U.S. oil exports to China are expected to reach a record next month, a sign that Beijing is stepping up its purchases to meet its commitments under a historic industry agreement.

About 19 tankers signed tentative reserves to load U.S. crude for China in September, according to shipping schedules, which are likely to change. If they all set sail, exports could reach 37 million barrels, the number ever recorded in a month without marriage. .

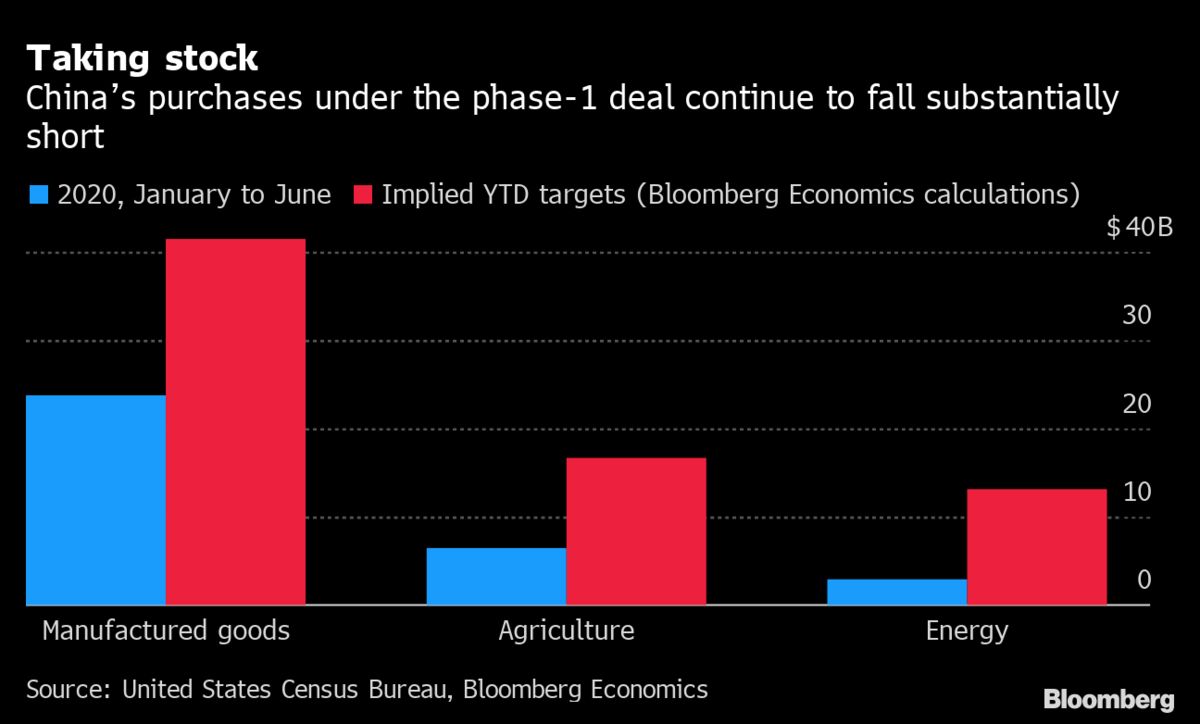

As a component of the first phase of the agreement between the world’s two largest economies signed in January, China pledged to buy about $52 billion of U.S. energy for two years.However, relations deteriorated after Preaspectnt Donald Trump blamed China for the Covid — on September 19 and the Hong Kong treatment, prompting fears from US lawmakers that Beijing would attach to its aspect of the deal.

However, China’s purchases have met the objective.Futures for reference U.S. crude were $60 in line with barrel diversity in January, but fell into negative territory in April.Since then, costs have been moderated by nearly $40 relative to the barrel.scheduled for August 15 has been cancelled and has still been postponed.

“It is transparent that the increase in oil purchases can be positive, but until the postponed assembly is held to talk about the progress of the industry agreement, we do not know if the United States is satisfied with its progress,” Sandy Fielden said., director of studies at Morningstar Inc.Even in this case, “I do not expect an improvement in relations between the United States and China before the election.”

Another explanation for why China has stepped up its purchases is to fill its new strategic oil reserve site in Zhanjiang, which will have a garage capacity of 32 million barrels, said Yuntao Liu, an analyst at Energy Aspects Ltd.

The facility is expected to be in a position this quarter and will give China more capacity to bring American crude, he said.There has also been an increase in demand for gas and petrochemicals, encouraging Chinese buyers to acquire more moth-rich qualities.like American oil, Liu said.

Despite China’s increased purchases, US crude oil costs are in the middle of the world’s economy.But it’s not the first time They remained broadly stable, and the Chinese called for a fill in the vacuum left by weak US consumption.But it’s not the first time The costs of West Texas Intermediate crude oil along the Gulf Coast are 80 cents consistent with the barrel above Nymex’s oil futures unchanged since the beginning of this month.

Exports in May were 35.2 million barrels, according to the knowledge of the US census.U.S. Compiled through Bloomberg.The May volume was also the highest of all U.S. oil buyers.But it’s not the first time For a given month, according to knowledge.

An oil tanker, which can bring about 2 million barrels each, will come from the Gulf Coast of the United States.Unipec, the advertising arm of China’s largest refineries, Sinopec, has reserved some of these tankers, while some others have been chartered through PetroChina Co Ltd, a subsidiary of China National Petroleum Corp.

However, it can be canceled or redirected if the basics of the market change.