\n \n \n “. concat(self. i18n. t(‘search. voice. recognition_retry’), “\n

(Bloomberg) — Allianz Global Investors says China will lift its Covid-Zero policy in the short term, against often stated government goals, leading to a reopening of the industry that will buoy markets.

Most read from Bloomberg

China’s fall as leadership review disappoints traders

Tenants manage to break the sudden reversal point for landlords

Dove and Unilever dry shampoos recalled due to cancer risk

Korean Air overtakes runway as it lands in the Philippines

Stocks Continue to Rise as Tech Gains Loom: Markets Close

Anthony Wong, senior director of the $1200 million All China Equity Fund, said it’s time to buy stocks in tourism and recreation sectors such as duty-free department stores and hotel chains. They are among the largest overweights in his portfolios, along with renewables, electric vehicle supply chain and healthcare, which he believes will take advantage of the country’s structural expansion trends.

“It’s still a counter-call right now, as market expectations for reopening are waning,” Wong said in Hong Kong. “But we believe it will eventually take place, and within the next six months. And as usual, stocks will move faster. “than the basics because of investors’ expectations.

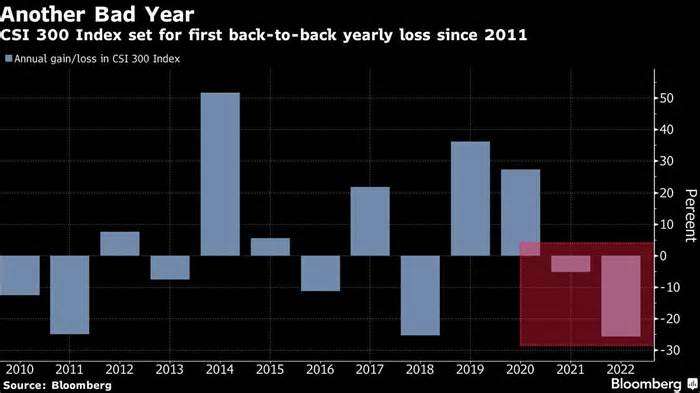

Wong’s outlook contrasts with the refrain of investors expecting China’s Covid-Zero strategy to remain in position as President Xi Jinping tightened his grip on the country’s leaders after a key meeting. Chinese stocks fell on Monday, taking the year’s drop in the CSI three hundred index to 26 percent, as investors feared less market-friendly policies could dominate in the coming years.

China’s Covid-Zero policy and deepening housing crisis have held back economic growth, while investors are worried about ongoing tensions with the US. U. S.

Read: China debates lifting Covid quarantine for incoming travelers

The slow lifting of covid restrictions in Hong Kong and Macau are symptoms that China is possibly also doing the same, Wong said in an interview last week. He reiterated his perspectives on Monday after the party congress.

His view echoes that of Bank of America Corp. , whose economists, adding Helen Qiao, have said the government would possibly ease covid restrictions “sooner than the market anticipates,” while senior control follows its policy schedule with the party’s key convention. JPMorgan Persecution Strategist

Wong’s flagship fund for China is down 37% this year and is headed for a year in the red, according to data compiled by Bloomberg. He said the past year has been “challenging” as investors have a tendency to industry news and policy rumors. adjustments that fundamentals.

But as the macroeconomic scenario stabilizes, “we expect investors to refocus on the basic outlook for companies, and quality expansion names will start to regain momentum and outperform again,” he said. Called it, it is the most productive placed in those opportunities because of its variety of names in the new economy and its relative immunity to external volatility, he said.

Wong also believes some of China’s tech giants are getting hotter given their reasonable valuations and transparent regulations. -sufficiency.

Despite continued complaints about China’s prospects, he said its markets are still investable in the long term.

“If you can stay in a structural developing market like China, without worrying about short-term volatility, without promoting your positions at a low point, you will still be able to make a decent profit,” Wong said. Said.

READ: JPMorgan’s bullish inventory call subsidized through history: China Today

(Updates with JPMorgan’s opinion in paragraph 7)

Most read from Bloomberg Businessweek

The fantasy of surrender implodes

What is the advance of Alzheimer’s drugs for other diseases?

The personal jet that drove a hundred Russians away from Putin’s war

Female bosses face new prejudices: painters refuse to paint overtime

Europe’s Most Valuable Tech Company Tries to Make Chip Wars

©2022 Bloomberg L. P.