Spot costs of cobalt increased significantly during the month and LME cobalt stocks decreased. Supply bottlenecks in Africa are driving the rising costs of cobalt.

Cobalt Market News – Friedland: “The new oil is copper, nickel, cobalt”. Roskill – Fastmarketplaces expects the cobalt market to remain balanced by 2020. China plans to accumulate cobalt reserves.

Cobalt miners news: Huayou suspends purchases of cobalt at two Congo mines. Australian Mines demonstrates its ability to produce fabrics for NCM batteries.

Welcome to the news of cobalt miners from August 2020. Last month, cobalt costs increased dramatically and much news of the cobalt miners society was transmitted.

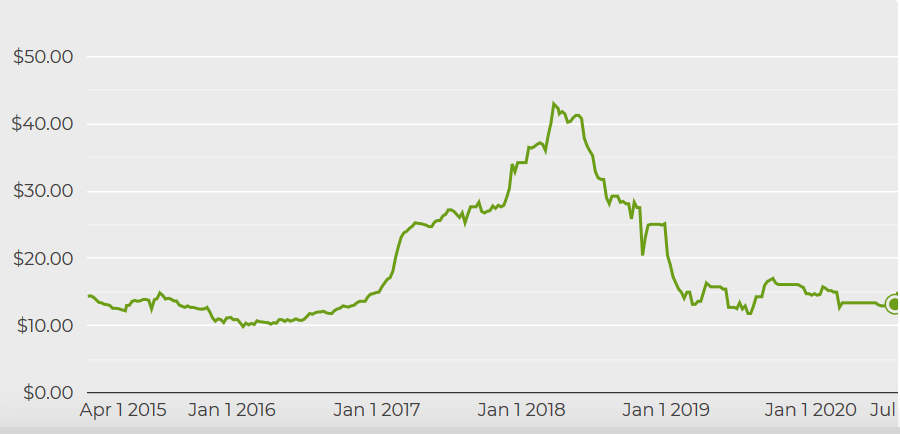

As of August 22, cobalt was worth $14.99/lb in cash, compared to $12.93/lb last month. The value of cobalt in the LME is US$33,045/tonne. LME Cobalt stock is 515 tonnes, a decrease that last month. More main points on cobalt prices (especially the most applicable cobalt sulfate), can be found here at Benchmark Mineral Intelligence or Fast Markets MB.

Cobalt Spot Value – Five-Year Chart – $14.99

Source: Mining.com

On August 5, Reuters reported:

Bottlenecks in supply in Africa are driving the rise of cobalt values ….. Shipping delays from South Africa amid a physically powerful Chinese call have increased in line with the values of cobalt hydroxide, used to manufacture chemicals for electric vehicle batteries … “We are seeing an avalanche of cobalt hydroxide in China, (but) buyers are locating that it’s not there,” said Caspar Rawles, head of valuation at Benchmark Mineral Intelligence [BMI] Array…. CBD0 cobalt prices in the London Metal The change is at $33,000 consistent with the ton, the highest since early March and more than 15% since the end of July, when the value decreased due to the slowdown in activity and the blocking of COVID-19 ended. are still expected. George Heppel of CRU Group puts the figure at 6,000 tonnes, while BMI forecasts an oversupply of about 5,000 tonnes.

Robert Friedland: The value of copper will have to double to inspire a new sourceArray ….. “Everything will be electric, and the world will realize that you can’t do it without some critical metals,” he said. the oil is copper, nickel and cobalt. »

On August 12, Investing News reported:

Roskill: The cobalt market will remain balanced by 2020. ” (We maintain) the view that this year we will probably see at most a slight decrease year after year in the global production of subtle cobalt, largely due to the adjustment of the mining source after Mutanda. and the slowdown in growth … In the future, Roskill expects to see an increase in sulfate and tetroxide premiums, the ultimate non-unusual chemical bureaucracy of cobalt, for the rest of the year, basically due to returning to the call and increasing production costs.

