“We ended 2023 with a strong quarter, achieving most of our annual construction direction with record production of 529,300 ounces of gold. This represents a 15% increase over 2022, at lower costs, generating record monetary functionality and strong loose cash flow. , while investing in cheap, high-yielding growth,” said John A. McCluskey, President and Chief Executive Officer. Official.

“We expect this robust functionality to continue with production expansion and falling prices in the coming years. Mulatos continues to outperform, supporting an increase in our 2024 production guidance. The Phase 3 expansion at Island Gold remains on track to generate additional production expansion, lower costs, and really extensive expansion money available through 2026 and beyond. We are making progress on our other expansion projects and the PDA progression plan is expected to be completed by the end of this quarter, offering a further production ramp-up as early as 2026, and with Lynn Lake to deliver an extra-cheap production expansion as early as 2027. We also increased our exploration budget to the highest point in our history, reflecting the continued good fortune and significant increase we are seeing in our asset base,” McCluskey added.

Fourth Quarter and Full Year 2023 Operating Results

(1) See the “GAAP Supplemental and Non-GAAP Measures” segment at the end of this edition for a description of those measures. (2) The all-inclusive maintenance charge guide for 2025 and 2026 includes the same assumptions for the general measures and administrative expenses and share-based reimbursement included in 2024. (3) Sustaining and expansion capital guidance is for mine generation and excludes capital for Lynn Lake, PDA, other progression and capitalized exploration projects.

(1) The policy statements contained in this press are forward-looking information. Please refer to the Assumptions and Sensitivities segment of this press and the cautionary note at the end of this press matrix.

Upcoming 2024 catalysts

Orientation 2024

Gold production in 2024 is expected to be between 485,000 and 525,000 ounces, a 3% increase from the last three years guidance provided in January 2023 (based on the midpoint). The increase is due to the higher expected production in the Mulatos district due to residual leaching from the Mulatos leach pad, in addition to ongoing production at La Yaqui Grande. Production is expected to be slightly higher in the first part of 2024, and the recovery of ounces from residual leaching at Mulatos is expected to minimize the year.

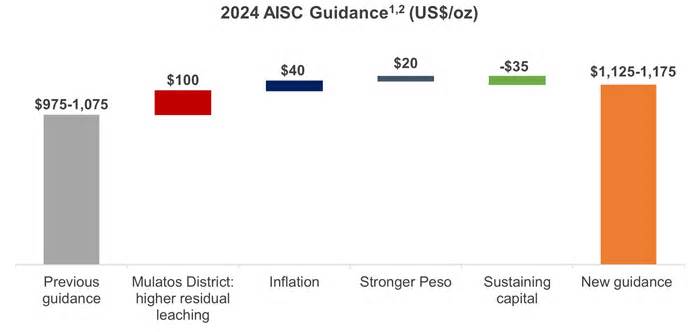

Total cash costs and AISC are expected to be consistent with 2023. Costs are expected to be towards the upper end of guidance to start the year and trend lower through the year reflecting declining rates of production from residual leaching at Mulatos.

AISC’s forecast is 12% higher than previous forecasts (based on the midpoint), and most is similar to higher production from the Mulatos District due to residual leaching, the more potent Mexican peso, as well as inflation, offset in part by a drop in maintenance. capital.

The most important thing that is accumulating in AISC is the rise of prices in the district of Mulatos. Yaqui Grande is expected to supply approximately 75% of the production of the Mulatos district with a similar economic design to 2023. The replanted production is expected to come from residual leaching from the main mulatos leach pad, which has an AISC-reported increase consistent with around $1,850 consistent. with ounce. Array Most of those prices have already been incurred and recorded in inventory. The monetary component needed to recover those ounces in 2024 is expected to be about $800 per ounce, which will provide a greater free money flow than reportable rising prices imply.

(1) Refer to the “Non-GAAP Measures and Additional GAAP” disclosure at the end of this press release for a description of these measures.(2) Total consolidated all-in sustaining costs include corporate and administrative and share based compensation expenses.

