Share this article:

JOHANNESBURG – The coronavirus outbreak has created significant turmoil on financial markets in South Africa as well globally and combined with the country’s uncertain economic climate, pension funds under severe pressure.

Meanwhile, employees are relying on their employers for their pension plans to continue as normal.

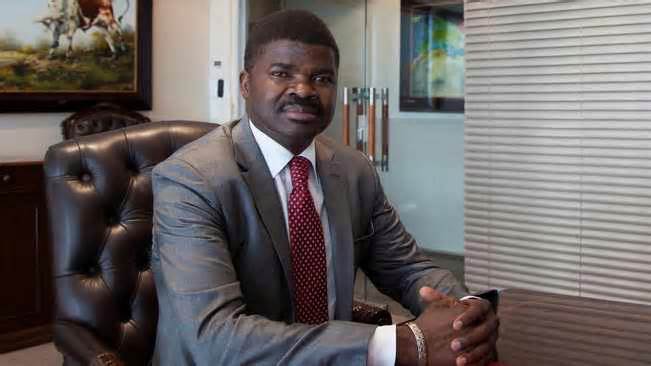

In an interview with Business Report founder and CEO of Akani Retirement Fund Administrators, Zamani Letjane said the Covid-19 pandemic was having a serious effect on South Africa’s pension funds, with catastrophic consequences in the future.

“Covid-19 has robbed everyone and the locks have brought economic activity to its knees not only in South Africa, but also around the world and retirement financing is in the expansion of the money market.

“Today, maximum asset managers grow by around 2%, while CPI is 5%, so you can imagine … there’s virtually no expansion. So, in the two years when an expansion is not expected, there will be a serious effect on pension funds,” he said.

Letjane said another vital factor was where employers were inactive and unable to pay wages. “Wages contribute to retirement financing because employers withheld workers’ contributions and pay them to the pension fund. Now, this activity is also minimized.

“I say downside because we look at other employers, like municipalities, at least 95% of them must contribute to their workers’ retirement budget because workers are there and offer services,” he said.

Letjane stated that there is virtually no activity in the personal sector and that if there was, at a minimum and, as a result, investment in pensions was particularly affected.

The national blockade through President Cyril Ramaphosa in March to curb the spread of coronavirus has led to significant monetary pressure.

Letjane said the personal sector pension budget had been affected through the resolution of some companies to suspend contributions to mitigate the effects of wage cuts.

“Government, local government and municipal pension funds have hardly felt the brunt due to the fact that the sectors they service are mostly essential services and as front-line workers, they have been active throughout the pandemic.

“The majority of my clients are local government and about 1 percent have suspended pension fund contributions,” he said.

Letjane suggested that employers at least retire to make a contribution to the risk of benefits so that workers have some form of protection.

Learn about Letjane and Akani

It all started in 1980 when Letjane joined Murray – Roberts Building (M-R) as a human resources specialist. Its main function was the recruitment and placement of professional and semi-professional workers, which were necessary for project structure purposes. The company had projects such as the purchase of supermarkets, offices and hotels.

“I gained extensive knowledge in the placement of various skilled and semi-skilled workers to various sites where M&R had projects or sites. I was reporting to a training manager who was also my mentor. We both visited all construction sites, doing quality checks.

“During this period, I gained knowledge of the quality of construction work as well as the entire construction processes. I was retrenched from M&R, but fortunately, I got employed at the Midrand Municipality where I worked for 10 years where I performed strictly ruman resources functions.

“In 1985, I became director of the Pension Fund of the Local Government of Transvaal. The Pension Fund has invested in commercial/commercial properties. One of my roles as a fiduciary to identify the site(s) to buy or build retail centers, and my extensive structure delights in helping with that function,” he said.

Letjane served as a trustee for 17 years and participated in the buying of properties and the construction of shopping malls. “I also gained knowledge from letting property managers on how to secure leases with tenants.

“In 1999, I applied for a leave to manage the pension budget and was successful. I founded Akani Retirement Fund Administrators (PTY) LTD, which is now the largest black-owned company in South Africa.

“It is maintained, controlled and controlled 100 percent through the blacks. This is a breakthrough in the industry because there are no significant players in this sector of the economy, but only the old classic insurance companies.”

“I took over the administration of the Municipal Employees’ Pension Fund (MEPF) in 2003. I was ordered to grow the fund, which included a portfolio of advertising real estate. My greatest achievement is the expansion of MEPF, because when I took over in 2003, the fund had 1.4 billion rand of assets and to date, the fund has 19.5 billion rand of assets,” he said.

The good fortune of the administrative company has given the following subsidiaries:

1. Munghana Leisure and Tourism

2. Destiny Exclusive Hotel, Gauteng

3. Destiny Country Lodge Mpumalanga

4. Akani Energy and

5. Akani Properties

“All the above companies that were established are fully functional and operational. We currently have a staff complement of 110 employees and should we receive the requested Funding to build the additional 200 hotel rooms, we anticipate employing 200 more individuals,” said Letjane.

Akani Properties has completed a development called the Ekurhuleni ICC to the value of more than R200 million. This project necessitated the addition of 200 hotel rooms to accommodate conference attendees.

The hotel has 40 rooms, which is an impediment to the expansion of the hotel.

ACTIVITY REPORT

Share this article:

Sections on IOL

Follow IOL

Learn about LIO

Legal

Trend in LIO

Newspapers

© 2020 Independent Online and affiliates. All rights are reserved

Please visit the official Government information portal for Coronavirus by clicking HERE