On August 12, Mining.com reported:

Huayou temporarily suspends cobalt purchases of two Congo mines. Chinese company Huayou Cobalt will not acquire artisanal cobalt from two mines in the Democratic Republic of the Congo until it is sure that the fabrics they produce are free from human rights violations in accordance with industry standards. Congo is the world’s largest manufacturer of metal, artisanal or subsistence miners for batteries, and represents a significant percentage of the world’s source. Huayou will continue with the Better Mining program developed through RCS Group, a Berlin-based source chain audit company, which aims to ensure that artisanal cobalt mines do not use child labour or contribute to the financing of armed groups.

On August 13, International Mining reported:

The RCS Global – Responsible Minerals Institute is expanding the DRC’s Better Mining mine tracking program for cobalt and copper. The expansion will begin with the early addition of a mine near Likasi followed by a fifth recently under evaluation. Better Mining and RMI aim to expand the program to 12 seconds in the Democratic Republic of the Congo until 2023. Implemented in cobalt, copper and 3TG ASMs in the Democratic Republic of the Congo, the extension of the partnership with Huayou Cobalt and the expansion to other companies is the latest milestone for the Better Mining program, which has the active support of major market players, adding Volvo Cars and other subsequent brands.

Cobalt investment: CRU: The European electric vehicle sector can encourage the expansion of demand for cobalt. According to George Heppel of CRU Group, one of the biggest surprises of the first part was the recovery of the call for and the expansion of the European electric vehicle sector. “More electric cars were sold in the first part of 2020 than in the 2018 total. By contrast, sales of electric cars in China remain largely at the same point in 2020 as in 2018.

On August 13, Forbes reported:

America’s transition of blank power demands a mining boom. In the present state of America, we are recklessly laying the groundwork for some other massive energy problem: the fact that we no longer depend on foreigners for the essential parts of tomorrow’s energy world. It would be our desire in development to import the rare earth minerals and other fabrics that are essential for the progression of bleaching energy sources.

On August 17, Investing News published:

Cobalt market site update: time of the 2020 quarter balance sheetArray .. In the future, the analyst expects cobalt hydroxide and cobalt sulfate debt to grow more powerful than commercials require, especially since the aerospace industry is likely to recover only slowly. “From late June to July, cobalt costs were rising due to the lingering effects of the lockout in South Africa at AprilArray. In July, cobalt hydroxide debts, which is the price of cobalt in hydroxide compared to metal, construction increased by about 10 percent. “[CECI] is a massive movement in the area of a month. “If the call continues as we saw at the end of the first part of 2020 in Europe and sales in China even more, our call to expectations will increase in our next forecast update,” Rawles said. Heppel agrees and says that one of the biggest surprises of the first part was the recovery of the call and expansion of the European Electric Vehicles Array sector. Fastmarketplaces has revised its forecast of a source surplus of 8,000 tonnes to a surplus of 2000 tonnes. a balanced market. Roskill also expects the place of the cobalt market to remain relatively balanced for the remainder of 2020.

China plans to accumulate cobalt reserves as the virus increases the threat of supply. China’s national workshop company has developed plans to buy 2,000 tons of cobalt after the coronavirus pandemic highlighted the fragility of strategic ore supplies.

Glencore [HK: 805] [LSE: GLEN] (OTCPK: GLCNF)

On July 31, Glencore announced, “2020 7th Production.” Highlights include:

Ivan Glasenberg, Managing Director of Glencore:

Marketing update

On August 6, Glencore announced, “Semen 2020.” Highlights include:

Industrial Adjusted EBITDA, $2.6 Billion Forged in a Challenging Operating Environment

Discontinue with update of the six months ended June 30, 2020 and update the earnings warning. In 2020 1H, the Group’s farming consisting of hations produced 39,006 tonnes of cop consisting of cop content consisting of cathode and cop consistent with concentrate (six months ended June 30, 2019 (” 2019 1H”) ,: 36897 tonnes) and 2635 tonnes of cobalt contained in cobalt hydroxide (2019 1H: 2611 tonnes). In the first half of 2020, the Group’s mining operations sold 34,000 tonnes of cop in line with (2019 1H: 38091 tonnes), a minimum of about 11% year-on-year until 2019 1H, and 2970 tonnes of cobalt (2019 1H: 844 tonnes). , an accumulation of about 252% for one year until 2019 1H. With regard to cobalt and cobalt sales, the Group’s oconsisteant mining generated revenues of approximately $149.0 million and $57.8 million, respectively (1S 2019: USD 203.4 million and USD 8.7 million, respectively) in 2020 1S, or approximately 27% consistent with the year – at a year-on-year minimum and a year-on-year accumulation of 563%, respectively, until 2019 1H. In addition, revenue from the marketing of minerals and metals of external origin amounted to approximately US$140.7 million, a minimum of approximately 71% of the US$493.3 million in 2019 1H.