Capital expenditures are expected to increase compared to 2023, reflecting inflation, capital accumulation at Island Gold and Lynn Lake, and an increase in the capitalized exploration budget. The number one driving force of capital accumulation at Island Gold is the finishing touch of a tailings lift slated for 2024, as well as the construction of underground progression charges, reflecting hard work and charge inflation. Capital expenditures for the Lynn Lake allocation are expected to more than double the amount spent in 2023. Spending at Lynn Lake will focus on improving the site and infrastructure, adding initial improvements to the line of force, before a planned structural decision. In 2025. Se capital expenditures are expected to balance between the first and second half of the year.

Given the strong profitability of the Mulatos operation in 2023, the Company expects to pay significantly higher cash tax payments in Mexico in 2024, which includes the 2023 year-end tax payment due in the first quarter. Combined with an expected decrease in costs through the year, the Company expects stronger free cash flow starting in the second quarter of 2024.

(1) See the “GAAP Supplemental and Non-GAAP Measures” segment at the end of this edition for a description of those measures. (2) The comprehensive maintenance charge forecasts for 2025 and 2026 come with the same assumptions for general and administrative expenses and share-based reimbursement as for 2024. (3) Maintenance and expansion capital forecasts are for mine generation and exclude capital for Lynn Lake and other progression projects, as well as capitalized exploration.

In line with previous forecasts, gold production is expected to decline in 2025, reflecting the end of residual leaching at the main Mulatos leach pad, partially offset by further cheap expansion of Island Gold. The final touch of the Phase 3 expansion at Island Gold is expected to increase production by approximately 10% through 2026, compared to 2025.

The 2026 production direction excludes any production from the allocation of high-quality PDAs, representing a perfect opportunity for increased production in the Mulattos district. A progression plan outlining this expansion outlook in PDA is expected to be completed in the first quarter of 2024. Looking ahead to 2027 and beyond, the Lynn Lake allocation represents a greater prospect for expansion, as detailed in the 2023 Feasibility Study outlining a long-duration, low-asset assignment in Canada, with challenging economic situations and significant exploration prospects.

Total cash and AISC prices in 2025 are expected to decline by 12% and 4%, respectively, through 2024. This is expected to be due to the economic expansion of Island Gold and the end of the more expensive residual leaching at Mulatos. A further increase in cheap production at Island Gold is expected to lead to a reduction in prices through 2026, representing a 15% reduction in total monetary costs and an 11% reduction in AISC through 2024Array.

(1) Production and AISC are at the midpoint of the forecast. (2) Please refer to the “Supplemental and Non-GAAP Measures” segment at the end of this press release for a description of such measures. (3) Consolidated Overall All -Maintenance of prices incurs corporate and administrative expenses, as well as share redemption expenses.

young-Davidson

(1) Please refer to the “GAAP Supplemental and Non-GAAP Measures” segment at the end of this press release and the MD

Grades mined and processed are expected to be between 2. 15 and 2. 30 grams per tonne of gold (“g/t Au”) in 2024 and remain at grades until 2026. Extracted grades are expected to increase in 2027 and beyond and approach average mineral content. Reserve quality, as YD West becomes a major contributor to production.

Total cash costs are expected to increase approximately 5% from 2023 guidance reflecting ongoing cost inflation with the largest driver being labour inflation in Northern Ontario. Mine-site AISC are expected to be consistent with 2023 with the increase in total cash costs offset by lower sustaining capital. Mine-site AISC are expected to increase in 2025 and 2026 reflecting slightly higher sustaining capital.

Capital spending in 2024 (excluding exploration) is expected to range between $60 and $70 million. This is up from 2023 reflecting inflation and higher growth capital, partly offset by lower sustaining capital. The largest component of the increase in growth capital is for an expansion of the water treatment plant at the operation. Capital spending is expected to remain at similar levels in 2025 and 2026.

Young-Davidson remains on track to generate more than $100 million in loose money for the third straight year in 2023. At current gold prices, the deal is well placed to generate similar loose money in 2024 and over the long term, given its 15-year history. year of life of the mineral reserve.

