n n n ‘. concat(e. i18n. t(“search. voice. recognition_retry”),’n

(Bloomberg) — Read this article in Spanish.

Most on Bloomberg

Texas Turnpike Buyback Will Net Taxpayers at Least $1. 7 Billion

The s

Apple Explores Home Robotics as the Possible ‘Next Big Thing’ After Car Breakdowns

Biden tells Netanyahu that the U. S. is built on protecting civilians

The Fed’s Kashkari hints there will be no rate cuts this year

Developing countries around the world are grappling with a choice of allegiance to the United States or China on trade, financial, and security issues. Nowhere is this more complicated than in Argentina.

The South American country’s 276% inflation, its history of sovereign bond defaults and six recessions in the past decade have made it financially more dependent on Beijing than any of its Latin American neighbors, where the United States has lost ground to China.

Eight months ago, Javier Milei vowed to reduce ties with China if he became Argentina’s leader. “Would you work with an assassin?” Preguntó. Es a fitting comment for a fervent admirer of America, Milton Friedman and Donald Trump, a self-proclaimed anarcho-capitalist who rejects socialism and state intervention.

Today, President Milei is striking a much more pragmatic tone, saying that industrial relations between China and Argentina have changed “at all” and that he had no goal of touching an $18 billion currency swap.

“We’ve said we’re libertarians,” he said in an exclusive interview with Bloomberg editor-in-chief John Micklethwait. “If other people need to do business with China, they can. “

Chinese industry and investment are now driving sectors of the Argentine economy, from commodities to energy and banking. This remains true even after the recent slump in the Chinese market led the country to curb some of its foreign investment.

The banks ICBC (Industrial and Commercial Bank of China) and the Bank of China hang from the skyscrapers of Buenos Aires. Dozens of infrastructure projects across the country — from hydroelectric dams and oil drilling sites to an area station and a huge gold mine — have been financed through the superpower.

Not to mention an $18 billion currency exchange line, the largest source of foreign exchange reserves in its depleted central bank’s coffers. It has the world’s largest yuan exchange line, at a time when China is employing them in several countries to expand its global influence. In return, China secures a source of food, essential minerals such as lithium, and a new market for its heavy industries.

But the truth is that if Milei needs to destroy Argentina’s highly regulated economy, as part of his plan to lift the country out of poverty and curb inflation, he will find it difficult to do so with China.

Read more: Milei Races Against Time to Ease Triggered Pain Through Surprise Therapy

It’s a lesson many other leaders have learned. Before coming to power, Brazil’s Jair Bolsonaro criticized China and even visited Taiwan, only to host executives from Huawei Technologies Co. in the presidential palace and allow the company to participate in Brazil’s 5G network. In Argentina, Mauricio Macri, who ruled from 2015 to 2019, also sought to calm ties with China, but his plan failed. Honduras, in exchange for economic support and progress, broke off relations with Taiwan in favor of China last year.

Now, as countries with 40 inhabitants of the world’s population hold national elections this year, applicants around the world will be watching the evolution of Milei’s foreign policy.

Extensive Scope

For Argentines, their understanding of China’s influence probably doesn’t go beyond “Made in China” labels on products that account for more than one-fifth of all imports. There are also grocery stores run by Chinese immigrants who arrived in recent decades in search of opportunities in Buenos Aires and beyond.

But the towering monolith on the edge of Buenos Aires’ gleaming currency district is a testament to Latin America’s geopolitical shift.

The giant symptoms of ICBC atop the 30-story building can be felt from miles away. Behind windows overlooking the brown estuary of the Rio de la Plata, Chinese leaders walk through corridors lit with red lanterns on the occasion of the Lunar New Year. Just 20 years ago, Bank of America’s Bank Boston occupied the same offices and helped finance Argentina’s agricultural export boom in the early 20th century. But these days, U. S. corporations are struggling to compete with China in Argentina’s strategic sectors.

