Now that the worst of Covid-19 is behind us, many of us are making plans or are already making plans for a trip. Before you fly to your dream destination, don’t buy the most vital item besides your plane ticket. We’re talking about travel insurance!

Remember the old days when lost luggage was your biggest concern?Today, there’s a bigger challenge when it comes to travel: disruptions will likely be similar to Covid-19, whether it’s an infection or a cancellation.

Most insurers have added a Covid-19 policy to their insurance plans, albeit to varying degrees. Some offer a much better policy than others. Find out how to choose, what to look for and the cheapest insurance you can buy with our comparison of the best Covid-19 insurance in Singapore.

With the sheer number of insurance providers, it can be a bit tricky to compare everything to everything else. We know this pain, because that’s precisely what we’ve just done. Wipe away your tears of exasperation, because we have made the paintings for you and decided on the five most sensible insurance plans in Singapore:

Why are they in the top 5 most sensible? We compared them based on affordability, inclusion of Covid-19 coverage, high-altitude emergency medical coverage, and high-altitude vacation cancellation coverage. If you’re an adventure seeker, check out this article to discover the best insurance for extreme sports and outdoor adventure.

If you’re in a position to dig into the details, we’ve compared the most popular travel insurance plans with COVID-19 coverage in Singapore. So if you’re looking for a quick type of coverage for your travel needs, for example, high vacation cancellation coverage, here’s a broader abstract table that can work with:

Note: All of the above insurance features come with the Covid-19 policy unless otherwise stated.

Bubblegum insurance is a great option if you’re looking for an essential, hassle-free policy at affordable prices. Bubblegum’s style of insurance is undeniable and offers a unique insurance plan. Here are your policy value and benefits:

If your most sensible priority is essential, hassle-free insurance, we think Bubblegum is a great option for you. Their insurance also includes a holiday cancellation and heist policy comparable to other providers, as well as a Covid-19 policy at no extra cost.

And if you’re thrill-seeking and looking for adventure activities, Bubblegum insurance will also cover you for hot air balloon rides, scuba diving, and skiing, with no height or depth restrictions.

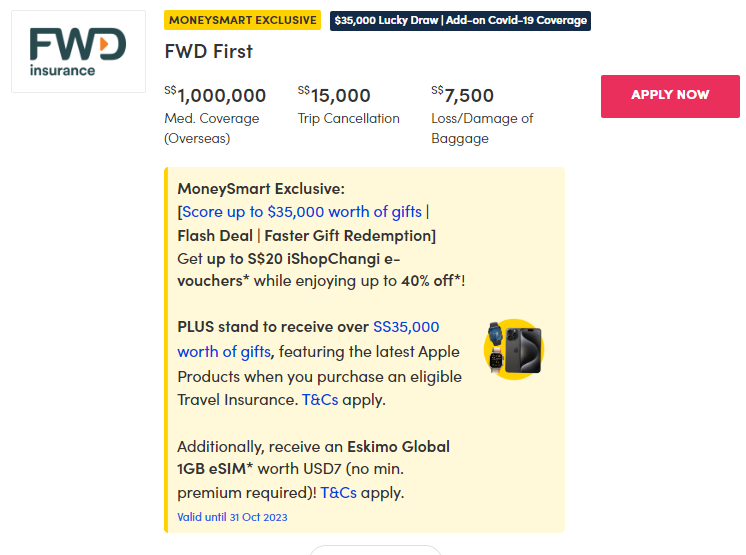

When you purchase FWD insurance, Covid-19 benefits are a burden. The value of the Covid-19 freight costs between $11. 59 and $21. 70 depending on which component of the global you choose. If you decide to upload it, it will give you a full policy of the following:

Starr’s insurance is called Starr TraveLead Comprehensive, and in fact, it’s a leader in terms of customizing your insurance.

When you check in, the medical canopy (including the Covid-19 canopy) is automatically included in all packages, but you can decide whether or not you want to load the canopy (e. g. , lost documents, holiday delay) and the baggage canopy (e. g. , baggage delay). You can also load runners seamlessly for protection in golf, boating holidays, scuba diving, and snow sports.

Starr TraveLead Comprehensive is available in 3 tiers: Gold, Silver, and Bronze. Although all of them are quite comprehensive (as the call suggests), we recommend that you at least stop by Plata. This provides you with foreign medical coverage of S$ 500,000. , as well as a $250 policy for similar Covid-19 discounts and cancellations; Let’s face it, those things can happen. You may not get this policy on the Bronze plan, so opt for Silver or Gold.

Here are the costs and policy amounts for each tier. Prices are given with the policy included in the plan.

MSIG insurance is categorized into 3 plans: Standard, Elite, and Premier. The cheapest fundamental plan still offers a pretty good policy in case of a medical emergency and vacation cancellation or delay.

Here’s a review of the plan’s key benefits:

A policy domain included through MSIG is for emergency dental expenses. You get a policy from $5,000 to $15,000, depending on the point of insurance you select.

MSIG Zones A and B refer more or less to ASEAN and Asia, respectively. Here’s a more comprehensive list of countries in each category:

MSIG Travel Insurance’s Covid-19 policy is an automatic inclusion in their insurance plans and provides the following policies:

Singlife’s travel insurance comes in 3 tiers: Lite, Plus, and Prestige. The value you pay and the policy increase with each plan.

