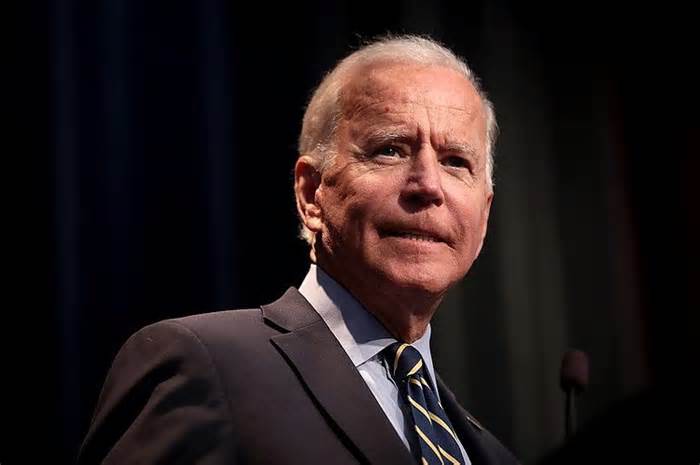

– Quiet day so far for economic knowledge and macro news catalysts; Midterm effects in the U. S. U. S. trucks continued to arrive over the weekend. This morning, Biden landed in Bali before meeting with Chinese President Xi; The two leaders under pressure lack of cooperation.

– The FTSE100 outperforms European indices ahead of the UK CPI on Wednesday and the highly anticipated autumn budget on Thursday.

– EE. UU. se shares pull out of last week’s historic 2-day bull rally, while the USD consolidates at a declining point after last week’s weaker-than-expected CPI.

– Asia closed basically lower with Nikkei225 performing below -1. 1%. EU indices are above 0. 3%. USA. Futures are -0. 3% to -0. 7%. Gold -0. 6%, DXY 0. 6%; Raw material: Brent -0. 6%, WTI -0. 8%, UK Nat Gas 11. 6%; Crypto: BTC 1. 2%, ETH 2. 4%.

– BOJ Governor Kuroda reiterated his overall economic assessment that the national economy is recovering and that the BOJ wishes to carry out a proper follow-up policy.

China’s PBOC and insurance regulator have reportedly asked currency corporations to increase their money for real estate corporations.

– President Biden and Chinese President Xi will meet in Bali on the sidelines of the G20.

The UK’s Office for Budget Responsibility (OBR) said it would most likely provide a recession picture to that provided through the BoE last week.

– November Rightmove house prices in the UK MoM: -1. 1% vs. 0. 9% previously; And/Y: 7. 2% vs 7. 8% before.

– Czech Central Bank (CNB) Governor Michl: calls for a cap on wage expansion in 2023 at ~5. 0%.

– Waller (voter) of the Fed pointed out that given the point of inflation, rates were not that high; The CPI report was “just a point of knowledge” and the markets were “ahead”; Rates would not fall until there was “clear and falsified evidence” that inflation was falling; the market overreacted to a CPI awareness point; Looking at an upcoming imaginable assembly of 50 foundation points.

Democrats hold the U. S. Senate, with at least 50 seats following the Nevada victory.

U. S. Treasury Secretary Yellen: Working with France on a value cap on Russian oil.

Indices [Stoxx600 0. 19% to 433. 10, FTSE 0. 60% to 7,361. 95, DAX 0. 31% to 14,269. 44, CAC-40 0. 32% to 6,615. 68, IBEX-35 0. 42% to 8,131. 94, FTSE MIB 0. 44,5,0. 7% to 24. 0% S futures

Market focal points/key themes: European indices open higher and turn positive again at the start of the consultation; the sectors leading to the increase come with finance and industry; lagging sectors come with real estate and discretionary clients; Indivior to win Opiant Pharma; Caisse des Dépôts is reportedly considering acquiring a stake in Orpea; spin-off of Cargotec from the MacGregor unit; focus on speeches at the G20 assembly that will begin overnight in Bali, Indonesia; the main gains expected in the upcoming US consultationThe U. S. Food and Drug Administration comes from Aecom and Tyson Foods.

– Discretionary consumption: Reports [INF. UK] 5% (commercial update).

– Health: Roche [ROG. CH] -4%, MorphoSys [MOR. DE] -29% (test data), Hutchmed [HCM. UK] 15% (study results), Merck KGaA [MRK. DE] 6% (analyst update). Indivior [INDV . UK] 1. 5% (acquisition).

– Technology: Sonova [SOON. CH] -1% (gains).

– Telecommunications: Tremor International [TRMR. UK] -21. 5% (gains).

– Panetta of the ECB (Italy) said that it is mandatory to adjust the source of cash to ensure that inflation does not take root but does not overreact. Monetary policy cannot forget the threat of excessive tightening.