Chemaf (a subsidiary of Shalina Resources)

Not for the month.

GEM Co Ltd [ELLA: 002340]

Not for the month.

Investors can learn more about GEM Co in my trend Investing article: “A Look at GEM Co Ltd, the world’s largest battery recycling company.”

Nornickel announces consolidated production results for 1S2020Array. First vice president and chief operating officer, Sergey Dyachenko, commented on the production effects of 1S 2020: “First, I would like to reiterate that reducing environmental impact remains our most sensible strategy to prioritize and verify our commitment to radically enhance the environmental scenario in the regions of our operations The corporate is making every effort to mitigate the effects of the fuel spill at the HP-3 plant. To date, the sanitation of the Ambarnaya River has been practically finished the collection of infected soils and the paintings of maximum complexity and labor on cleaning and rehabilitation of soils have been initiated.

Sherritt announces the effects of the superior production of nickel and cobalt in Moa JV in the last quarter of 2020 Array.. “We look forward to continuing this momentum until the end of the year and expect to produce between 32,000 and 33,000 tons of finished nickel and between 3300 and 3400 tons of finished product, one hundred percent cobalt by 2020, in line with our initial forecast for the year.

Fortune Minerals announces the NICO exploration program. Induced polarization and floor magnetometer studies will be conducted on the combined magnetic, gravitational and magnetoteluric anomaly of the 1.2-kilometer wide peanut lake for drilling targets.

Investors can see the company’s latest presentation here.

Future catalysts include:

Clean TeQ [ASX: CLQ] [TSX: CLQ] (OTCQX: CTEQF)

Clean TeQ contained 132 kt of cobalt in its Sunrise project.

On July 31, Clean TeQ announced:

Expected depreciation of assets. Clean TeQ Holdings Limited expects to record a non-monetary deterioration in the e-book price of its Sunrise allocation and assets related to the allocation of approximately A180 million dollars in the full-year monetary effects of June 30, 2020 in an initial review of the e-book price of Non-Current Assets assumed through the Company.

Investors can read the company’s latest presentation here.

Future catalysts include:

2020 – Other tax arrangements imaginable and financing of projects/associations.

Australian Mines [ASX: AUZ] (OTCQB: AMSLF)

On August 13, Australian Mines announced:

Australian Mines demonstrates its ability to produce fabrics for NCM batteries. Australian Mines Limited, a developer of complex battery fabrics, confirms that production of forerunners of nickel-cobalt-manganese [NCM] battery precursor fabrics, widely used in the electric vehicle industry [EV], has begun.

On August 18, Australian Mines announced, “Australian Mines achieves the first certification of the carbon-neutral industry.”

Canada Silver Cobalt completes the acquisition of Polymet Resources assets. Canada Silver Cobalt Works Inc. is pleased to announce that the past announced acquisition of Polymet Resources Inc. assets has been completed, adding a research laboratory and a bulk sampling plant located in Cobalt, Ontario …..

On August 19, Canada Silver Cobalt Works Inc. announced: “Canada Silver Cobalt announces another $3.5 million to be raised in a personal placement of the final leg.

Nickel from Canada [TSXV: CNC]

On July 27, Canada Nickel announced:

Canada Nickel launches wholly owned netZero Metals Inc. to expand carbon-free nickel, cobalt and iron.

On July 30, Canada Nickel announced, “Fill drilling continues to highlight the search for higher-grade cores in Canada Nickel’s Crawford Nickel-Cobalt-Palladium project.”

