n n n ‘. concat(e. i18n. t(“search. voice. recognition_retry”),’n

(Bloomberg) — Bahrain’s sale of $2 billion of debt was met by strong investor demand, allowing the country to tighten the pricing.

Most on Bloomberg

Phasing Out 99% of Bonds Gives Hedge Funds a Hard Lesson on China

Biden’s decision to solve the reminiscence problem backfires with a new mistake

Ukraine’s Army Chief Replaced After Rift With Zelenskiy

New York City Considers Cracking Down on Laundry Pods

Einhorn says markets are ‘fundamentally broken’ due to passive, quantitative investing

Pricing on a seven-year Islamic notes has decreased to 6% from the initial talk for the profit rate of around 6.625%, according to a person familiar with the matter. It’s also issuing 12-year conventional debt with final yield 7.5% versus guidance in range of 7.625%-7.75% down from around 8%. The size of each tranche is fixed at $1 billion.

The $14 billion order books, which exclude the interests of major joint managers, are skewed toward Islamic bonds, the report said. Prices will be known later on Tuesday.

Bahrain is following the lead of Mexico, Brazil and neighboring Saudi Arabia, which issued a $12 billion bond last month, taking advantage of falling U. S. yields since October and to finance budget deficits.

“Lately, the market situation is exceptionally favourable,” Karim Adouane, senior portfolio manager at Abu Dhabi Investment Company, said by email, noting that the market had definitely reacted to the announcement and that Bahrain’s bond curve had been revalued. 10 to 15 basis points. ” I would expect a final value very close to the secondary curve as there will be strong demand from investors around the world. “

Heavily dependent on oil production, Bahrain is one of the more economically vulnerable sovereigns in the Gulf. The country came under fiscal strain during the Covid-19 pandemic despite a $10 billion bailout package from its wealthier neighbors in 2018, including Saudi Arabia and the United Arab Emirates.

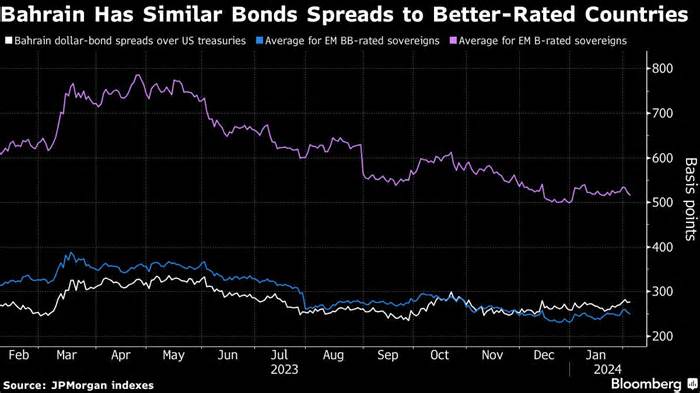

Bahrain has a classification of B to S

It needs crude prices to average nearly $97 a barrel to balance its budget in 2024, the International Monetary Fund says. That’s significantly more than the average for Brent crude so far this year of less than $80 a barrel.

HSBC Holdings Plc, JPMorgan, National Bank of Bahrain BSC and Standard Chartered Plc are the main banks handling the transaction.

Bahrain last entered the foreign bond market in August, promoting a 10-year, $1 billion deal.

(Correct the spelling of the person’s last call in the fifth paragraph. )

Most read Bloomberg Businessweek

OpenAI’s secret weapon is Sam Altman’s 33-year-old lieutenant

How Jack Dorsey’s Plan to Get Elon Musk to Save Twitter Went South

In a jet club where everything went wrong

A Tiny Fund Takes a Big Short on Corporate Debt Maturity Wall

The Story Elon Musk Doesn’t Need to Talk About

©2024 Bloomberg LP.