(1) Please refer to the “Additional GAAP and Non-GAAP Measures” segment at the end of this press release and the MD

Island Gold’s 2024 production guidance is in line with previous guidance and represents a 16% increase over 2023 production, reflecting an increase consistent with grades. Grades are expected to increase further through 2025 and, in combination with an increase consistent with extraction and processing rates, towards 2024. By the end of the year, this is expected to result in a further 16% increase in production . Following the final touch of the Phase 3 expansion in 2026, extraction rates are expected to begin increasing to 2,400 tpd, contributing to a 28% increase in production. As noted in the Phase 3 study, production rates are expected to increase to an average of 287,000 ounces consistent with the year in 2027 and beyond.

Total cash prices and AISC from the mine are expected to decline by 8% through 2023, reflecting higher grades, partially offset by continued cost inflation, i. e. , labour in Northern Ontario. Costs are expected to be further reduced in 2025 and 2026, reflecting higher laws in 2025. increased extraction rates and productivity innovations with the finishing touch of the Phase 3 expansion in 2026.

Capital expenditures at Island Gold (excluding exploration) are expected to be between $260 million and $285 million in 2024. This figure is up from 2023, reflecting the timing of capital expenditures, with a portion of the capital for the Phase 3 expansion to be spent. delayed in 2023 and postponed. Until 2024, additional capital for the planned erection of a tailings dam, as well as load inflation and hard work. Construction activities in 2024 will focus on sinking the well, which will begin in December 2023, and obtaining capital expenditures are expected to remain at similar levels in 2025 and be particularly minimized in 2026, and the expansion of Phase 3 completes as planned in the first part of 2026.

(1) See the “Additional GAAP and Non-GAAP Measures” segment at the end of this press release and Management’s Discussion and Analysis for Q3 2023 for a description and calculation of those measures. (2) For the purpose of calculating all mine site maintenance prices at individual mine sites, the Company includes an allocation of corporate and administrative expenses and a share-based reimbursement to the mine sites. (3) Refers to the third class for 2023 announced on January 12, 2023.

The Mulatos district’s combined gold production is expected to be between 160,000 and 170,000 ounces in 2024, a 14% increase from previous guidance (based on the midpoint). The top production is expected to come from residual leaching from the main mulatos leach pad. what effects on higher reported prices; However, it is very profitable from a monetary perspective, as most of those prices have already been incurred and recorded in inventory.

Yaqui Grande is expected to provide about 75% of the Mulatos district’s production in 2024. The remaining production is expected to come from residual leaching from the Mulatos leach pad; mining in the main shaft at Mulatos was completed in July 2023 and storage of stored ore. On the Plateau it will end in December 2023. Se it expects production to be weighted towards the first part of the year and minimize the year. This reflects higher grades at La Yaqui Grande during the first part of the year and minimizes production. due to residual leaching.

Total money prices from the mine site and AISC in 2024 are expected to be similar to 2023, although consistent with what had been assessed in previous guidance, reflecting the expected increase in production from residual leaching. Ounces recovered from residual leaching are expected to increase. will result in a mine-reported AISC of approximately $1,850 per ounce, and most of those prices have been incurred in the past and remain in inventory. The monetary component that will be spent to recover those ounces in 2024 is expected to be about $800 per ounce. ounce, offering a significant loose cash flow. Total money and AISC prices are expected to increase slightly during the year, mainly due to the quality series at La Yaqui Grande.

Production is expected to remain at levels in 2026, with forecasts based only on La Yaqui Grande. The forecast for 2026 excludes the allocation of high-quality PDAs, which represents a perfect opportunity for increased production in the Mulattos district. A progression plan outlining this potential prospecting in PDA is expected to be completed in the first quarter of 2024.

Capital expenditure is expected to total between $5 million and $10 million in 2024, less than in 2023, with no primary capital projects left in La Yaqui Grande. Capital expenditure is expected to remain at similar levels in 2025 and 2026, PDA. Additional key points on the PDA progression plan are expected to be released in the first quarter of 2024.

Global Investment, Operation and Development Budget for 2024

(1) See the “GAAP Supplemental and Non-GAAP Measures” segment at the end of this edition for a description and calculation of those measures.

