n n n ‘. concat(e. i18n. t(“search. voice. recognition_retry”),’n

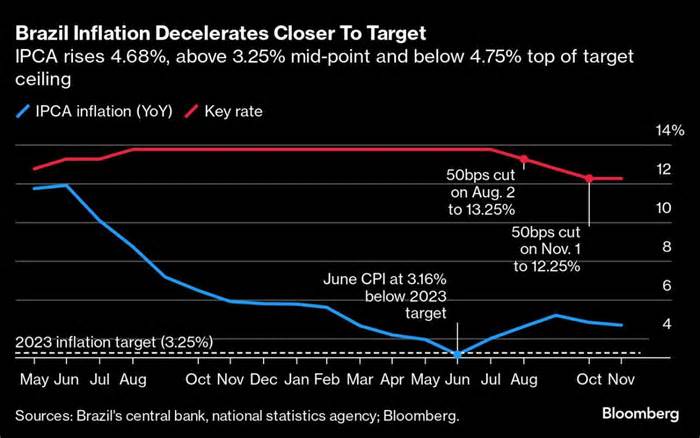

(Bloomberg) — Brazil’s annual inflation rate fell to within the central bank’s target range, keeping policymakers on track to deliver a fourth straight borrowing cost cut at Wednesday’s meeting.

Most on Bloomberg

JPMorgan Is in a Fight Over Its Client’s Lost $50 Million Fortune

Goldman Trader has paid $100 million since his resignation in 2020

Raimondo Vows ‘Strongest Possible’ Action on Huawei’s Chip Breakthrough

Netflix releases data on every show and movie for the first time

Traders Betting Fed Peak Is Here Curb Pivot Wagers: Markets Wrap

Official data released on Tuesday showed customer costs rose 4. 68% in November from a year earlier, just below the 4. 7% median estimate from analysts polled via Bloomberg. Monthly inflation reached 0. 28%.

This year, the central bank targets annual inflation at 3.25% with a tolerance range of plus or minus 1.5 percentage points.

Faced with signs of a slowdown in Latin America’s largest economy, authorities plan to cut the benchmark Selic index by a fraction of a percentage point on Wednesday, to 11. 75%, and then do so again in January. High borrowing costs have helped customer costs that had risen in line with the lifting of Covid-era restrictions, but now weigh heavily on expansion prospects for next year.

Read more: Brazil’s central bank may keep lowering rates, says Campos Neto

“Overall, disinflation continues in Brazil, driven by subdued economic activity, low commodity prices, and tighter monetary conditions,” Andres Abadia, lead economist for Latin America at Pantheon Macroeconomics, wrote in a note. “In the longer term, headline inflation is expected to end the year at around 4. 5%. “

The central bank, led by Roberto Campos Neto, began easing financial policy in August after cutting the annual inflation rate to a point near its highest point in two decades. Still, the higher value of fuel has sparked fear within the president’s administration. Luiz Inácio Lula da Silva, as he fights to fulfill his promises to crusade for the quality of life of Brazilians.

What Bloomberg Economics says

“Tighter headline inflation in Brazil and a slight acceleration of core measures in November’s CPI figures allow the central bank to maintain its 50 basis point easing speed at Wednesday’s monetary policy meeting. “

—Adriana Dupita, economist from Brazil and Argentina

-Click to view the full report.

A 0. 63% increase in the price of food and beverages, caused by high temperatures and rains that affected crops, and a 0. 48% increase in asset values, driven by higher utility costs, were the main participants in November’s inflation. At the same time, the value of communications fell 0. 5 percent, according to the statistics firm.

The inflation report “sets the level by which inflation is sure to be below in the first few months of 2024,” said Carla Argenta, lead economist at CM Capital, a brokerage firm.

State-owned oil company Petroleo Brasileiro SA, which sets wholesale prices for gas and diesel, has faced a backlash as more expensive jet fuel has led to a steady rise in airfares. The price of airline tickets increased by 19. 12% in November, and this is the third consecutive month with double-digit increases.

While rates tend to rise as the holiday season approaches, a tightening labor market and emerging post-pandemic demand have also driven up costs. Low unemployment and a strong services sector have helped boost Brazil’s economy this year. Analysts expect the expansion to slow in the coming months.

Starting next year, the central bank will target annual inflation of 3%, with a tolerance of plus or minus 1. 5 percentage points.

–With those of Giovanna Serafim and María Eloisa Capurro.

(Rephrase the lede, add research and context throughout. )

Most Read from Bloomberg Businessweek

SBF’s Lawyer Says His Consumer Is the ‘Worst’ Ever Subjected to Cross-Examination

The pivot of rate cuts may not come soon enough for indebted companies

How the Largest Fitness Company Turned Suburban Moms Into Bankrupt Franchisees

Hottest Job in US Pays $80,000 a Year, No College Degree Needed

What It’s Like to Paint in a Hot Dog Building

©2023 Bloomberg L. P.