BEIJING, China: China’s economy recovered faster than expected in the third quarter, but a longer-term recovery will be tested through the lingering effects of COVID-19, a prolonged housing crisis, and the dangers of a global recession. .

With the help of a series of government measures, the world’s largest economy grew 3. 9 in July-September from a year earlier, according to official data released on Monday (Oct. 24), beating the 3. 4 speed forecast in a Reuters vote and faster than the 0. 4 percent expansion in the current quarter.

However, domestic demand declined towards the end of the quarter as a surge in coronavirus cases led to lockdowns, while export growth slowed and the key real estate sector cooled further, indicating a difficult recovery.

To further cloud the picture, it appears that China will continue its ultra-strict policies against COVID-19 through the ruling Communist Party, which concluded its leadership reshuffle on Sunday, October 23, with Xi Jinping securing his third term as leader.

The new makeover of China’s more sensible governance framework has raised investor fears that President Xi will redouble his efforts on ideological policies at the expense of economic growth.

“There is no chance of China lifting its zero COVID policy in the near future, and we don’t expect any significant easing before 2024,” said Julian Evans-Pritchard, senior China economist at Capital Economics.

“Recurrent viral disruptions will continue to weigh on in-person activity and large-scale lockdowns cannot be ruled out. “

Hong Kong stocks fell to their lowest point in thirteen years and the onshore yuan fell to its weakest point in 15 years on economic considerations.

Final inflows accounted for 2. 1 percentage points of the 3. 9 percent gross domestic product (GDP) expansion, while capital formation or investment and net exports accounted for 0. 8 and 1. 1 percentage points, respectively.

In the months to September, China’s inflation-adjusted urban rate consistent with capital inflows fell 0. 2% year-on-year.

The information was originally scheduled to be released on Tuesday, October 18, but was delayed at the Communist Party Congress last week.

On a quarterly basis, GDP grew through 3. 9% to a revised decline of 2. 7% in April-June and an expected accumulation of 3. 5%.

The economy relied on the productive sector, with separate data appearing on commercial output in September rising 6. 3% from a year earlier, beating expectations for a 4. 5% gain and 4. 2% in August.

In addition to domestic risks, the Chinese economy will suffer external tensions due to the Ukraine crisis and a global slowdown due to interest rate hikes to curb runaway inflation.

A Reuters vote forecast China’s expansion would slow to 3. 2% in 2022, well below the official target of around 5. 5%, marking one of the worst results in nearly a century.

In signs of continued stress, exports rose 5. 7% from a year earlier in September, beating expectations but registering the slowest speed since April. Imports rose just 0. 3 percent, below growth estimates of 1 percent.

Retail sales rose 2. 5 percent, in the absence of forecasts of a 3. 3 percent increase and a 5. 4 percent slowdown in August, underscoring still-fragile domestic demand.

In particular, foodservice sales fell 1. 7% in September from 8. 4% in August due to stricter COVID-19 measures.

As of Oct. 17, 30 cities were implementing varying degrees of lockdown or control, affecting some 225. 1 million people, up from 196. 9 million last week, according to Nomura.

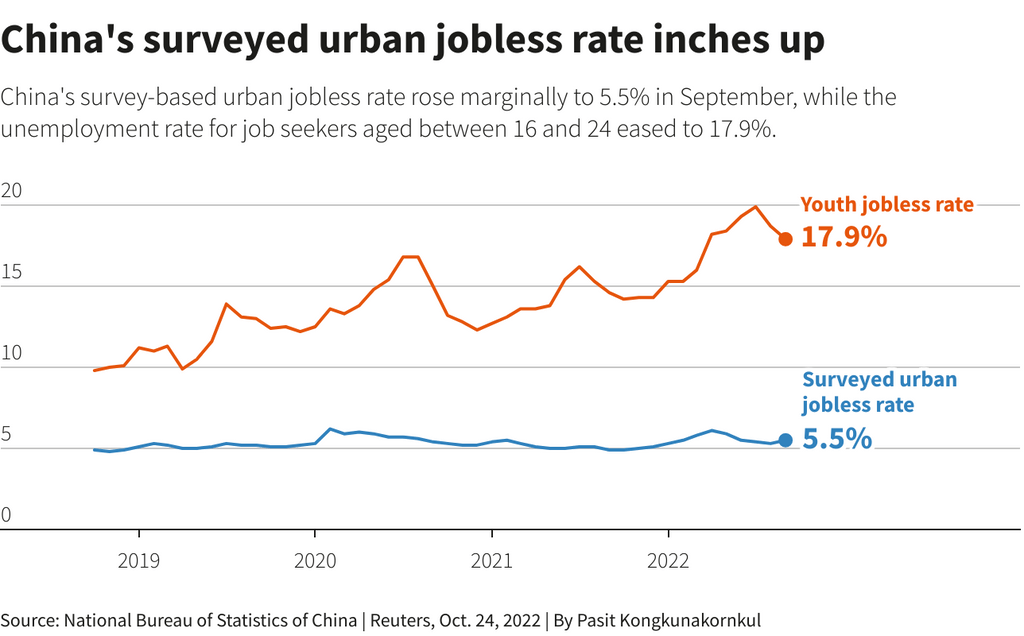

By September, China’s surveyed urban unemployment rate rose to 5. 5 percent, from June, and the unemployment rate for job seekers aged 16 to 24 and older reached 17. 9 percent.

Month-over-month, new housing also fell for the time being directly in the month of September, reflecting lingering aversion among buyers, as indebted developers rushed to pool resources and deliver projects on time.

“This dataset sends a vital message that even COVID measures have more flexibility because it depends on the number of COVID cases, lockdowns remain a huge uncertainty for the economy against the backdrop of the housing crisis,” said Iris Pang, China’s lead economist at EN G.

“This uncertainty that the effectiveness of the expansion policy would be compromised. “

Lawmakers have put in place more than 50 economic measures since last May, seeking to get the economy to ease pressure on jobs, although they have downplayed the importance of meeting the expansion target, which was set in March.

“Politically, the overall policy will be favorable,” said Hao Zhou, chief economist at Guotai Junan International.

“In our view, new political momentum is needed to aid economic recovery, but further interest rate cuts are unlikely to occur in an era of competitive rate hikes through global central banks Rappler. com. “