\n \n \n “. concat(self. i18n. t(‘search. voice. recognition_retry’), “\n

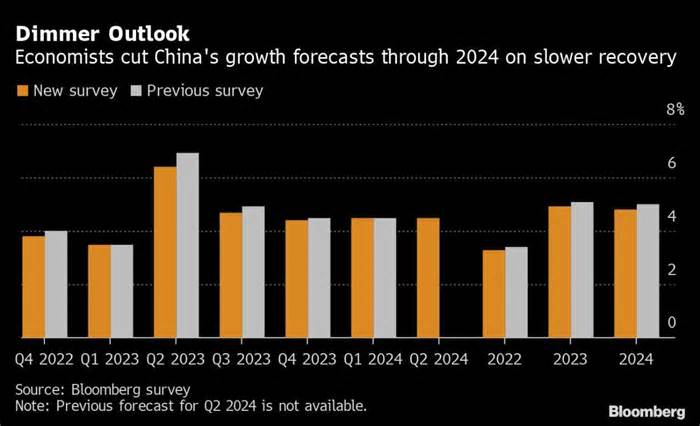

(Bloomberg) — China’s prospect of economic expansion is darkening as economists cut their forecasts through 2024, as many bet Beijing will be slow to abandon its Covid Zero policy.

Most read from Bloomberg

Twitter CEO Leaves Executives When Musk Takes Control

Mark Zuckerberg’s Wealth Loss Reaches $100 Billion, While Meta Is Missing Again

Tesla engineers stop on Twitter to review Musk’s code

Masked election observers appear at polling places with guns and Kevlar vests

Growth is now expected to be less than 5% each year through 2024, according to Bloomberg’s most recent survey of economists. 5,1 %. In 2024, the economy is expected to grow by 4. 8%, down from 5% previously.

China’s zero-tolerance strategy to combat covid infections has been a major drag on the world’s second-largest economy, with regular lockdowns and normal testing making consumers wary and spending, while businesses face continued disruptions. At the most sensitive of that, the worst housing The recorded market slump is spreading through sectors such as structure and banking.

The recent Communist Party Congress leaves no trace that Covid Zero will be abandoned, adding to investor concerns about China’s prospects and fueling a slump in the stock market and yuan.

The Bloomberg survey showed that a majority of economists, 11 of the 18 respondents, expect China to reopen its borders only in the early part of next year. The others plan to reopen only from this part of the year until the first quarter of 2024. Some foreign investors, such as Mark Mobius, say China could ease its Covid policy until the end of this year, many experts are less optimistic.

“As we expect an immediate change of covid-19 policy after the Chinese Communist Party summit, and with the real estate sector still depressed and global expansion in sharp decline, we have revised downwards our expansion forecasts,” said Arjen van Dijkhuizen. , Senior Economist at ABN Amro Bank NV. It now forecasts 3. 5% expansion next year and 5. 2% expansion in 2023.

Some 60 of the economists surveyed see China’s delayed reopening as the biggest risk to economic growth, and 30 cite slowing global growth.

As for inflation, economists see weaker effects for customer and manufacturer costs in the fourth quarter than in previous forecasts. Consumer inflation is expected to average 2. 7% in the latest quarter, while output inflation is expected to be zero, according to the latest forecast.

Economists raised their estimates of fourth-quarter export expansion from 3. 1 percent to 3. 7 percent, while cutting their import forecast to 0. 5 percent from 2. 9 percent. Retail sales are now expected to reach 4%, up from 4. 8% in the previous survey.

“Consumption remains a weak link amid the zero covid position, with its expansion darkening,” said Bernard Aw, Asia-Pacific economist at Coface SA, which now forecasts 3. 2% for this year.

Most read from Bloomberg Businessweek

Student debt headaches soar to millions despite Biden’s relief

What is the advance of Alzheimer’s drugs for other diseases?

The fantasy of surrender implodes

From bedrooms to kitchens, Europe wonders what it’s like too

10 conclusions from Matt Levine’s “The Crypto Story”

©2022 Bloomberg L. P.