– Herodotou (Cyprus) of the ECB said that he had noticed rate hikes, the magnitude of which would depend on the data.

European Commission President von der Leyen said he could expect to cap Russian oil prices until the end of 2022 because the EU can essentially continue. He added that the price of the Russian oil price limit has not yet been decided.

– Germany Foreign Min Baebock said new EU sanctions on Iran target the investment mechanism.

– The governor of the Central Bank of Romania (NBR), Isarescu, said that inflation is reaching a plateau.

– The German VCI (Chemical Industry Association) maintained its outlook for 2022 at -5. 5%.

– Russia Foreign Min Lavrov was reportedly taken to hospital after landing in Bali for the G20 (**Note: refuted via Russia).

China’s PBOC reportedly allowed Chinese small businesses to overcome COVID restrictions to delay loan repayment until June 2023.

President Biden said the United States and China play a key role in addressing demanding situations and handling differences without conflict.

Chinese President Xi said he hopes to run with Biden to get back on track. It needs to work with all nations to achieve more peace in the world.

– The USD remained solid but held on to its recent losses despite some Fed members signaling it was softening its fight against inflation. The CPI figure for EE. UU. de last week raised hopes that the possible rise in inflation would translate into less competitive rate increases. through the Fed.

– GBP/USD was above the 1. 18 points ahead of this week’s key events. Knowledge of UK inflation will be known on Wednesday and UK autumn on Thursday. Markets believe the UK’s Fin Min Hunt would put in place tax increases and spending cuts.

– USD/JPY first started the query below 140 points ahead of Japan’s GDP release on Tuesday. BOJ Governor Kuroda reiterated his position that the national economy is recovering and the BOJ will have to carry out proper policy through risk monitoring.

– (FI) Finland October CPI m/m: 0. 9% with 0. 8% earlier; And/Y: 8. 3% vs 8. 1% before.

– (FI) Finland Final retail volume in September Y/Y-2. 4% v-3. 6%

– (IN) October wholesale costs in India (WPI) Y/Y: 8. 4% vs. 8. 5%e.

– (CH) Swiss manufacturing and import costs in October Mo/M: 0. 0 to 0. 2% earlier; And/Y: 4. 9% vs 5. 4% before.

– (CH) Swiss weekly general demand deposits (CHF): 529. 8 billion to 532. 1 billion previously; Domestic demand tanks: 529. 8B v 572. 1B above.

– (CZ) Czech existing account in September (CZK): -55. 8 B-22. 0 Be.

– (EU) Industrial production sept. de euro Mo/M: 0. 9% versus 0. 5%e; Yo/Y: 4. 9% vs. 3. 0%e.

– (NO) Norway sold NOK 2000 million to NOK 2000 million shown in 6-month invoices; Average profitability: 3. 11% vs 2. 84% previously; Coverage offer: 2. 28x vs. 1. 00x before.

– OPEC Monthly Oil Report.

– 05:25 (EU) ECB liquidity statistics.

– 05:30 ((DE) Germany will generate €5 billion in combined BuBills in 3 and 6 months.

– 05:30 (ZA) South Africa announces the main points of the next I/L bond sale (held on Friday).

– 06:00 (PT) Labor Costs Portugal Q3 Y/Y: Not 5. 7% before.

– 06:00 (RO) Romania to sell millions of RON in 2028 bonds at 8. 75%; Average yield: %; Offer to cover: x.

– 06:00 (IL) Israel will combine ILS 950 million bonds in 2025, 2028, 2030 and 2032.

– 06:45 (United States) Daily Libor fixing.

– 07:00 (IN) India announces the main points of the next bond sale (held on Friday).

– 07:00 (BR) September Brazilian Economic Activity Index (monthly GDP) M/M: 0. 2% vs. -1. 1% earlier; And/Y: 4. 1% vs 4. 9% before.

– 07:00 (PL) Quarterly inflation from the Central Bank of Poland (NBP).

– 07:00 (IN) India Oct CPI y/y: 6. 7% vs. 7. 4% previously.

– 07:25 (BR) Weekly survey of economists of the Central Bank of Brazil.

– 08:00 (PL) Poland Seven Current account balance: -€3. 1 vs. -€4 billion earlier; Trade balance: -2. 2 billion euros compared to -2. 9 billion euros previously; Exports: €2. 765 billion compared to €25. 4 billion previously; Imports: €29. 6 billion compared to €28. 3 billion previously.

– 08:00 (UK) Daily Baltic dry bulk index.

– 08:00 (EN) Announcement of the Spanish Debt Agency (Treasury) on the next issue.

– 09:00 (FR) The French Debt Agency (AFT) will deliver 4. 9 to 5. 1 billion euros in 3-, 6- and 12-month bonds.