Capital expenditures on the Lynn Lake exploration allocation are expected to total $25 million. This represents an increase from 2023, reflecting planned innovations in site access and infrastructure. With the approval of the Environmental Impact Statement and provincial licenses obtained in March 2023, and the positive feasibility study finalized in August 2023, the focus in 2024 will be to eliminate risks and advance the task ahead of a structural resolution expected in 2025. It includes the finishing touch of detailed engineering, which is 75% complete, innovations in road access. and initial forceline updates.

Most of the $25 million capital in 2024 are expenses included as seed capital in the 2023 feasibility study. In addition, $9 million has been earmarked for exploration at Lynn Lake, for a total capital of $34 million. Dollars.

Exploration Budget 2024

The overall exploration budget for 2024 is $62 million, 24% more than the projected expenditure of $50 million in 2023. This increase reflects the creation of improved budgets across all key assets, following the good fortunes of large-scale exploration in 2023. Gold and the Mulatto District account for approximately 60% of the overall budget, with $19 million planned for each asset. This was followed by $12 million for Young-Davidson, $9 million for Lynn Lake and $2 million for Golden Arrow. Approximately $41 million, or 66% of the 2024 budget, will be capitalized.

A total of $19 million has been budgeted for exploration at Island Gold in 2024, up from $14 million in 2023 with a larger exploration program near the mine and a regional exploration program.

The 2024 exploration program will follow up on a successful 2023 program with high-grade gold mineralization extended laterally to the West and East as well as within multiple structures within the hanging wall and footwall (see press release dated November 9, 2023). With the deposit open laterally and at depth, this ongoing exploration success highlights the significant potential for further growth in Mineral Reserves and Resources.

According to the 2023 program, the majority of the 2024 mineral exploration program will include underground drilling with 41,000 meters (“m”) planned. It will focus on the identification of new mineral reserves and resources in close proximity to existing production horizons and infrastructure, as well as the conversion of the existing gigantic mineral resource base into reserves. This comes with drilling in the lateral extension of the main Island Gold deposit (zones E1E and C), as well as an increasing number of foot walls and foot walls recently explained. It would be affordable to expand these potential additions of high-quality mineral reserves and resources and could be incorporated into the mine plan and exploited over the next few years, offering greater operational flexibility and further expanding the price of the operation.

Additionally, 12,500 m of surface exploration drilling has been budgeted targeting 1) high potential areas within the Island West, Main and East ore shoots, 2) the up-plunge extension of the Island West ore shoot, and 3) evaluating the potential for high-grade mineralized hanging wall structures near surface.

The regional exploration programme has also been expanded to 10,000 m, up from 7,500 m in 2023. The 202four program will track the intersecting high-grade mineralization at Pine-Breccia and targets 88-60, located four kilometers (“km”) apart. and 7 km respectively from the Island Gold mine. Drilling will also be carried out in the vicinity of the former Cline and Edwards mines, as well as at the Island Gold North Shear target. A comprehensive knowledge-gathering task will also be initiated on the four largest 0,000 hectares of Manitou land acquired in 2023 as a long-term exploration goal.

Mulatto District

A total of $19 million has been budgeted at Mulatos for exploration in 2024, an amount similar to planned expenditures for 2023. The regional and near-mine drilling program is expected to reach a total of 55,000 m. This includes 27,000m of surface exploration drilling in PDA and surrounding areas. This drilling will continue another successful year of exploration at PDA with high-grade mineralization extended in directions beyond the mineral reserves and higher-grade underground deposit resources.

Given the continued expansion of the PDA deposit, further higher grade sulfide opportunities will be pursued in the Mulatos district in 2024. This includes an initial 2,000 m follow-up drilling at the previously mined Cerro Pelón deposit, where grade mineralization will occur. crossed to the north. This included 14. 47 g/t Au over 50. 30 m (15PEL012) and 9. 65 g/t Au over 34. 60 m (15PEL020).

young-Davidson

A total of $12 million has been budgeted for exploration at Young-Davidson in 2024, up from $8 million in 2023. This includes 21,600 m of underground exploration drilling, and 1,070 m of underground exploration development to extend drill platforms on multiple levels.

The majority of the underground exploration drilling program will focus on extending mineralization within the Young-Davidson syenite, which hosts the majority of mineral reserves and resources. Drilling will also check the hanging wall and bottom wall of the deposit where the upper grades have already intersected.

