” o. itemList. length ” this. config. text. ariaShown “

“This. config. text. ariaFermé”

Key challenges: higher litigation, major judicial verdicts, and movements of elegance in the US, and more important judicial verdicts, and movements of elegance in the US. But it’s not the first time And other regions; more expensive recalls in the automotive and food industries; have an effect on civil unrest and unrest around the world; and the possibility of claims for mold and legionella after the closures of Covid-19.

Social inflation, adverse trends in claims, and economic and pandemic customers are creating a challenging market for liability insurers.

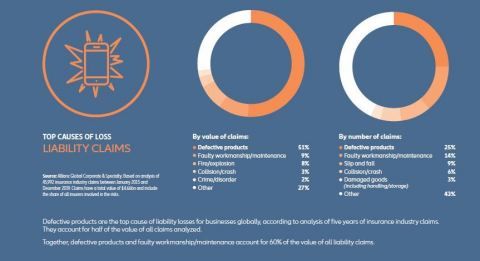

Research shows that defective products have been the main cause of liability claims for more than five years, however, the Covid-19 pandemic has another effect on loss scenarios.

The threat of accountability to corporations around the world is increasing. Factors such as the accumulation of litigation, movements of primary elegance and judicial verdicts, costly and common withdrawals in the automotive and food sectors, disruptive ones have an effect on civil unrest and unrest. in a number of developing countries, and environmental considerations such as indoor air quality and higher fines and remediation criteria are likely to have an effect on companies and their insurers in the long term, all face-to-face in a complicated global situation. pandemic, according to a new report by Allianz Global Corporate

This multimedia press release. See the full edition here: https://www. businesswire. com/news/home/20200909005101/fr/

Main reasons for loss of liability for companies around the world (Chart: Business Wire)

“The costs of the Liskill insurance market may have replaced in recent months, however, social inflation trends and vital court decisions continue in the United States. This, combined with increased exposure from non-U. S. corporations operating in the US, is a major increase in the number of non-U. S. corporations operating in the US. But it’s not the first time And rising recalls of auto parts are putting pressure on liskill insurers,” says Ciara Brady, global director of liskill at GATS. “Add to that the dubious economic outlook. Fix the political skill and unknown effects of coronavirus and this creates a complicated market for customers, agents, and insurers. While we will have to react to new trends in claims underscrims, AGCS remains committed to supporting our customers. with strong responses from threat movements and the ability to deal with today’s Liskill threats. “

Social inflation in the United States and increased movements of elegance around the world

Social inflation is a widespread phenomenon in the United States, due to the developing emergence of litigation funders, high jury prices, claims for reimbursement of more liberal workers, and new concepts of grievance and neglect. The verdicts from 2014 to 2018 almost doubled from $28 million to $54 million.

Litigation funding is not only found in the United States, but also in Europe and around the world, contributing to a developing trend in elegance movements as barriers for consumers are lowered to movements of the organizations. Arabia and South Africa are classified as “medium risk” of a company facing class action in those jurisdictions, according to the GATS national consultant on litigation financing.

Another thing that influences the duration of regulations in the United States is the increasing sophistication of the plaintiff’s bar with specialized experts and psychologists deployed to influence the jury’s decision. The U. S. legal formula has noticed a deterioration in customer confidence in companies. This lack of acceptance as true leads to anger among Americans or categories of Americans towards perceived “greedy enterprises,” resulting in so-called “nuclear” verdicts.

GATS experts say it is too early to identify an opposite trend, however, court closures due to the Covid-19 pandemic would possibly slow social inflation, as plaintiffs realize that it may also be years before their case reaches a jury and possibly more. willing to reach an out-of-court settlement.

Increased car and recovery costs

In recent years, there have been a growing number of in the automotive industry in the United States and Europe. In the United States, there were 966 protections affecting more than 50 million cars in 2019, or more than two consistent with the day.

In many cases, parts can be produced through one of the few suppliers serving the entire industry, which can make it vulnerable to accumulation hazards; as a result, recalls become bigger and more expensive over time. For example, an airbag or engine can simply be removed due to a defect that affects many corporations and models.