– 11:30 (United States) The Treasury will sell thirteen and 26-week bonds.

– 11:15 (ES) BCE’s from Guindos (Spain) to Frankfurt.

– 11:30 (United States) Fed Brainard.

– 11:30 (CH) President of SNB Jordan.

– 16:00 (KR) South Korea October Export Value Index Y/Y: not v 15. 2% earlier; Import value index Y/Y: Not v 24. 1% before; Export value M/M: not v 3. 2% before; Import value M/M: not 3. 3% before.

– 16:00 (United States) Weekly crop report.

– 16:45 (NZ) September net migration to New Zealand: without this v before.

– 18:30 (AU) Australia ANZ Roy Morgan Weekly Consumer Condence Index: No est v # before.

– 18:50 (JP) Japan’s Q3 initial Qo-Q GDP: 0. 3% vs. 0. 9% previously; annualized GDP Q/Q: 1. 2% vs 3. 5% previously; Nominal GDP Q/Q: 0. 2%e to 0. 6% earlier.

– 19:30 (AU) Reserve Bank of Australia (RBA) minutes in November.

– 21:00 (CN) Industrial production in October in China Y/Y: 5. 2% 6. 3% earlier; YTD Y/Y: 4. 0% vs. 3. 9% before.

– 09:00 PM (CN) China October Retail Y/Y: 0. 7% vs. 2. 5% previously; YTD Y/Y: 0. 8% vs. 0. 7% before.

– 21:00 (CN) China Oct. Urban assets YTD y/y: 5. 9% vs. 5. 9% earlier.

– 21:00 (CN) China Oct YTD Property Investment Y/Y: No est v -8. 0% previous.

– 21:00 (CN) October residential home sales since the start of the year in China: without this compared to -28. 6% previously.

– 21:00 (CN) Unemployment surveyed in October in China: 5. 5% compared to 5. 5% previously.

– 22:00 (KR) South Korea Seven M2 Money M/M: Not v 0. 7% before; “L” Money M/M: Not v 0. 6% before.

– 22:00 (TH) The Central Bank of Thailand will sell billions of THB in 3-month bills.

– 22:00 (TH) Thailand will issue combined THB36B bonds in 2026 and 2052.

– 22:35 (JP) Japan will have 5-year JGB bonds.

– 23:00 (ID) October industry balance in Indonesia: $4. 5 billion compared to $4. 99 billion previously; exports and/y: 13. 5% compared to 20. 3% previously; Imports and/y: 24. 8% compared to 22. 0% previously.

– 23:30 (JP) Japan Seven Final commercial production M/M: Not v -1. 6% preliminary; Y/Y: not v 9. 8% preliminary; M/M capacity usage: Not v 1. 2% before.

– 23:30 (TW) Taiwan to award NT$25 billion in 5-year bonds.

EURUSD controlled above 1. 0300 in the momentary part of Monday. However, the cautious temperament of the market allows the US dollar to hold the company and limits the pair’s rise, as investors closely follow the comments of central bankers.

The GBPUSD pair lost momentum after being above 1. 1800 on the previous day and falling below 1. 1750. With Wall Street’s major indices opening deep into negative territory, the US dollar maintains its strength and forces the pair to stand out again.

Gold extended its rebound in the first US poll. It rose to $1,770. U. S. Treasury yieldsThe 10-year U. S. economy erased previous gains, allowing XAUUSD to extend higher as investors waited for comments from U. S. Federal Reserve officials. U. S.

BTC, along with ETH and XRP, are battling for a bullish outlook. The cryptocurrency market lately hovers around $800 billion, still well below the $1 trillion mark.

The stock market continued on Friday, the movements were more subdued due to the effects of the final bond market on Veterans Day.

Note: All data on this page is subject to change. The use of this implies acceptance of our user agreement. Read our privacy policy and legal notice.

Forex trading on margin carries a high degree of risk and may not be suitable for all investors. The maximum level of leverage can be for both you and you. Before you decide to invest in currencies, you should thoroughly consider your investment. objectives, point of experience and appetite for threats. It is conceivable that you will suffer a total or partial loss of your initial investment and therefore deserve not to invest money that you cannot lose. You deserve to be aware of all the threats related to forex trading and seek the recommendation of an independent monetary advisor if you have any doubts.

The perspectives expressed on FXStreet are those of the individual authors and do not necessarily constitute the opinion of FXStreet or its management. FXStreet has not verified the accuracy or factual basis of any or constitution made through an independent author: errors and omissions may occur. . Any opinions, news, research, analyses, pricing or other data contained on this website, through FXStreet, its employees, clients or collaborators, are provided as a general market observation and do not constitute investment advice. FXStreet will not accept any liability for any loss or damage, including but not limited to any loss of profits, that may arise directly or indirectly from the use of or reliance on such data.