Covid-19 hit the coast of Singapore and Grab retaliated.

The application giant has reduced it by more than 5%, totaling about 360 employees. Despite this setback, it emerged from the pandemic as the top-value company in Southeast Asia, priced at $14 billion.

Grab is ready for a long term in which its users are probably watching paintings from home, according to Anthony Tan, CEO of Grab.

“Food delivery has the norm, grocery delivery is developing very fast, cashless bills are expanding very quickly, so those behaviors have been permanently replaced with or without a vaccine and we have benefited.”

The Southeast Asian region has noticed that more than 650 million people in the market have been limited to their homes. As its users went into lockouts, Grab reduced plans for its vertical and hotel facility sectors.

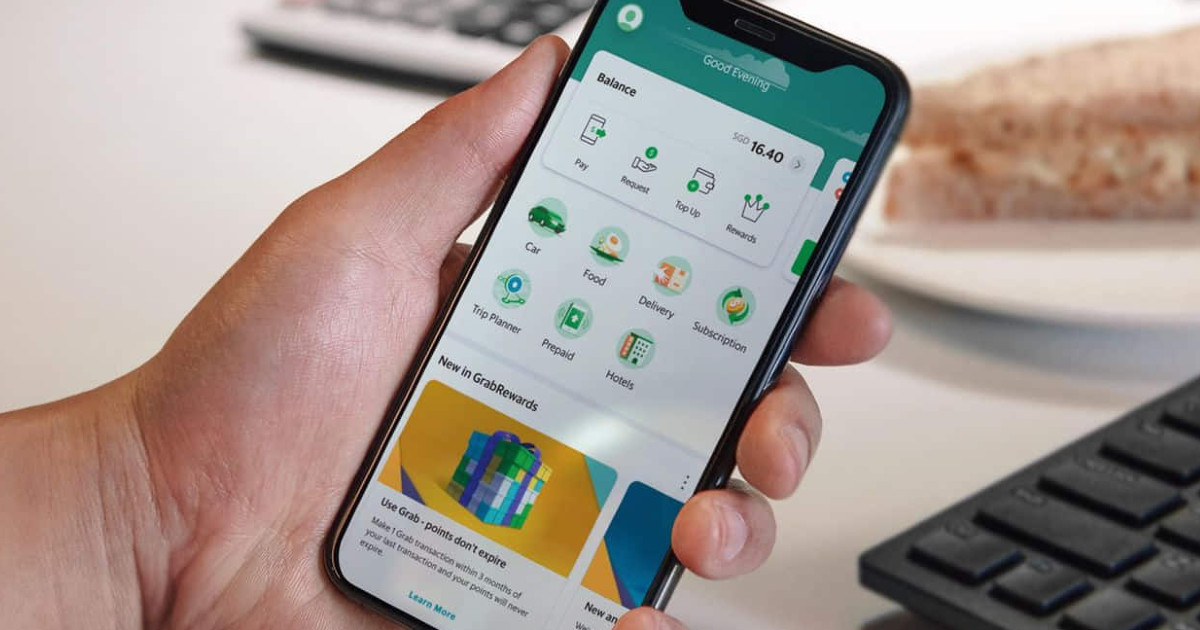

Grab’s twist and hospitality is obvious. In the 2020 screenshot of the app’s homepage, the ticket, hotel and planner functions are obviously missing.

Instead, subsections committed to facilities that remain at the head of a pandemic, such as insurance, are shown.

As Grab’s order and transportation faded, more than 150,000 drivers abandoned the ship and joined Singapore’s thriving food delivery sector such as Grab Riders.

Cashless bills and grocery delivery have grown rapidly.

Recently, Grab’s Autoinvest service was introduced to encourage platform spending. The service allows users to invest with each of the transactions they make through Grab, earning about 1.8% per year.

Online transactions through installations like GrabPay have increased. The advent of small business loans also capitalizes on the monetary desires of commercial homeowners during the pandemic.

Grab’s money has been expanded to manage assets, insurance and loans. The app also requires an online banking license in Singapore.

Today, Grab employs more than nine million drivers, traders and agents.

The super-app again focuses on profitability, being “crazy and microscopic in costs,” Anthony says.

This is news for Grab, but a sadness for its users. On the one hand, Grab subscriptions are significantly less exciting than they used to be.

In April, the app quietly ended a popular food subscription plan per month that charged only S$9.99 and included 50 coupons for loose shipments.

Grab also presented a “daily pricing plan” that provides 15% on trips with 25 transportation vouchers at S$35 depending on the month. Compared to your previous provisions, existing subscription plans are very poor.

The existing Grab RideSavers package has been criticized for its low added value, providing only S$0.80 on the road. However, the new Grab Foodie package is more interesting as it offers a $3.73 reduction in delivery.

Since food delivery is a more cost-effective street Covid-19, the relative price consistent with the subscription package makes sense.

It is difficult to blame a company for hardening its efforts in a crisis; especially for a giant like Grab, which has enough market penetration to offset the profits of its users.

“In smart times, everyone gains market share,” says Anthony. “When the tide changes, it’s corporations that respond the fastest, they’re the fastest in terms of business.

Featured Symbol Credit: Grab