The increasing complexity of generation is a vital factor in industry losses, due to factors such as increased time and labor to perform repairs, more specialized education for mechanics and other repairers, and prices of emerging portions.

Dangers and recalls of expensive food

Food recalls are increasing internationally due to points such as global manufacturing, fewer suppliers in complex source chains, advanced regulatory review, and advanced generation that enables greater traceability and detection of pathogens. Manufacturers will need to recognize those points, be diligent about the identity of their suppliers, and conduct normal audits.

The coronavirus pandemic can have a significant effect on food recalls in the future and pose demanding situations specific to them: on the one hand, hygiene criteria have accumulated significantly, which can simply lessen the threat of contamination that is a problem. On the other hand, with new operations, temporarily closed and restarted factories, remote personnel, fewer regulatory visits, and erratic source chains, threat exposures can also increase in the future.

Riots and civil unrest threaten beyond harm

The “yellow card” protests in France, civil unrest in Chile, Hong Kong and Bolivia, and, more recently, racist unrest in the United States are prominent examples of civil unrest around the world.

Political violence is causing more and more asset damage, alterations and loss of charm and source of income for many companies. For example, civil unrest following George Floyd’s death in many U. S. cities is expected to have caused losses of more than $1 billion. There are many insurance claims reported in connection with insurance policy strikes, riots and civil unrest or looting. According to GATS experts, the coronavirus epidemic may have temporarily eliminated civil unrest in some countries, but the underlying social uprest has not been resolved and outbreaks are more likely to occur in the near future.

Indoor air after coronavirus

Incidents of environmental pollutants can have negative consequences for a company: two threats are important: indoor air quality disorders similar to legionella and mold proliferation, and secondly, the growing threat of environmental demands, fines and corrective measures, due to public awareness of pollutants and capital depletion.

The threat of mold and legionella has been compounded by the closure of advertising buildings or hotels opposed to coronaviruses: when some air quality systems or water systems are idle for a while, they are more vulnerable to bacterial contamination. Mold expansion may result from the postponement of planned maintenance or renovation activities through genuine real estate companies.

Main reasons for claims for liability and effects of coronavirus

The report also discusses some of the main reasons for insurance liability claims over the more than five years (defective product incidents represent part of the price of all claims) and examines how the coronavirus outbreak is already affecting the insurance industry. During the pandemic and with the transient closure of many shops, airports and businesses, reports of slip and fall incidents, which are one of the main reasons for claims of liability, have slowed down. injury or damage to assets due to the lack of good enough coverage against the coronavirus, as well as the movements of workers who oppose employers who have not sufficiently protected them. Product liability and recall claims tend to stick to economic activity, so it may have an effect on those spaces with the economic downturn. During this time, restarting production after hibernation periods can lead to human error incidents.

About Allianz Global Corporate

Allianz Global Corporate

Our customers are as diverse as the business world, from Fortune Global 500 corporations to small businesses and individuals, including not only major customer brands, generation corporations and the global aviation and shipping industry, but also wineries, satellite operators or Hollywood. Film productions. Everyone turns to GATS for intelligent responses to its maximum, vital and complex hazards in a dynamic and multinational business environment, and they accept as true that we offer an exceptional crisis experience.

Globally, GATS operates with its own groups in 32 countries and through the Allianz Group network and partners in more than two hundred countries and territories, employing more than 4,450 people. As one of the largest damage insurance sets in the Allianz Group, we enjoy a strong, forged monetary rating. In 2019, GATS generated a total of 9. 1 billion euros in gross premiums worldwide.

www. agcs. allianz. com

Twitter: @AGCS_Insurance

Caution related to forward-looking statements

See the edition in businesswire. com: https://www. businesswire. com/news/home/20200909005101/fr/

contacts

Press: Sabrina GlavanAllianz Global Corporate

Erin Burke Communications Partners Harden 631239 6903eburke@hardenpartners. com