\n \n \n “. concat(self. i18n. t(‘search. voice. recognition_retry’), “\n

(Bloomberg) — Norway is looking for deeper oil in the Arctic. The U. S. is begging drillers to extract more. Germany has reactivated coal-fired power plants to cope with natural gas shortages.

Most read from Bloomberg

The new Covid reinforcements are nothing more than the old ones, according to a study

Adidas breaks ties with Ye and absorbs 250 million euros in profits

These are the most esteemed cities in the U. S. for tenants right now

Blinken warns of whether nuclear weapon is used in Ukraine

Many of the world’s largest countries are backtracking or delaying parts of their plans to move away from fossil fuels.

Its first leftist president, Gustavo Petro, stopped granting new oil exploration licenses to Latin America’s third-largest producer. He is also pushing Congress, through a law he rejected on his first day in office, to raise taxes on energy exports and is running to put a fracking ban into effect. No other oil country limits the industry so much.

Bogotá’s oil executives get the message. Ecopetrol SA, the state-controlled producer, is abandoning pilot hydraulic fracturing projects, a questionable extraction strategy it relied on to restart production. And independent manufacturers like Gran Tierra Energy are now looking elsewhere, adding neighboring Ecuador, as they expand production. The Colombian Petroleum Association estimates that Petro’s projects will cause a 30% drop in investment in the industry.

“They scare away the bejesus from the sector,” said John Padilla, managing director of Colombia-based energy consultancy IPD Latin America.

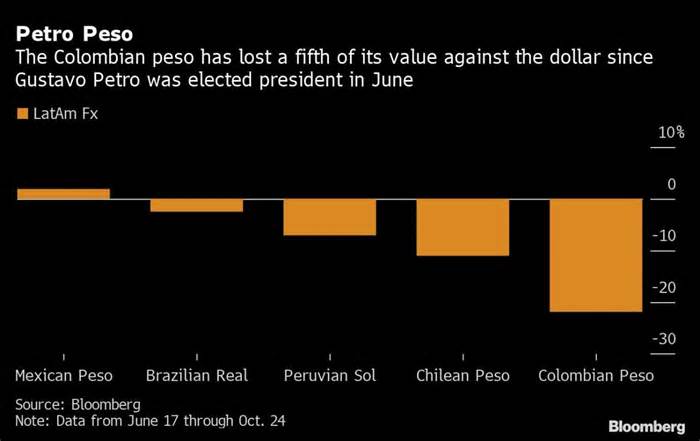

All of this, of course, is wonderful news for anyone who is worried about global warming. The challenge is that the repression of oil is helping to cause a collapse of Colombian markets that, if left unchecked, will exert monetary and political pressure on the new market. government. The peso has plunged more than 20 percent against the dollar since Petro’s election in June, driving up import costs and adding to an inflationary spiral that hits Colombians every day.

“The question,” Padilla said, “is how this rhetoric can continue. “

Petro’s environmental activism stands out in a region where uncooked fabrics have been the engine of the economy. Approximately 50% of Colombia’s export earnings come from oil and mining. If Petro succeeds, it will provide a roadmap for other emerging countries on how to move forward from the transition of power.

Or it may simply become a warning story of overly ambitious environmentalism. The anti-oil push will drive Colombia’s falling production and exports at a time when the country wants all the profits it can make to finance its social spending stimulus packages. Colombia is not the only country fighting climate change. The UK reinstated the fracking ban today after the opposition set its elimination last month. Unlike Colombia, the UK continues to offer exploration licenses.

Risk of backlash

The threat of a public backlash against Petro is real, not least because it also cancels out costly fuel subsidies. The Ecuadorian president was on the verge of being impeached this year because of fuel prices. Brazil and Mexico have sacrificed tax revenues to subsidize gas and diesel. Many industries observers still expect Petro to retreat under the weight of stretched national budgets.

“Circumstances will dictate and the rhetoric will have to align as soon as possible,” said Schreiner Parker, director for Latin America at Rystad Energy, a consultancy.

Members of Petro’s economic team disagree on how temporarily the country ditches oil and fuel. Finance Minister Jose Antonio Ocampo said there was no final resolution on ending oil and fuel exploration. Meanwhile, Energy and Mines Minister Irene Velez, an education and environmental activist who has worked with Petro since he became mayor of Bogotá, said a ban on allocating new exploration space was still in place.

The Energy Ministry, in response to questions, said Ecopetrol and other explorers already have enough licenses to build Colombia’s shown oil reserves, and that the government will allow existing projects to go ahead.

Read more:

A $900 million oil bond defeat is a flag for Green Push

Most read from Bloomberg

The new Covid reinforcements are nothing more than the old ones, according to a study

Adidas breaks ties with Ye and absorbs 250 million euros in profits

These are the most esteemed cities in the U. S. for tenants right now

Blinken warns of whether nuclear weapon is used in Ukraine

Canada’s Energy Stocks Fall as Colombia Elects Anti-Oil President

Most read from Bloomberg

The new Covid reinforcements are nothing more than the old ones, according to a study

Adidas breaks ties with Ye and absorbs 250 million euros in profits

These are the most esteemed cities in the U. S. for tenants right now

Blinken warns of whether nuclear weapon is used in Ukraine

Perspectives

Most read from Bloomberg

The new Covid reinforcements are nothing more than the old ones, according to a study

Adidas breaks ties with Ye and absorbs 250 million euros in profits

These are the most esteemed cities in the U. S. for tenants right now

Blinken warns of whether nuclear weapon is used in Ukraine

Even if Petro were to slow or oppose its increase, it has already weakened Colombia’s ability to reverse an oil industry that has been in decline for years. The country has been a tough sell for foreign oil majors.

Colombia is offering the same kind of billion-barrel discoveries that have been made in Guyana and Brazil and wants to offer more incentives for corporations to take exploration risks. Chevron Corp. se withdrawn from Colombia in 2019. Occidental Petroleum Corp. Even Ecopetrol, a company personally selected by the government, has turned to U. S. shale for expansion opportunities.

If Petro manages to switch to renewable energy in a country with strong winds, raging rivers and abundant sunlight, he will forget the complicated start to his term. Colombia’s thirteen-gigawatt renewable energy projects will reduce dependence on hydrocarbons, and Ecopetrol will concrete renewable energy and green hydrogen plans than its regional counterparts Petroleos Mexicanos or Petróleo Brasileiro SA, according to BloombergNEF.

Read more: Tumultuous transition forward for Latin American oil majors

The Colombian Petroleum Association, however, sees a crisis coming before the country reaches this transition.

“All the alarms are going on,” Francisco Lloreda, leader of the group, in an interview.

(Updates the first and tenth paragraphs to the fact that the United Kingdom has reimposed its fracking ban. )

Most read from Bloomberg Businessweek

What is the advance of Alzheimer’s drugs for other diseases?

The fantasy of surrender implodes

From bedrooms to kitchens, Europe wonders what it’s like too

10 conclusions from Matt Levine’s “The Crypto Story”

California tech millionaires can’t agree on tax to fund electric vehicles

©2022 Bloomberg L. P.