Here are the main costs and benefits of Singlife insurance:

This is a pretty decent list of benefits, but hospital money for per diem is on the list.

In addition to the above coverage, Singlife covers you for Chinese chiropractor and/or doctor treatments: S$250 (S$50 per visit) for Lite, S$500 (S$75 per visit) for Plus, and S$1000 (S$100 per visit). with visit). ) for Prestige.

When it comes to Covid-19 coverage, here’s an overview:

Although Singlife’s insurance policy for similar non-Covid related medical expenses, holiday delays and holiday cancellation is comprehensive, we have to admit some issues due to the lack of monetary allowance for overseas hospitals and quite low Covid-19 similar holiday cancellation coverage.

Also note that the lowest tier, Lite, does not come with secure coverages, such as cancellation or postponement for any reason and Covid-19 quarantine abroad allowance.

Like Singlife, Chubb insurance also covers you for classic Chinese medicine remedies abroad. It costs $750 on all tiers of their plan.

Chubb insurance plans automatically come with a Covid-19 policy for the following:

Chub’s insurance plans are very comprehensive and usually offer a comparable or slightly higher policy than other providers. These come with your overseas medical expenses, which start at $300,000.

When I buy insurance, I don’t really care if the insurer has 900 years of experience or if the plan includes an additional policy for Chanel bags. Just give me the cheapest insurance plan possible!

If this sounds familiar to you, too, feel pleased to know that we’ve done everything we can for you. After comparing the most popular travel insurers in Singapore, assuming you charge a Covid clause if necessary, the honor of the cheapest travel insurance in Singapore is going to. . . Starr Travel Insurance.

But as the old saying goes, you get what you pay for. Will you regret being stingy and lose a vital policy if the only number you get is the price?

As for non-Covid coverage, STARR’s out-of-country medical limit of $200,000 is similar to other providers. FWD’s lowest point also comes with a $200,000 limit for medical expenses.

Below, we take a look at the media coverage of Covid-19. The STARR Bronze level doesn’t cover you for Covid-related cancellations, but it does give you $15,000 in medical coverage for Covid-19. The next tier of STARR, Silver, will charge you $46 for a $250 refund if you want to cancel your coverage due to Covid-19. You might be better off with AMEX, Bubblegum, or FWD – they’ll offer superior Covid coverage at a lower price.

In short, ask yourself which express insurance policy you need to purchase and compare the characteristics of the insurance to locate one that fits your needs.

When the Covid-19 pandemic began, most insurers did not extend their policy for Covid-19-related accidents. (Learn more here. ) Temporarily, the pandemic has been considered a “known event,” for which insurers are not offering compensation. Therefore, if your flight is cancelled due to Covid-19, you may not have a chance to have your insurance claims approved.

Now, as restrictions are lifted, insurance companies are rushing to grab a slice of the pie. Since the virus is here to stay, most insurers will offer policies that include express benefits for Covid-19. Where does Covid-19 benefit? If they are not already included in the policy, insurers will offer an optional Covid-19 rider that you can pay to supplement the existing normal policy.

Read your policy documents to see if Covid-19 is covered and upload them if necessary.

The Covid-19 policy can vary greatly from insurer to insurer. When looking for the most productive insurance policy, there are three things you need to keep in mind when it comes to opting for the most productive insurance with Covid-19 policy:

Please note that plans exclude travel despite a travel advisory issued through the Singapore government or the local government of your travel destination. This means that if your destination country is on red alert for Covid-19, visitors will most likely come into contact with the virus and your insurance will most likely reject any Covid-19 claims. So be sure to check the listings on both ends before you leave.

Another common exclusion is not taking precautions against Covid-19. This is vaguely worded in those long insurance policies, but it can simply involve non-compliance with Covid-19 regulations at your destination or on the plane. So be sure to wear your mask whenever it’s mandatory (or even when you don’t have one, if you need to play safely) and don’t attend any illegal raves.

First and foremost, when booking your Array, you deserve to keep all receipts, tickets, and itineraries in case your wishes are canceled or changed.

At the first sign of a Covid-19 infection or related disruption, it is worth calling your insurer and asking for advice. Many insurers have a 24-hour claims hotline. Save this number before you leave Singapore so you don’t get stuck somewhere without Wi-Fi or 4G to Google the hotline.

To file a claim, you will need to submit your insurer’s form along with supporting documents within the time period stipulated in your contract (30 days). Don’t wait until you return to Singapore to check which documents you want.

If you contract Covid-19 while in Singapore, you will most likely want to present the effects of a PCR swab test or an immediate antigen test performed in a clinic or hospital.

It gets a little more confusing if you’re abroad. The insurer will most likely require documentation from the hospital, as well as a letter from the doctor stating that you are not worthy of treatment and/or recommending treatment.

If you want to quarantine abroad, you need to make sure you have a quarantine order from the government; Otherwise, you may not be able to claim quarantine payment. Do not apply, as not all countries automatically take this into account. documents.

READ ALSO: Top Five Reasons Travel Insurance Claims Are Denied, According to Insurers

This article was first published on MoneySmart.