n n n ‘.concat(e.i18n.t(“search.voice.recognition_retry”),’n

(Bloomberg) — Some Brazilian corporates will be forced to come up with alternative financing plans after the country restricted the issuance of certain tax-exempt local bonds that have grown increasingly popular with individual investors.

Most Read from Bloomberg

Citadel Among Hedge Funds That Caused Trade Leaks at Morgan Stanley Blocks

Tesla Asks Which Jobs Are Critical, Stoking Fears of Layoffs

China replaces more sensible market regulator as Xi tries to end defeat

Haley Loses Nevada Primary on “None of These Candidates” Option

Contagion from EE. UU. se’s commercial real estate sector now moves to Europe

The government last week barred companies outside of the real estate and agribusiness sectors from issuing asset-backed securities known as CRIs and CRAs that allow issuers to borrow against receivables as a way to boost investment in those two areas of the economy.

It’s a reversal from previous decisions from the nation’s securities regulator dating back to 2016, which had broadened the scope of the instruments as long as proceeds were used to fund payments like rent or agribusiness-related products. That had prompted a torrent of sales from banks to fast-food chains and supermarkets, fueling a billion-dollar market.

“The exemption existed to channel resources into two sectors, and then the rule was incredibly flexible,” said Leonardo Ono, credit portfolio manager at hedge fund Legacy Capital. “In terms of fundamentals, this substitution makes sense. “

The restriction, the extent of which took markets by surprise, comes as the government looks to increase revenue to meet an ambitious fiscal target set by Finance Minister Fernando Haddad for the year.

At the same time, it’s also part of a plan to correct what the government sees as distortions in financial markets, said a person with knowledge of the matter, who requested anonymity because the matter isn’t public. As part of that push, the administration has already begun taxing offshore and exclusive funds, and plans to tax dividends in an income tax reform.

Banks

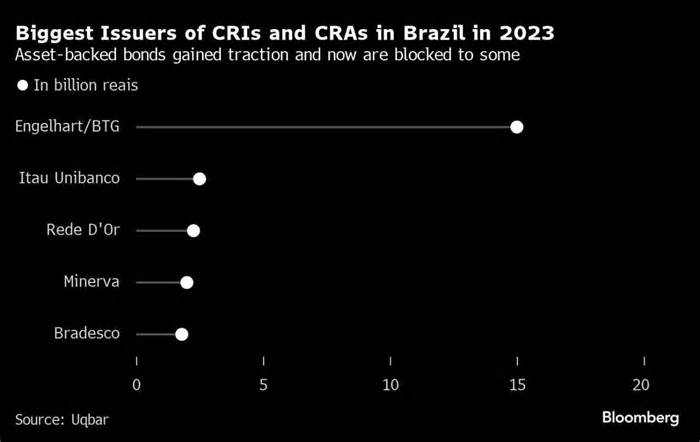

Lenders had just started LIRA for rent invoices and LIRA connected to their business subsidiaries. Last year alone, Banco BTG Pactual SA issued 15 billion reais ($3 billion) to credit rating agencies and Itaú Unibanco Holding SA issued about 2. 5 billion reais in LIRA, according to Uqpar, a Rio de Janeiro-based company that provides securitization data in Brazil.

Outside of the financial sector, health care provider Rede D’or was one of the biggest issuers, with about 2.26 billion reais, Uqbar said. Dasa, Zamp — which controls Burger King’s Brazilian operations — and gas station chain Posto Ipiranga had also issued similar debt, sparking debate among market participants around the scope of these instruments.

Rede D’Or said in an email that IRCs sold starting in 2018 allowed it to build more than 300,000 square meters (3. 2 million square feet) housing about 2,000 hospital beds, “making it one of the largest property developers in the world. “countries” and supporting thousands of jobs. Posto Ipiranga and Dasa declined to comment, while Zamp did not respond to a request for comment.

One Billion R$

In its resolution on Thursday, the National Monetary Council (a government body that includes the Minister of Finance, the Minister of Plans and the head of the central bank) also adjusted the design of tax-exempt bank bonds known as LCI, LCA and LIG, blocking the use of subsidized loans as collateral.

“We expect banks to increase their investment burden as they will not roll over some of those cheap instruments – this is negative for the credit profile,” Moody’s Investors Service analysts led by Daniel Girola said this week.

BTG declined to comment. Itau Chief Executive Milton Maluhy said on an earnings conference call on Tuesday that tax-exempt bonds account for about 15% of the bank’s total funding. The substitution, he said, affects a small part of the collateral used through the bank. Although there will be “some migration to other funding resources,” “this is not expected to particularly replace the bank’s funding burden. “

Banco Bradesco SA’s CEO Marcelo Noronha told reporters Wednesday that the government measure “reduces liquidity a little,” but largely doesn’t affect the bank.

Collectively, the market for those securities (adding CRAs, LIRAs, and tools used through banks) has soared to more than 1 trillion reais ($200 billion), according to capital markets agreement Anbima. Individuals have around R$ 854 billion invested in SCIs, LCAs, and IGLs, while LIRA and CRAs reached around R$ 158. 6 billion. From 2022 to 2023, this figure will increase to 40%.

Rule Change

The National Monetary Council decided that only companies whose revenue largely derives from the real estate sector can issue CRIs, bonds backed by real estate receivables, and only companies from the agribusiness sector can sell CRAs, which are backed by agribusiness receivables. And only debt from those industries can be used as collateral in those transactions.

The finance ministry and the central bank have said the new regulations apply to debt securities that have already been issued. In 2023, around R$90 billion was sold on IRC and CRA, according to Anbima.

Lured through tax incentives, local investors were accepting maturities of up to 10 years on some of those factors, all the way up to global bonds, and banks and corporations that planned to factor more of those types of bonds will have to look for other structures.

While the move was rumored to be in the works, the changes were harsher than anticipated and should cause an abrupt drop in the sales of CRIs and CRAs, said Romulo Landim, partner and legal director at Octante Capital, an asset manager and securitization firm.

“This will force state-owned enterprises to seek a new financing bureaucracy through non-exempt debt instruments, in the domestic or foreign bond market,” Landim added.

–With those of Martha Beck, Aline Oyamada and Ezra Fieser.

(Updates with Bradesco CEO comment in 13th paragraph.)

Most read Bloomberg Businessweek

In a jet club where everything went wrong

The story Elon Musk doesn’t need to talk about

Layoffs Show That Tech Jobs Aren’t Sacred Anymore

HSBC’s new ‘Wise Killer’ app targets FX clients

The user I hired is now my boss.

©2024 Bloomberg L.P.