In the war for “regional supremacy” (and those wars will be harder now, in what may simply be a no man’s land between two black swans), the recovery from the pandemic and the traffic gains that are being made lately may be crucial.

In some parts of the world, travel recovery is progressing similarly in all countries. But in Asia-Pacific, this is not the case, with North Asian countries in particular lagging behind due to prolonged travel restrictions.

This has given some of Southeast Asia’s airports a chance to gain an edge.

Singapore’s Changi Airport is at the forefront and aims to lead the entire Asia-Pacific region in this recovery.

The numbers look promising, but the government has yet to make a big decision on whether to satisfy desires for long-term capacity, a resolution that postponed the pandemic and where intentions appear to remain vague.

This is the first of two reports.

resume

Singapore’s Changi Airport Group (CAG) says it has strengthened its airport offerings and continued to have interaction airline partners over the past two years in anticipation of the resumption of travel.

Singapore’s Changi Airport says it is “now the Asia-Pacific region’s recovery leader,” and control is “confident” that the organization can gradually repair Changi’s connectivity and traffic to pre-COVID levels.

Changi Airport handled 32. 2 million passenger movements in 2022, almost a portion of the traffic point as it was in 2019, before the start of the COVID-19 pandemic. This represents a 975% accumulation over the past year, when strict access and non-public restrictions were still in place.

Before the COVID pandemic, there was a stable passenger of 4-5%.

Aircraft movements totaled 219,000: 57. 2% of the 2019 grades and one hundred percent accumulated from 2021.

But air shipment throughput recorded 1. 85 million tonnes by 2022, down 4. 8% from the previous year.

However, cargo shipment declined to the same extent as passenger numbers during the 2020-22 era.

In 2022, all regions saw a strong recovery in passenger traffic, with North America even above pre-COVID levels for a full year, and the Southwest Pacific, South Asia and Europe each accounting for two-thirds of 2019 traffic.

In Southeast Asia, there was also a strong recovery in traffic after the reopening of the region, ending the year with a new record of two million passenger movements in December 2022, accounting for more than three-quarters of December 2019 traffic.

The table below shows the distribution of departure seats by region for the week beginning February 6, 2023.

Not surprisingly, Asia predominates as a whole, with Western Europe being the region with the largest capacity outside Asia.

Changi Airport’s five most sensitive passenger markets during the year were, in order, Australia, Malaysia, Indonesia, India and Thailand.

As with 2019 figures, Kuala Lumpur, Bangkok and Jakarta Changi Airport are the 3 busiest urban markets in 2022.

The Singapore-Kuala Lumpur address is lately the busiest address in the world in terms of seating capacity.