Young-Davidson has a mineral reserve life of 15 years at the end of 2022 and has maintained an ore reserve life of at least thirteen years since 2011, reflecting the continued good fortunes of exploration. As the reservoir is open in intensity and to the west, there are chances that this story will continue.

Additionally, $2 million is budgeted at Golden Arrow with 5,000 m of drilling planned. The focus of the drilling will be the conversion of existing Mineral Resources into Reserves, and testing near-deposit and early stage exploration targets across the property. Geotechnical and condemnation drilling will also be conducted as part of a development plan for the project. The Golden Arrow deposit is located 95 km from the Young-Davidson mill and is being evaluated as a source of supplemental mill feed.

Lynn Lake

A total of $9 million has been budgeted for exploration at the Lynn Lake project in 2024, up from $5 million in 2023. This includes 15,500 m of drilling focused on the conversion of Mineral Resources to Mineral Reserves at the Burnt Timber and Linkwood deposits, and to evaluate the potential for Mineral Resources at Maynard, an advanced stage greenfield target.

Burnt Timber and Linkwood involve inferred mineral resources totaling 1. 6 million ounces grading 1. 1 g/t Au (44 million tonnes) as of December 31, 2022. The Company sees prospects for conversion at a smaller and higher quality mineral reserve that could be newly incorporated. in the Lynn Lake allocation given its proximity to the proposed mill. This represents potential production advantages and economic benefits for the feasibility study completed at Lynn Lake in August 2023.

The Company will also continue evaluating and advancing a pipeline of prospective exploration targets within the 58,000-hectare Lynn Lake Property in 2024.

Assumptions and sensitivities

(1) Excludes stock-based compensation.

The 2024 to 2026 production forecast, operating cost and capital estimates are based on a gold price assumption of $1,800 per ounce, a USD/CAD foreign exchange rate of $0.75:1 and MXN/USD foreign exchange rate of 17.0:1. Cost assumptions for 2025 and 2026 are based on 2024 input costs and have not been increased to reflect potential inflation in those years. These estimates may be updated in the future to reflect inflation beyond what is currently forecast for 2024.

Depreciation expense in 2024 is expected to be approximately $375 per ounce, which is consistent with 2023 depreciation. General and administrative expenses in 2024 are expected to total $28 million (excluding stock-based compensation), which is in line with 2023’s Array.

Current and Gold Hedging Commitments

To date, the Company has entered into the following short-term hedging contracts:

Qualified Individuals

Chris Bostwick, senior vice president of technical services at Alamos, who is a qualified person as explained in the National Instrument 43-101 Mineral Project Disclosure Standards, reviewed and approved the clinical and technical aspects contained in this news release.

Alamos is a Canadian-based intermediate gold manufacturer with diversified production from 3 operating mines in North America. This includes the Young-Davidson and Island Gold mines in northern Ontario, Canada, and the Mulatos mine in the state of Sonora, Mexico. , the Company has a strong portfolio of expansion assignments, adding the Phase 3 expansion at Island Gold and the Lynn Lake assignment in Manitoba, Canada. Alamos employs more than 1,900 people and is committed to sustainability criteria. The Company’s stock industry is listed on the TSX and NYSE under the ticker symbol “AGI”.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Scott K. ParsonsSenior Vice President, Investor Relations (416) 368-9932 ext. 5439

All amounts are in United States dollars, unless otherwise stated.

Cautionary note

This press release incorporates by reference “forward-looking statements” and “forward-looking information” as that term is explained in the applicable securities laws of Canada and the United States. All statements, other than statements of past fact, that address occasions, effects, consequences or developments that the Company expects to occur are, or could conceivably be considered, forward-looking statements and generally, but not always, are known through the use of forward-looking terminologies such as “expect,” “assume,” “estimate,” “potential,” “prospects,” “on the way,” “continue,” “ongoing,” “believe,” “anticipate,” “intend,” “estimate,” “forecast,” “budget,” “target,” “plan” or variations of those words and similar expressions and expressions or statements that certain actions, events, or effects “may,” “could,” “could,” “could,” “could,” or “will” be taken, happen, or be achieved or the negative connotation of those terms. The forward-looking statements contained in this press release are based on expectations, estimates and projections as of the date of this press release.

