n n n ‘.concat(e.i18n.t(“search.voice.recognition_retry”),’n

(Bloomberg) — Canada’s Small Business Minister is resisting pressure to give businesses more time to repay loans made by the government during the pandemic, despite warnings from a lobbying organization that 250,000 businesses are in jeopardy if she doesn’t.

Most Read from Bloomberg

JPMorgan fights for client’s lost $50 million fortune

Goldman Trader has paid $100 million since his resignation in 2020

Argentina’s Milei Devalues Peso by 54% in First Batch of Shock Measures

Raimondo promises “strongest action imaginable” on Huawei’s chip breakthrough

Netflix releases data on every show and movie for the first time

Rechie Valdez, who took office in July, said the government has shown flexibility by pushing back the deadline multiple times and providing billions of dollars for small businesses.

“I don’t think we’re giving enough credit to small businesses. They’re incredibly resilient,” he said in an interview in his Ottawa office.

Nearly 900,000 small and medium-sized businesses borrowed up to $60,000 CAD from Canada’s Emergency Business Account for the COVID-19 economic surprise. The government has disbursed a total of 49 billion Canadian dollars ($36 billion) under this program.

The program is designed to have up to C$20,000 of the loan forgiven if the remainder is repaid by the end of 2022. This deadline has been extended until the end of this year and then until January 18, 2024.

The Canadian Federation of Independent Business says up to 250,000 small businesses are at risk of bankruptcy if they miss the deadline and lose the reimbursable portion. There are 1. 2 million businesses with paid staff in Canada and the average number of small businesses ends each year. about 90,000 before the pandemic.

“This could turn into a bloodbath,” said CFIB president Dan Kelly.

Read more: Canadian Economy Shrinks as Rates Squeeze Spending

After Jan. 18, CEBA loans, which are currently interest-free, convert to a term loan at a 5% rate, with full repayment due by the end of 2026. But Kelly said many small businesses are operating “so close to the line” that losing the forgivable portion would be catastrophic, and he wants a further extension.

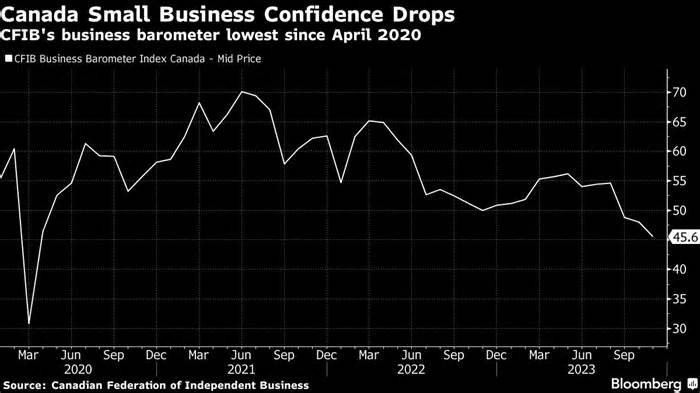

Canada has experienced some of the longest Covid lockdowns in the world, and businesses have struggled to survive amid inflation and peak interest rates. The CFIB Business Barometer, which measures small business confidence, is at its lowest point since April 2020.

Kelly added that it is “shameful” that the government is encouraging businesses to take out bank loans to pay off their CEBA debt. “It’s like telling a cash-strapped Canadian relative that if he can’t pay his Visa bill, just take a Mastercard. And pay for it. “

Canada’s Parliamentary Budget Officer has estimated that extending the deadline until the end of next year would cost the government C$907 million.

The government has invested billions in small businesses and will continue to be there for them, Valdez said. He highlighted Canada’s Business Benefits Finder, which allows owners to search a database of approximately 1,500 federal, provincial and territorial supports and locate the systems for which they are eligible. for.

“I recognize that we are not completely out of danger either. I am not naive,” she added. “I need small businesses to know that we have other features to get us through these difficult times. “

Valdez has private small business experience, having started her own confectionery and dessert business after more than 15 years at the Bank of Montreal, where she worked as a corporate banker.

She stressed that the reason Trudeau established a standalone role as small business minister — previously, it was part of Trade Minister Mary Ng’s portfolio — was to give it the attention it deserves. “I’m actually really grateful that not only did he give me the opportunity, but really to put that laser focus on small businesses.”

–With Erik Hertzberg’s.

Most read Bloomberg Businessweek

SBF’s Lawyer Says His Consumer Is the ‘Worst’ Ever Subjected to Cross-Examination

Rate-Cut Pivot Can’t Come Soon Enough for Debt-Strapped Companies

How the Largest Fitness Company Turned Suburban Moms Into Bankrupt Franchisees

America’s Best Job Pays $80,000 a Year, No College Degree Required

What It’s Like to Paint in a Hot Dog Building

©2023 Bloomberg L. P.