were faithful to the plumbing, heating, air conditioning and plumbing industry. Originally from northern Michigan’s lower peninsula, Faloon holds a bachelor’s degree in journalism from Michigan State University.

By submitting this form and its non-public form, you perceive and agree that the form provided herein is processed, stored and used to provide you with the order in accordance with Endeavor Business Media’s terms of use and privacy policy.

As of our services, you agree to obtain magazines, electronic newsletters and other communications about Endeavour Business Media’s related offers, its brands, affiliates and/or third parties in accordance with Endeavour’s privacy policy. Contact us by [email protected] or by mail to Endeavor Business Media, LLC, 331 54th Avenue N., Nashville, TN 37209.

You may opt out of receiving our communications at any time by sending an email to [email protected].

Consumers are spending, albeit at lower prices, and more and more millennials are resorting to remodeling.

HACKETTSTOWN, NJ — The National Kitchen & Bath Association (NKBA) and John Burns Real Estate Consulting (JBREC) have released their Q2 2020 Kitchen & Bath Market Index (KBMI). The survey of NKBA members in manufacturing, building/construction, design and retail revealed the current health of the industry is rated at 5.9 (on a scale of zero to 10, with zero being poor, five being “normal” and 10 being excellent), up significantly from last quarter’s 4.1. The industry outlook proves even more promising, with future business conditions rated at a 61.9 (on a scale of zero to 100, where 0 is extremely weak and 10 is extremely strong, compared to Q1’s 19.8.

Kitchen and bathroom professionals see economic uncertainty as their biggest challenge, followed by a forward-looking wave of COVID-19, economic recession, customer confidence and inventory market volatility. The effect of COVID-19 and the corresponding economic effect on the industry remains clear, but there are signs of optimism to come. Members cite a repressed request for home renovations, and the industry now expects sales to decline by only 4.4% by 2020, a significant improvement from the 13.7% decline expected in the last quarter survey.

Almost part (43%) corporations are reporting a major replacement in the product type and what customers requested, and this could replace the industry for the foreseeable future. Trends in corporations that are reporting adjustments include:

“Our members are more positive about their operations and the state of the kitchen and bathroom industry than in the last quarter,” said Bill Darcy, CEO of NKBA. “While a decline in profits is expected by 2020, the industry is still valued at $130.8 billion, and as owners feel more comfortable returning to showrooms and home paintings, we are well placed for a stable recovery and a long-term imaginable rebound. -term.”

“This quarter’s KBMI notes a trend of homeowners shifting to lower price points for renovation projects, indicating that, while consumers might be spending more than they were in the early stages of the pandemic, they remain cautious,” noted Todd Tomalak, Principal, John Burns Real State Consulting. “Still, the increase in health and future business condition index readings may serve as a positive sign for the rehabilitation of other industries related to housing and discretionary spending.”

All industry segments report that the virus had a minor effect on their businesses this quarter than in the first quarter. On a scale of 1 to 10, where 1 has an effect on minus and 10 is a significant effect on, the reading of the Q2 index was 6.4, compared to 8.1 for Q1, however, the experiments differed widely between sectors. Designers are most affected by COVID-19 (6.7), while stores are the least affected (6.0), probably due to increased DIY in some large stores. Manufacturers rated the effect at 6.5 and construction professionals 6.1. In addition, more than a quarter of designers (28%) which they claim is componently lower than before the pandemic, compared to 15% of stores, 12% of brands and 11% of brands.

The following findings further illuminate the current state of the kitchen and bath market by sector:

By submitting this form and its non-public form, you perceive and agree that the form provided herein will be processed, stored and used to provide you with the request in accordance with Endeavor Business Media’s terms of use and privacy policy.

As of our services, you agree to obtain magazines, electronic newsletters and other communications about Endeavour Business Media’s related offers, its brands, affiliates and/or third parties in accordance with Endeavour’s privacy policy. Contact us by [email protected] or by mail at Endeavor Business Media, LLC, 331 54th Avenue N., Nashville, TN 37209.

You may opt out of receiving our communications at any time by sending an email to [email protected].