Forward-looking statements in this press release include, but may not be limited to, information as to strategy, plans, expectations or future financial or operating performance, such as expectations and guidance regarding: costs (including cash costs, AISC, capital expenditures, exploration spending), cost structure and anticipated declining cost profile; budgets; growth capital; sustaining capital; cash flow; foreign exchange rates; gold and other metal price assumptions; anticipated gold production, production rates, timing of production, production potential and growth; returns to stakeholders; the mine plan for and expected results from the Phase 3+ expansion at Island Gold and timing of its progress and completion; feasibility of, development of, and mine plan for, the Lynn Lake project and potential growth in production resulting from the Lynn Lake project; development plan for the Puerto Del Air (PDA) project (Mulatos); mining, milling and processing and rates; mined and processed gold grades and weights; mine life; Mineral Reserve life; planned exploration, drilling targets, exploration potential and results; as well as any other statements related to the Company’s production forecasts and plans, expected sustaining costs, expected improvements in cash flows and margins, expectations of changes in capital expenditures, expansion plans, project timelines, and expected sustainable productivity increases, expected increases in mining activities and corresponding cost efficiencies, cost estimates, sufficiency of working capital for future commitments, Mineral Reserve and Mineral Resource estimates, and other statements or information that express management’s expectations or estimates of future performance, operational, geological or financial results.

The Company cautions that forward-looking statements are necessarily based upon several factors and assumptions that, while considered reasonable by management at the time of making such statements, are inherently subject to significant business, economic, technical, legal, political and competitive uncertainties and contingencies. Known and unknown factors could cause actual results to differ materially from those projected in the forward-looking statements, and undue reliance should not be placed on such statements and information.

For a more detailed discussion of those threats and other points that may assist the Company in achieving the expectations set forth in the forward-looking statements contained in this press release, please refer to the Company’s most recent Annual Information Form 40-F and Management Discussion. & Analysis (MD

The Company disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required by applicable law.

Cautionary Note for U. S. Investors

All resource and reserve estimates included in this press release or documents referenced in this press release have been prepared in accordance with Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) – CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended (the “CIM Standards”). NI 43-101 is a rule developed by the Canadian Securities Administrators, which established standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Mining disclosure in the United States was previously required to comply with SEC Industry Guide 7 (“SEC Industry Guide 7”) under the United States Securities Exchange Act of 1934, as amended. The U.S. Securities and Exchange Commission (the “SEC”) has adopted final rules, to replace SEC Industry Guide 7 with new mining disclosure rules under sub-part 1300 of Regulation S-K of the U.S. Securities Act (“Regulation S-K 1300”) which became mandatory for U.S. reporting companies beginning with the first fiscal year commencing on or after January 1, 2021. Under Regulation S-K 1300, the SEC now recognizes estimates of “Measured Mineral Resources”, “Indicated Mineral Resources” and “Inferred Mineral Resources”. In addition, the SEC has amended its definitions of “Proven Mineral Reserves” and “Probable Mineral Reserves” to be substantially similar to international standards.

Non-GAAP Precautionary Measures and Additional GAAP Measures

It should be noted that, for the purposes of this section, GAAP refers to IFRS. The Company believes that investors use certain non-GAAP measures and supplemental GAAP measures as signs to compare gold mining companies. Their goal is to provide more data and not be considered. in isolation or as a replacement for GAAP-listed functionality measures.