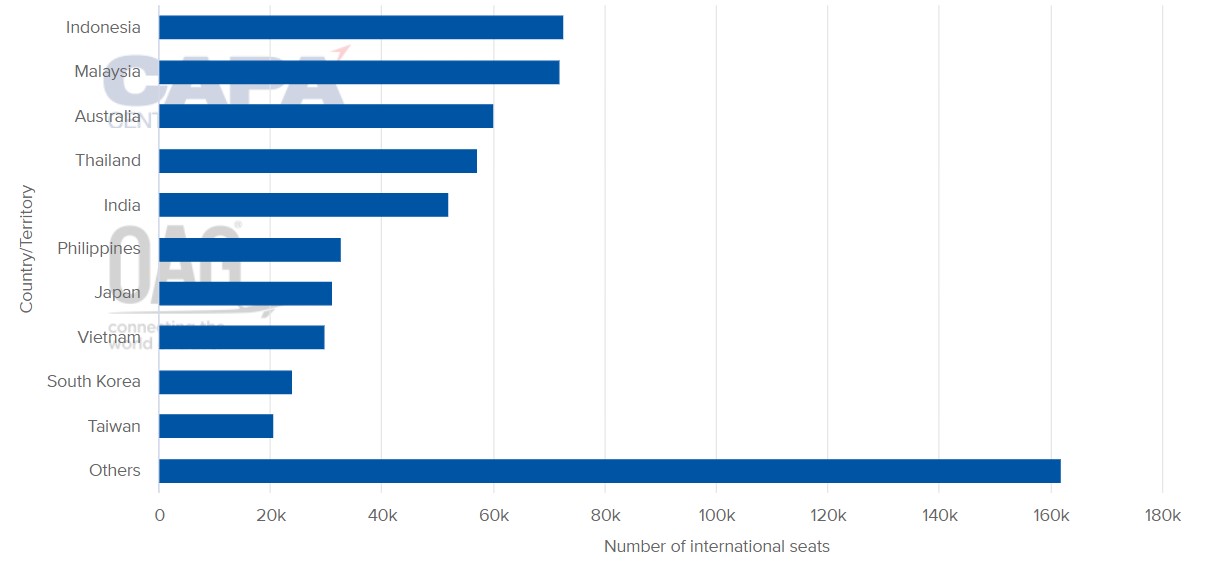

These statistics are largely represented in the chart below, for the week beginning February 6, 2023, indicating that those five countries continue to lead the league in seating capacity, albeit in another order.

Notable absences are China and Hong Kong.

Cargo flows declined amid global economic uncertainty and inflationary pressures.

Changi’s five most sensitive air shipping markets during the year were, in order: China, Australia, Hong Kong, Japan and the United States of America.

The shipping payload that will be in the week beginning February 6, 2023 varies somewhat, with China, Hong Kong and Australia at the top of the list, Japan down and the U. S. UU. no in the top 10.

Passenger traffic continued to grow in 2022 and peaked in December, with 4. 62 million passenger movements recorded. This accounted for 72% of Changi Airport’s traffic in December 2019.

During the busiest week of the year (December 12, 2022 to December 18, 2022), more than 1. 07 million passengers passed through Changi terminals, 82% of the weekly average in 2019.

For the month, aircraft registered 25,400, reaching 76% of pre-COVID-19 levels.

Air shipping throughput, through December 2021, fell 17. 3% to 153,000 tonnes.

Among Changi’s 10 most sensitive markets, South Korea experienced passenger traffic expansion beyond pre-COVID levels in December 2022. This is partly due to the increased capacity of Changi’s partner airlines, adding new airlines T’way Air and Air Premia on Singapore- Seoul and Scoot route on a new Singapore-Jeju route.

The reopening of Terminals 2 and 4 has restored the airport’s capacity to meet the increased demand for travel.

The new routes come with those of Ethiopian Airlines, which will debut flights from Addis Ababa in March 2023.

Despite short-term challenges such as global economic uncertainty and inflationary pressures (which may be more than short-term), CAG is confident that it will gradually repair connectivity and traffic at Changi Airport to pre-COVID levels. .

In the war for “regional supremacy” (and those wars will be harder now, in what may simply be a no man’s land between two black swans), the recovery from the pandemic and the traffic gains that are being made lately may be crucial.

In some parts of the world, travel recovery is progressing similarly in all countries. But in Asia-Pacific, this is not the case, with North Asian countries in particular lagging behind due to prolonged travel restrictions.

This has given some of Southeast Asia’s airports a chance to gain an edge.

Singapore’s Changi Airport is at the forefront and aims to lead the entire Asia-Pacific region in this recovery.

The numbers look promising, but the government has yet to make a big decision on whether to satisfy desires for long-term capacity, a resolution that postponed the pandemic and where intentions appear to remain vague.

This is the first of two reports.

resume

Singapore’s Changi Airport Group (CAG) says it has strengthened its airport offerings and continued to have interaction airline partners over the past two years in anticipation of the resumption of travel.

Singapore’s Changi Airport says it is “now the Asia-Pacific region’s recovery leader,” and control is “confident” that the organization can gradually repair Changi’s connectivity and traffic to pre-COVID levels.