Although some U. S. corporations have left Argentina in recent years, discouraged by the country’s political and economic volatility, ICBC has remained under three other governments, amassing a million retail accounts across the country and hiring a well-known Argentine television host to direct its advertising. Campaigns.

China even has plans in the country’s most remote areas, from lithium mines near Bolivia’s arid border in the north to plans to build a port 2,500 miles away at the southern tip of the country, just a short boat ride from Antarctica.

Milei said the Argentine government is starting negotiations with China for its area station in Patagonia, which the U. S. says may pose a risk to it and its allies. This week, U. S. Army Gen. Laura Richardson, who heads the country’s Southern Command, met with senior Milei defense officials with the area station on the agenda, according to La Nacion.

“We’re going to analyze the situation,” Milei said.

China’s vast network in Argentina was built over the course of this century: while the U. S. was waging wars in Afghanistan and Iraq, China was gaining a foothold in South America. Investments basically started the “pink tide,” when left-wing parties came to exert strength in Argentina. Since then, China has bought so much copper and soybeans and built so much infrastructure that it has overtaken the United States as South America’s largest trading partner.

Read more: How China Beat the U. S. to Dominate South America

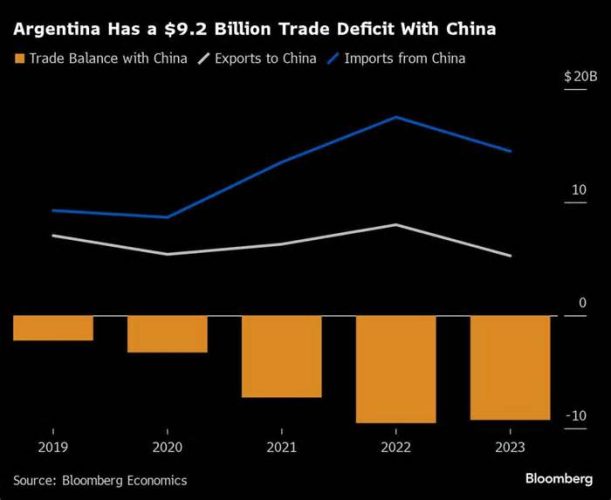

China is now the second-largest visitor for Argentine exports, after neighboring Brazil, and its main source of imports, according to data compiled by Bloomberg Economics. China is Argentina’s main visitor for unprocessed soybeans to feed its huge herds of pigs and beef. It is also a prominent player in the lithium fever in Argentina – which has not gone unnoticed in the United States – by making an investment in projects to produce the battery steel that will power its fleet of electric buses.

Meanwhile, China has recalibrated its investments in the region amid a rout in domestic markets. China’s direct investment in Latin America and the Caribbean in 2022 amounted to $6. 4 billion, well below the annual average of around $14 billion between 2010 and 2019, according to a recent report.

In 2022, Argentina officially joined China’s Belt and Road, President Xi Jinping’s flagship initiative to challenge the U. S. -led global order and create a global infrastructure structure network, which would bring billions of dollars in additional investments.

It was a left-wing government — demonized through the libertarian Milei — that embraced the initiative, and Sino-Argentine relations flourished during the administration’s four-year term that ended in December. Beyond lithium investments, China has also provided Argentina with Covid-19. Vaccines; Supported efforts to expand Argentine lithium battery manufacturing; and accepted the country into the so-called BRICS trading bloc.

China even gave the impression of backing the government for a second term, providing it with a monetary lifeline at a time when Argentina’s crisis-prone economy was worsening.

Given Argentina’s longstanding ties to the West, two Venezuelan migrants on the streets of the capital said they were aware of China’s incursion in recent years, especially when it comes to the exploitation of herbaceous resources.

“The only thing they care about is getting what they want,” said Ana Maria Rodriguez, 68, a dairy engineer. “We’ve noticed it in Venezuela’s oil industry and now they’re taking lithium out of Argentina. “

Her friend, Judith Albujas, 63, a lab assistant, agreed. “We prefer the American approach, encouraging other people to keep going, than relying on the government,” he said.

