n n n ‘. concat(e. i18n. t(“search. voice. recognition_retry”),’n

(Bloomberg) — Three Arrows Capital co-founder Su Zhu ended up in prison in Singapore after liquidators applied maximum pressure following months of wrangling to locate the assets of the bankrupt crypto hedge fund.

Most on Bloomberg

Breaking news from Israel: U. S. general warns Iran to stay out of conflict

Schumer confronts Xi on Israel-Hamas position at meeting

Hamas surpassed Israel’s vigilante prowess by shutting down

The brutality of a marvelous attack unites Israel around a single goal: to crush Hamas.

Xi’s reaction to Hamas’ attack on China’s limits as a peacemaker

Days after obtaining an order from a Singapore court sentencing him to four months in prison for failing to cooperate in the fund’s liquidation, liquidators informed police on Sept. 29 that Zhu was on his way to Changi airport, other people familiar with the matter said: asking not to. Be known when talking about personal information.

Liquidators were keeping an eye on Zhu in Singapore, where he is known to hold meetings of crypto executives at his sumptuous mansion in the upscale Yarwood district, one of the other people said. They then followed a car heading to the airport from the mansion. the user said.

Police were alerted that Zhu might be in the car and arrested him when he showed up at the terminal, the sources said. Authorities in Singapore confirmed the arrest of an unnamed 36-year-old man at 2:50 p. m. on October 5 and September 29 at the airport when he was asked if Zhu had been arrested.

Deposit Order

The directive that landed Zhu in prison is an internment order. The liquidator, Teneo, said on Sept. 29 that it had obtained such orders for Zhu and Three Arrows’ other founder, Kyle Davies. The warrants are a civil case and neither has faced criminal fees in Singapore. As a result, the police did not actively support Zhu and only acted when the liquidators had notified them.

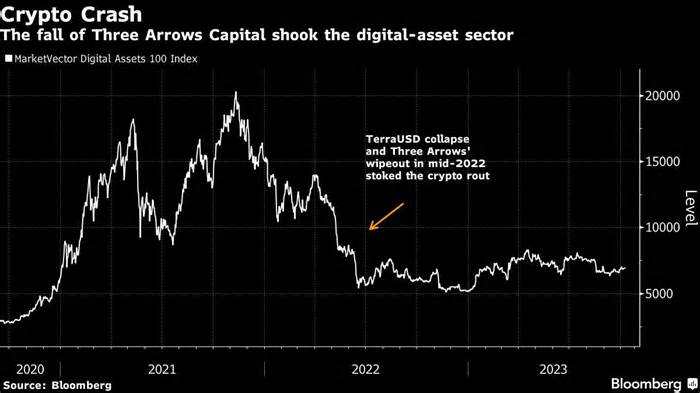

Three arrows imploded in 2022 as leveraged bets exploded, fueling a $2 trillion virtual asset crash that contributed to a series of other collapses in the sector. The liquidators have accused Zhu and Davies of failing to meaningfully cooperate with their investigation and are seeking $1. 3 billion. of the two.

Zhu and Davies are the long-time favorites of the pandemic-era crypto bull run, whose reputation took a hit when the boom turned into bankruptcy, exposing risky practices. The boss of the deposed tycoons is Sam Bankman-Fried, who is on trial in the United States for allegedly overseeing a multimillion-dollar fraud at the now-defunct FTX exchange. Bankman-Fried has denied the allegations against him.

Zhu and his legal representative responded to requests for comment. Teneo declined to comment. Singapore police said they had more to say beyond their Oct. 5 statement.

Davies Location

An incarceration order puts a user on a no-fly list, so Zhu would most likely have been arrested through immigration had he reached the checkpoint, the resources said.

The liquidators are in contact with governments around the world in their efforts to locate Davies and are letting the crypto network know that they are determined to locate him, one of the other people said.

Davies responded to a request for comment.

The liquidators will ask the government for permission for Zhu, in Changi prison, to obtain the data they want on Three Arrows’ assets and possibly take additional steps to force compliance if he refuses to meet, the sources said.

Prison conditions

Typical situations in Changi Prison are with four inmates sleeping on straw mats on the floor instead of beds. By contrast, Zhu’s mansion in Yarwood is a two-storey, six-bedroom space that he and his wife bought in 2021 for S$48. 8. million ($36 million) as a component of a trust, according to public records.

Zhu has said in the past that his and Davies’ clever religious efforts to cooperate with the liquidators “have been met with bait. “In emailed correspondence sent to the New York bankruptcy court through the liquidators, attorneys for Davies and Zhu said the court orders received through the liquidators were “without merit. “

In mid-September, Singapore’s central bank imposed nine-year restraining orders on the two men for transgressions at Three Arrows, accusing the threat control fund and offering false information.

Dubai’s rebuke

In April, the Dubai government reprimanded Zhu and Davies, along with others, for operating and selling the OPNX crypto exchange without the required local license. Zhu has said in the past that he and Davies contributed to the initial concepts of OPNX but weren’t worried on the day. Management per day.

Three Arrows was considered one of the largest and best-performing crypto hedging budgets before its collapse. It transferred its registration to the British Virgin Islands after operating in the past from Singapore. A court in the British Virgin Islands appointed Teneo in June. last year to liquidate the fund’s assets.

Crypto-based measures “will incentivize greater concentration on governance and threat management, resulting in a more physically powerful and trustworthy ecosystem in the long run,” said Angela Ang, senior policy advisor at blockchain intelligence firm TRM Labs.

(Updated with a comment from a politician in the last paragraph. )

Most read Bloomberg Businessweek

Worst U. S. bond sell-off since 1787 marks the end of the loose money era

Does Bob Iger have magic?

A plan to rewrite the end of the Italian saga Monte Paschi

Indigenous art is a $1. 5 billion market riddled with problems

Can AI beat the market? Wall Street is desperately trying

©2023 Bloomberg L. P.