Changi Airport handled 32. 2 million passenger movements in 2022, almost a portion of the traffic point as it was in 2019, before the start of the COVID-19 pandemic. This represents a 975% accumulation over the past year, when strict access and non-public restrictions were still in place.

Before the COVID pandemic, there was a stable passenger of 4-5%.

Singapore Changi Airport: Annual traffic, passenger/growth, 2013-2023

Source: CAPA – Changi Airport Aviation and Group Center.

Aircraft movements totaled 219,000: 57. 2% of the 2019 grades and one hundred percent accumulated from 2021.

But air shipment throughput recorded 1. 85 million tonnes by 2022, down 4. 8% from the previous year.

However, cargo shipment declined to the same extent as passenger numbers during the 2020-22 era.

Singapore Changi Airport: annual traffic, shipping volume/growth, 2013-2023

Source: CAPA – Changi Airport Aviation and Group Center.

In 2022, all regions saw a strong recovery in passenger traffic, with North America even above pre-COVID levels for a full year, and the Southwest Pacific, South Asia and Europe each accounting for two-thirds of 2019 traffic.

In Southeast Asia, there was also a strong recovery in traffic after the reopening of the region, ending the year with a new record of two million passenger movements in December 2022, accounting for more than three-quarters of December 2019 traffic.

The table below shows the distribution of departure seats by region for the week beginning February 6, 2023.

Not surprisingly, Asia predominates as a whole, with Western Europe being the region with the largest capacity outside Asia.

Singapore Changi Airport: International Departure Seats by Region, Week of February 6, 2023

Source: CAPA – Aviation Center and OAG

Changi Airport’s five most sensitive passenger markets during the year were, in order, Australia, Malaysia, Indonesia, India and Thailand.

As with 2019 figures, Kuala Lumpur, Bangkok and Jakarta Changi Airport are the 3 busiest urban markets in 2022.

The Singapore-Kuala Lumpur address is lately the busiest address in the world in terms of seating capacity.

These statistics are largely represented in the chart below, for the week beginning February 6, 2023, indicating that those five countries continue to lead the league in seating capacity, albeit in another order.

Notable absences are China and Hong Kong.

Singapore Changi Airport: international seating departing through country/territory, week of 6 February 2023

Source: CAPA – Aviation Center and OAG

Cargo flows declined amid global economic uncertainty and inflationary pressures.

Changi’s five most sensitive air shipping markets during the year were, in order: China, Australia, Hong Kong, Japan and the United States of America.

The shipping payload that will be in the week beginning February 6, 2023 varies somewhat, with China, Hong Kong and Australia at the top of the list, Japan down and the U. S. UU. no in the top 10.

Singapore Changi Airport: Total payload of foreign shipments (kg) through country/territory, week of February 6, 2023

Source: CAPA – Aviation Center and OAG

Passenger traffic continued to grow in 2022 and peaked in December, with 4. 62 million passenger movements recorded. This accounted for 72% of Changi Airport’s traffic in December 2019.

During the busiest week of the year (December 12, 2022 to December 18, 2022), more than 1. 07 million passengers passed through Changi terminals, 82% of the weekly average in 2019.

For the month, aircraft registered 25,400, reaching 76% of pre-COVID-19 levels.

Air shipping throughput, through December 2021, fell 17. 3% to 153,000 tonnes.

Among Changi’s 10 most sensitive markets, South Korea experienced passenger traffic expansion beyond pre-COVID levels in December 2022. This is partly due to the increased capacity of Changi’s partner airlines, adding new airlines T’way Air and Air Premia on Singapore- Seoul and Scoot route on a new Singapore-Jeju route.

The reopening of Terminals 2 and 4 has restored the airport’s capacity to meet the increased demand for travel.

The new routes come with those of Ethiopian Airlines, which will debut flights from Addis Ababa in March 2023.

Despite short-term challenges such as global economic uncertainty and inflationary pressures (which may be more than short-term), CAG is confident that it will gradually repair connectivity and traffic at Changi Airport to pre-COVID levels. .