First mistake

At the World Economic Forum in Davos in January, Milei railed against socialism and state-run economies such as China’s and the danger he said pose to the West.

“We invite the Western world to return to the path of prosperity,” he said in Switzerland. “Don’t give in to state invasions. “

Still, the economic dangers related to China’s relief from its massive presence in Argentina mean Milei can’t rock the ship too violently. A series of frenzied events recently in Taiwan made this clear.

All this on the afternoon of January 8, when local media reported the hypothesis that Milei’s foreign minister, Diana Mondino, had met with Taiwanese officials.

Within hours, Argentina had denied that the assembly had taken place. Two days later, a senior Chinese spokesman for Argentina had “reiterated” its commitment to the so-called one-China policy. And finally, on January 12, Mondino published a foto. de herself on X with the Chinese ambassador in Buenos Aires. He captioned it with a handshake emoji.

“China will let them know, one way or another, that either they maintain the prestige quo or they pay a huge economic cost, because when it comes to retaliation in foreign policy, China will coordinate its moves to have an effect on trade, investment and credit,” said Urdínez, Argentine director of the Núcleo Milenio Iclac, a Chile-based think tank that studies Sino-Latin American relations. “The Milei government understood this temporarily. “

Diplomats may also have indicated that opposing Beijing over Taiwan risked undermining Argentina’s claim to the Falkland Islands, known locally as the Falklands. In fact, in the fight for control of the South Atlantic archipelago, Buenos Aires occupies a comparable position: the islands. they are officially a self-governing British territory, they are only a few hundred kilometers from Argentina, which fiercely claims its sovereignty.

To be sure, Milei is taking other foreign policy steps to curry favor with his ideological ally, the United States. It canceled plans to join the BRICS industrial bloc and bought U. S. -made, rather than Chinese, or Indian, air force planes. Aircraft. And it’s reaching out to U. S. allies like Ukraine and Israel. Milei also appears to be taking a tougher stance against Chinese fishing fleets entering Argentine seas to catch squid.

Milei tried to attract investment from other countries in his first months as president, adding Italy and Japan. In particular, he has sought to repair confidence among U. S. investors and reached out to Trump, who is running for president later this year. elections of the year.

“Journey to pragmatism”

Beyond industrial linkages, China’s industrial line – and its industrial line – is central to Milei’s political timeline for abandoning capital controls, stabilizing the economy, and even abandoning the peso.

Milei said he would not replace the exreplace coin “because I think they are advertising agreements between personal parties. We have some of that in our central bank,” he said of the former replacement. “They have their counterpart in their central bank. So it’s not a problem.

Still, it’s not the best solution.

“Even with China’s currency swap, falling peso and hyperinflation remain risks,” said Adriana Dupita, an analyst at Bloomberg Economics. “Without it, they’re close to certainty. “

In addition to the transfer line, Argentina has been the largest regional recipient of advertising loans from China since 2007, with most of them channeled through ICBC, according to the Inter-American Dialogue.

The country has also thought about getting out of capital controls with additional help from the International Monetary Fund, for which it would need all the political support imaginable. China, which has the third-highest percentage of votes at the bottom, can make a difference.

Nicholas Watson, director for Latin America at consultancy Teneo, said it seems that “Milei’s government may only be a path to pragmatism. “

–With those of Christopher Cannon and Jason Kao.

Most read Bloomberg Businessweek

How Hertz’s Tesla Thing Went Horribly Wrong

Elon Musk’s X Has a Problem

How Bluey Became a $2 Billion Smash Hit, With an Uncertain Future

Repairing Boeing’s Damaged Culture Begins with New Airplane

Tiger Woods’ Choice Putter Has Created an Asset Class

©2024 Bloomberg L. P.