\n \n \n “. concat(self. i18n. t(‘search. voice. recognition_retry’), “\n

Vietnam’s vast inventory of coffee beans is declining, a phenomenon that is expected to push further globally.

Most read from Bloomberg

Biden to Unveil Long-Awaited Student Debt Relief Measures on Wednesday

Covid incubation shortens with new variant, study finds

Saudi Prince Says Oil Disconnect Could Force OPEC to Act

Apple’s new iPhone 14 will show that India is ending the tech hole with China

Cuts from home sellers in prosperous cities due to the pandemic

Inventories will halve through the end of September last year, according to the median estimate from a Bloomberg survey of traders. Production from Vietnam, the world’s largest supplier of robusta and the largest coffee maker at the moment, is also expected to fall in 2022. 23

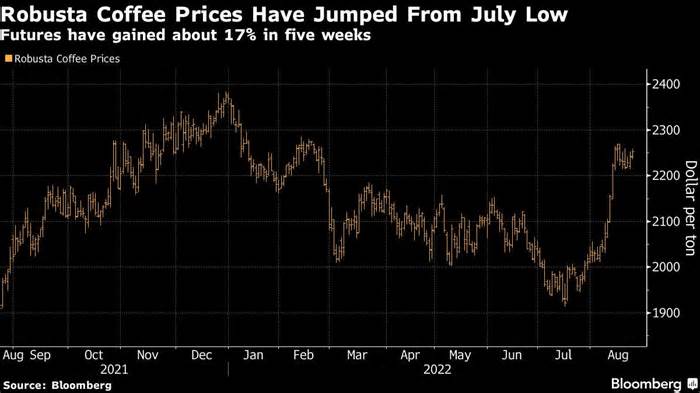

Dwindling stocks and poorly harvested customers come at a time when global coffee intake is recovering from a virus-induced collapse. Robusta’s benchmark costs rose 17% from a 10-month low in mid-July due to Brazil’s disruptions in Africa.

Robusta, used in instant coffee makers that add Nestlé SA or combined in espressos, is making a comeback. The variety, generally less expensive than Arabica, is the most sought-after as other people are looking for opportunities to mitigate the effect of emerging inflation.

In Australia, known for its snobbery about coffee, the supermarket Coles Group Ltd. he said his coffee at the A$1 (69 cents) store “has never been more popular. “It’s a radical replacement in a country that prides itself on its coffee culture and where other people pay five Australian dollars for a flat white.

LIS: Sixty-nine cent coffee appeals to Australians as living rate rises

Bean availability in Vietnam fell, with shipments rising 17% to 1. 13 million tonnes in January-July from a year earlier, according to customs data. The increase in exports has been supported by an improvement in the source of boxes and ships however, it would possibly be complicated given the decrease in inventories.

“We are concerned” about the shortage until early November, said Phan Hung Anh, general manager of Quang Minh Coffee Trading JSC in the southern province of Binh Duong. Local manufacturers only have about 2 percent of their annual output, up from thirteen percent a year earlier, he said.

The global coffee market is facing one of the biggest memory deficits recently after drought and frost reduced Brazilian production. Colombia suffers from rains that have ruined crops, while Honduras, Guatemala and Nicaragua are running out of materials for the 2021-22 harvest. Costa Rica’s next season’s harvest is showing signs of tension and a drought has reduced robusta yields in Uganda.

“Substantial risk”

The drop in Vietnamese stocks pushed domestic robusta costs in Dak Lak province, which accounts for about a third of the country’s harvest, to a record 49,100 VND ($2. 10) consistent with the kilogram last week.

Remaining stocks are estimated at 200,000 tonnes at the start of the new season on Oct. 1, up from about 400,000 tons the year before, according to the survey. Production could fall just 6% to 1. 72 million tonnes in 2022-23. according to the survey. The robusta variety accounts for about 90% of Vietnam’s coffee production.

A decline in the dominance of “profitable” fruit trees and an increase in fertilizer costs will most likely generate production in 2022-23, said Do Ha Nam, president of intimex Group and deputy director of the Vietnam Coffee and Cocoa Association.

Citigroup Inc. cut its forecast for coffee production in Vietnam this year and next, as surveys of local crops indicated that cherry progression had been affected by a lack of fertilizer use this year. he said in a report earlier this month.

(Updates with main points in the fifth paragraph)

Most read from Bloomberg Businessweek

Get in position for the magic mushroom pill

SoftBank’s Epic Losses Reveal Masayoshi Son’s Broken Business Model

Many Korean Elon Musk enthusiasts have a $15 billion stake in Tesla

A ‘tsunami of cuts’: 20 million American homes are on their electricity bills

IRS injection of $80 billion more in audits, in 2026 or 2027

©2022 Bloomberg L. P.