n n n ‘. concat(e. i18n. t(“search. voice. recognition_retry”),’n

(Bloomberg) — Bahrain’s sale of $2 billion in debt has drawn demands from investors, allowing the country to adjust prices.

Most Read from Bloomberg

Trump Denied Immunity in Washington Election Case Through Appeals Court

Xi to discuss Chinese stocks with regulators as rescue stakes mount

Wall Street snubs China in favor of India in historic market shift

‘Money Dysmorphia’ Traps Millennials and Gen Zers

King Charles Treated in New Royal Fitness Scare

The value of seven-year Islamic banknotes has fallen to 6% since the initial talks, for a profit rate of around 6. 625%, according to a user familiar with the matter. It also issues traditional 12-year debt with a final yield of 7. 5%. compared to forecasts of between 7. 625% and 7. 75%, compared to approximately 8%. The duration of the tranche is set at $1 billion.

The $14 billion orderbooks, which exclude joint lead manages interest, are skewed to the Islamic bond, the person said. Pricing is expected later on Tuesday.

Bahrain is following in the footsteps of Mexico, Brazil and neighboring Saudi Arabia, which issued a $12 billion bond last month, taking advantage of falling U. S. yields since October and to finance budget deficits.

“Lately, the market situation is exceptionally favorable,” Karim Adouan, senior portfolio manager at Abu Dhabi Investment Company, said in an email, noting that the market definitely reacted to the announcement and that Bahrain’s bond curve was revalued by 10 to 15 basis points. “We would expect a final value very close to the secondary curve because there will be strong demand from investors around the world,” he said.

Bahrain, which is heavily dependent on oil production, is one of the most economically vulnerable sovereign countries in the Gulf. The country has struggled fiscally over the Covid-19 pandemic, despite a $10 billion bailout package from its wealthier neighbors in 2018, plus Saudi Arabia and the United Arab Emirates.

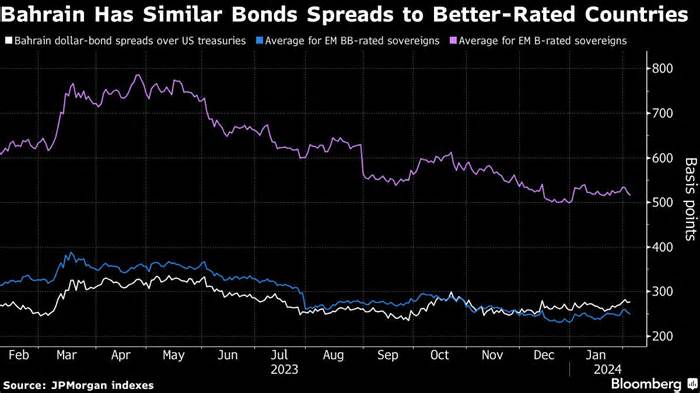

Bahrain is rated B+ by S&P Global Ratings and Fitch Ratings Ltd. That’s four levels into junk territory. Still, its bonds trade far tighter than the average for single-B rated emerging markets, according to JPMorgan Chase & Co. indexes.

The country wants the value of crude to average about $97 a barrel to balance its budget in 2024, according to the International Monetary Fund. That’s particularly higher than the year-to-date Brent average, which is below $80 a barrel.

HSBC Holdings Plc, JPMorgan, National Bank of Bahrain BSC and Standard Chartered Plc are among the main banks managing the transaction.

Bahrain last entered the international bond market in August, selling a $1 billion 10-year deal.

(Add transaction duration, update numbers in third chart)

Most Read from Bloomberg Businessweek

In a jet club where everything went wrong

The user I hired is now my boss.

The Story Elon Musk Doesn’t Want to Talk About

Is It Morning in Joe Biden’s America?

Powell needs the Fed to stay out of the electoral crosshairs. Good for that.

©2024 Bloomberg L. P.