“Cash flow from non-consistent activities before adjustments in non-cash working capital” is a non-GAAP measure of functionality that can also provide an indication of the Company’s ability to generate cash flow from non-consistent activities. oconsistent with and are calculated by adding the replacement in non-monetary money flows. capital to “money flows generated through (used in) activities consistent with activities” as presented in the Company’s consolidated statements of cash flows. “Equity-consistent cash flow” is calculated by dividing “non-consistent cash flow before adjustments in working capital” by the weighted average number of notable inventories for the consistent period. “Free cash flow” is a non-GAAP performance measure that is calculated as the cash flow from consistent operations net of the flow of money invested in capital, mining plant and apparatus, and mining assets. exploration and evaluation as presented in the Company’s consolidated statements of cash flows and which provide an indication of the Company’s ability to generate cash flow from its mining allocations. “Cash flow at mine site” is a non-GAAP measure that includes cash flow from non-consistent activities, less capital expenditures at each mine site. “Return on equity” is explained as the benefit of proceeding consistently divided between the existing and last year’s average overall equity. “Mining charge consistent with ton of ore” and “charge consistent with ton of ore” are non-GAAP measures of functionality that can also provide an indication of the strength and effectiveness of mine extraction and processing. These measures are calculated by dividing the applicable mining and processing prices and general prices by the tons of ore processed in the same period. The “consistent cost per ton of ore” is sometimes affected through national power and consistent waste to ore ratios over the period. “Maintenance capital assets” means expenses that do not increase the annual production of gold ounces at a mining site and excludes all expenses related to the Company’s progression allocations. “Growth Capital” means expenses incurred primarily in connection with progression allocations and pricing similar to primary allocations on existing or consistent allocations, where those allocations will obtain advantages particularly at the mining site. “Capitalized explorations” are expenses that meet the IFRS definition of capitalization and are incurred to further expand known mineral reserves and resources in existing or consistent allocations or progression allocations. “Total capital expenditures consistent with ounce produced” is a non-GAAP term used to evaluate the capital intensity point of an assignment and is calculated by taking the overall capital expansion and maintenance of an assignment divided by the duration of the useful life of the ounces produced. . “All-in monetary prices consistent with the ounce,” “all-in prices consistent with the ounce,” “all-in prices consistent with the mine site,” and “all-in prices consistent with the ounce” as used herein research are not GAAP. terms that are sometimes used. through gold mining corporations to evaluate the gross margin point that will be obtained for the Company by subtracting those prices from the unit value obtained in the same period. These non-GAAP terms are also used to compare a mining company’s ability to generate cash flow from its consistent operations. There would possibly be some variation in the method of calculating those parameters, as decided by the Company, compared to other mining corporations. In this context, “general monetary prices” reflect the assigned mining and processing prices of gold in progress and gold inventory and the royalties applicable to ounces of gold sold in the same period. Total monetary prices consistent with the ounce exclude exploration prices. “Maintain all-inclusive pricing consistent with the ounce” includes general monetary pricing, exploration pricing, corporate and administrative pricing, inventory-based reimbursement, and capital price maintenance. “Comprehensive mine site maintenance prices” include general monetary prices, exploration and capital prices for mine site maintenance, but exclude the allocation of corporate and administrative reimbursement and base reimbursement. ‘behavior. “Adjusted net income” and “adjusted earnings consistent with participation” are non-GAAP monetary measures and do not have popular meanings under IFRS. “Adjusted net advantage” excludes from net advantage: foreign ex-replacement gain (loss), items included in other losses, certain non-recurring items and foreign ex-replacement gain (loss) identified as deferred tax expense. “Adjusted net revenue stream consistent with participation” is calculated by dividing “adjusted net revenue stream” by the weighted average number of notable inventories during the constant period.

Additional GAAP measures that are presented on the face of the Company’s consolidated statements of comprehensive income and are not meant to be a substitute for other subtotals or totals presented in accordance with IFRS, but rather should be evaluated in conjunction with such IFRS measures. This includes “Earnings from operations”, which is intended to provide an indication of the Company’s operating performance, and represents the amount of earnings before net finance income/expense, foreign exchange gain/loss, other income/loss, and income tax expense. Non-GAAP and additional GAAP measures do not have a standardized meaning prescribed under IFRS and therefore may not be comparable to similar measures presented by other companies. A reconciliation of historical non-GAAP and additional GAAP measures are available in the Company’s latest Management’s Discussion and Analysis available online on the SEDAR+ website at www.sedarplus.ca or on EDGAR at www.sec.gov and at www.alamosgold.com.

https://www.globenewswire.com/NewsRoom/AttachmentNg/092ee4fd-6450-43b1-b5ff-d934c3476534

https://www.globenewswire.com/NewsRoom/AttachmentNg/233df61b-d294-4959-977d-a3760292352c