n n n ‘. concat(e. i18n. t(“search. voice. recognition_retry”),’n

(Bloomberg) — The Bank of Indonesia will most likely keep loan prices unchanged and mark the end of its tightening cycle, as the worst appears to be over for the rupiah.

Most on Bloomberg

Vilified Zero-Day Options Blamed by Traders for S&P Decline

Hedge Fund Traders Dominate Massive Bond Bet

Citigroup abandons distressed debt negotiations

Trump Excluded from Colorado Election in Unprecedented Decision

Dos Santos, once Africa’s richest woman, has frozen her assets to the tune of $734 million

All 29 economists voted in a Bloomberg vote expect BI to keep its seven-day buyback rate at a four-year high of 6% on Thursday. They are causing the budget to return to Indonesian assets, according to 19 of 21 analysts in a separate survey.

“Most likely, BI will start to get less involved in external factors,” said Lavanya Venkateswaran, an economist at Oversea-Chinese Banking Corp. “That said, BI would likely err on the side of caution and avoid appearing dovish given the strong domestic inflationary pressures and the existing account deficit persists for two consecutive quarters.

Indonesia’s central bank, whose main goal is to maintain financial stability, will likely be watching for definitive signs that the Federal Reserve is cutting interest rates and that local food costs are stabilizing. BI’s neighbors also fear being blinded by inflation and capital flight shocks. The Philippines and Australia maintained their hawkish stance despite rate pauses this month, keeping an eye out for potential source disruptions that could increase inflation.

Here are the things to watch out for on Thursday:

Rupee outlook

The rupiah has rebounded from its sharp drop in October that prompted BI’s surprise 25-basis point hike, but it may not be out of the woods yet. The currency has hovered around 15,500 against the dollar this month, lagging behind gains seen in peers including the Thai baht and the Malaysian ringgit.

The drop in exports kept Indonesia’s existing account in deficit. There is also a “substantial gap” between market expectations and the Federal Reserve’s fundamental signal, which may simply fuel more volatility, said David Sumual, Central Asia economist at PT Bank.

The small US-Indonesia spread could still spur investors to park their funds in dollars, said PT Bank Mandiri Chairman Chatib Basri, a former finance minister.

The Return of Inflation

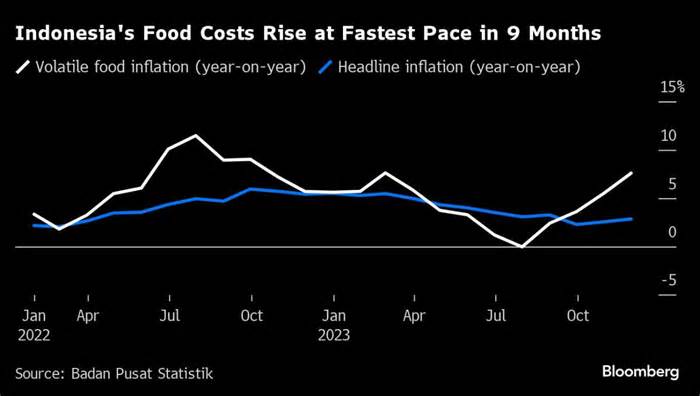

Central bank Governor Perry Warjiyo sounded the alarm on rising food prices in the November policy meeting, foregoing the usual statement that the central bank was “confident” inflation would stay within its target band of 2%-4% in 2023 and 1.5%-3.5% the next year.

El Niño-induced drought and supply chain disruptions have caused the costs of commodities such as rice, chili and sugar to skyrocket. Headline inflation accelerated to a three-month high of 2. 86% in November, still on target but above forecasts. Volatile food inflation rose much faster, to 7. 59%.

Attacks on a key maritime address in the Middle East can also push up global oil prices. Investors will be keeping a close eye on whether the Bank of Indonesia raises its inflation forecast for 2024 again, following an upward revision in November from 2. 8% to 3. 2%.

Navigating the Pivot

Unlike the “preemptive, forward-looking, and early” mantra that guided the BI’s tightening cycle, its easing will most likely be done at a slower pace and encouraged by the Federal Reserve’s pivot, according to Brian Tan, an economist at Barclays Bank Plc.

There are also several fronts to relax, given the other equipment BI has used in the past year. In addition to rate hikes on 250 core issues since mid-2022, the central bank also raised the reserve requirement ratio and generated deposits for export dollars. , as well as rupees and foreign currency securities to absorb liquidity, with yields above interest rates.

This provides some relief to Southeast Asia’s largest economy, which is experiencing a slowdown in income and gross domestic product growth. Bank Indonesia expects GDP to grow by 5. 01% in 2023 and 5% in 2024.

The policy rate is set to end next year at 5.25%, according to the median forecast by 21 analysts. While nine of them expect the first cut to happen in the third quarter, eight see an easing in the April-June period, and two each see that scenario playing out as early as the first quarter or as late as the last.

–With those of Tomoko Sato and Matthew Burgess.

Most Bloomberg Businessweek

The Most Secret Longevity Lab Finally Opens Its Doors

One man’s obsession with longevity now includes fountain of youth injections

Michael J. Fox and Sergey Brin take their effort to find a cure for Parkinson’s to the next level

Musk’s AI chatbot ‘Grok’ is strangely good after all

We Are So Not Ready for a Society Where Living to 100 Is Common

©2023 Bloomberg L. P.