\n \n \n “. concat(self. i18n. t(‘search. voice. recognition_retry’), “\n

(Bloomberg) – China’s economic recovery accelerated in July as business activities resumed and confidence improved, despite disruptions caused by sporadic outbreaks of COVID-19 across the country.

Most read from Bloomberg

Who is Nicole Shanahan, the protagonist of the drama Musk-Brin?

Trump plans to blow up the Constitution

Calls for a superficial recession are “totally illusory,” Roubini warns.

China’s Gen Z is discouraged, underemployed and slowing down the economy

Sergey Brin ordered the sale of Musk Investments after an adventure: WSJ

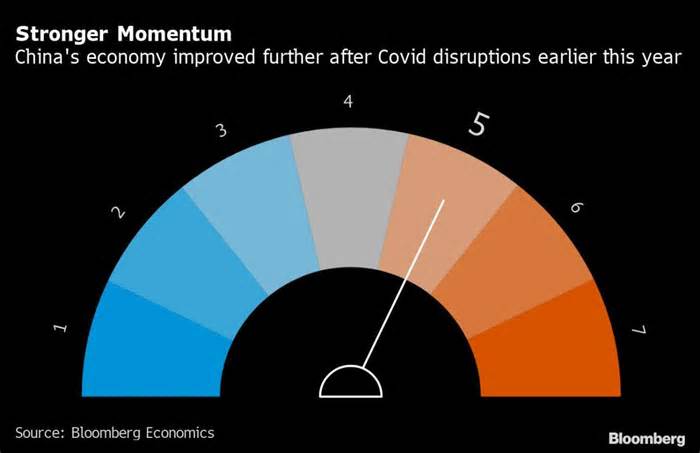

Such is the outlook based on Bloomberg’s aggregate index of 8 early signals for this month. The overall indicator was 5, a point indicating that the economy is warming. This was unchanged since June, which was revised upwards from the neutral point after knowledge showed production. it began to grow again and grew faster than in May.

Small business confidence has improved thanks to higher expectations and better credit conditions, according to Standard Chartered Plc. , which surveys more than 500 small businesses a month. Overall output remained strong, while structural activity recovered thanks to political support, corporate economists Hunter Chan and Ding Shuang wrote in a report.

However, activity in July “did not accelerate,” and readings normalized compared to June’s recovery, they wrote, adding that “sporadic covid outbreaks in provinces such as Shandong, Guangdong, and Shanghai would possibly have disrupted the business” of workers. intensive small and medium-sized enterprises. industrial enterprises.

Read more: Decreased city closures, Shenzhen High Risk: China Lockdown Tracker

The focus of the covid outbreak in China has changed over the past month, with low cases in Shanghai and surrounding provinces but expanding elsewhere, with new lockdowns and restrictions imposed. The eastern province of Anhui, Xi’an, home to the famous terracotta. Warriors and the Wuxi Manufacturing Center imposed restrictions on the month. Lanzhou, the capital of Gansu province, is blocked and on Monday, Shenzhen put factories into a “closed loop” production formula in an attempt to control an outbreak.

In addition to considerations about the virus, the slowdown in China’s real estate market is not yet showing any signs of depression. Home sales continued to decline in the first 3 weeks of July in China’s 4 major cities, the drop was slower. it has been in free fall over the past year, with falling costs and home buying, delinquent developers and now an increasing number of other people refusing to pay their mortgages on homes that have not been delivered through cash-strapped builders.

These disruptions to the commercial sector. While there was a decrease in inventories of corrugated rods, which are used in construction, this was accompanied by a further decrease in metal production in July.

The automotive market has taken a step forward thanks to the relaxation of Covid restrictions and a push from the government to boost sales. In May, China halved the purchase tax on some low-emission passenger cars and the government is accelerating a study on the extension of purchase tax exemptions. for electric cars and examine tactics to encourage car sales in rural areas.

It is very likely that the external call remained resilient in July, and supply continued to the Chinese economy after the industry’s record surplus in June. of considerations about a global recession that may simply irrigate demand.

However, this knowledge showed that demand for Chinese imports continued to slow, indicating the lingering effects of the slowdown in the current quarter.

Read more: China’s slowdown is affecting imports from primary economies

This month, Chinese Premier Li Keqiang signaled that the government would not meet the official expansion target and reiterated caution regarding exaggerated stimulus measures, arguing that the economy was showing the first signs of recovery from covid outbreaks. expansion rates are appropriate as long as employment is sufficient, household incomes rise and costs are stable, Li told world business leaders organized through the World Economic Forum last week.

Many economists expect China likely to miss its economic expansion target of around 5. 5% this year by a significant margin. This would be the first time this would happen: the government failed to set a target in 2020, the first wave of the coronavirus outbreak, and only lost it in 0. 2 percentage issues in 1998.

Early indicators

Bloomberg Economics generates the overall activity reading by aggregating a three-month w8ed average of monthly adjustments into 8 indicators, which are based on trade surveys or market prices.

Main stocks on land: CSI index three hundred A shares indexed in Shanghai or Shenzhen (at the close of the market on the 25th of the month).

Total dominance of home sales in the 4 Chinese Tier 1 cities (Beijing, Shanghai, Guangzhou and Shenzhen).

Inventory of metal rebar, used for reinforcement in (at 10,000 metric tons). The decline in inventories is a sign of developing demand.

Copper value: Spot value of subtle copper in the Shanghai market (yuan/metric ton).

South Korean exports: South Korean exports in the first 20 days of the month (year-on-year change).

Factory inflation tracking: Tracking created through Bloomberg Economics for the Chinese manufacturer (change year after year).

Confidence of small and medium-sized enterprises – Business survey conducted through Standard Chartered.

Passenger Car Sales: Monthly result calculated from the knowledge of average weekly sales through the China Passenger Car Association.

Most read from Bloomberg Businessweek

The $260 Swatch-Omega MoonSwatch revives the brand

Hong Kong’s Solution to Loan Boycotts in China

Post-mortem sperm extraction turns men into fathers

USA. The U. S. has lost control of PC chips

The ghosts of 2012 frequent Europe as the walks begin

©2022 Bloomberg L. P.