On August 6, Canada Nickel announced:

Fill drilling further strengthens top grade cores at Crawford Nickel-Cobalt SulphideArray ….. The CR20-44 hole returned 0.41% nickel over a duration of 51 meters with 0.33% nickel over a duration of 118 meters, which widens extra the width of the top quality shells in this section.

Bar will get a refund of approximately $400,000. Barra Resources Limited (Barra) takes note of the granting and issuance of the rights of its joint venture spouse Conico Limited [ASX: CNJ; Conico] announced the market today. Conico’s $2.87 million fundraising is underwrite through RM Corporate Finance.

Investors can see corporate here.

I am pleased to hear the commentators’ updates. The junior cobalt tickers that I will simply include:

21st Century Metals (CSE: BULL) (OTCQB: DCNNF), African Battery Metals [AIM: ABM], Alloy Resources [ASX: AYR], Artemis Resources Ltd [ASX: ARV] (OTCPK: ARTTF), Auroch [ASX: AOU ] [GR: T59], Azure Minerals [ASX: AZS] (OTC: AZRMF), Bankers Cobalt [TSXV: BANC] [GR: BC2] (NDENF), Blackstone Minerals [ASX: BSX], BHP (NYSE: BHP), Bluebird Battery Metals Inc. [TSXV: BATT] (OTCPK: BBBMF), Brixton Metals Corporation [TSXV] : BXTMD), Canadian International Minerals [TSXV: CIN], Carnaby Resources [ASX: CNB], Celsius Resources [ASX : CLA] [GR: FX8], Centaurus Metals [ASX: CTM], CBLT Inc. [TSXV: KBLT] (OTCPK: CBBLF), Cobalt Power Group [TSX: CPO], Cohiba Minerals [ASX: CHK], Corazon Mining Ltd [ASX: CZN], Cruz Cobalt [CSE: CRUZ] (OTCPK: BKTPF), Cudeco Ltd [ASX: CDU] [GR: AMR], Dragon Energy [ASX: DLE], European Cobalt Ltd. [ASX: EUC] , First Quantum Minerals (OTCPK: FQVLF), Fuse Cobalt Inc [CVE: FUSE] (WCTXF), Galileo [ASX: GAL], Global Energy Metals [TSXV: GEMC] (OTC: GBLEF), GME Resources (OTC: GMRSF), Global Energy Met als [TSXV: GEMC] [GR (OTC: HNLMF), Hylea Metals [ASX: HCO], Independence Group [ASX: IGO] (OTC: IIDDY), Karora Resources Inc. (TSX: KRR) (KRRGF) (formerly RNC Minerals), King’s Bay Res (OTC: KBGCF) [TSXV) : KBG], Latin American Resources, M2 Cobalt Corp. (TSXV: MC) (OTCQB: MCCBF), MetalsTech [ASE: MTC], Metals X (ASX: MLX) (OTCPK: MLXEF), Meteoric Resources [ASX: MEI], Mincor Resources (OTCPK: MCRZF) [ASX: MCR], Namibia Critical Metals [TSXV: NMI] (OTCPK: PACIFIC Rim[ PolyMet Mining [TSXV: POM] (NYSEMKT: PLM), OreCorp [ASX: ORR], Power Americas Minerals [TSXV]: PAM], Panoramic Resources (OTCPK: PANRF) [ASX: PAN], Pioneer Resources Limited [ASX: PIO], Platina Resources (OTCPK) : PTNUF) [ASX: PGM], Quantum Cobalt Corp [CSE: QBOT] GR: 23BA] (OTCPK: BRVVF), Regal Resources (OTC) : RGARF), Resolution Minerals Ltd [ASX: RML], Sienna Resources [TSXV: SIE Victory], (OTCPK: SNNAF) and Mines [

Trend reversal

Thank you for reading the article If you need to sign up for Trend Investing to get my most productive investment ideas, the latest trends, exclusive interviews with the CEO, a chat room for me and other complicated investors aimed at renewable energy and the electric vehicle and metals sector. You can get more information by reading “The Difference in Trend Reversal”, “Subscriber Reviews on Trend Investment” or signalal here.

Latest articles: